Form it 607 Claim for Excelsior Jobs Program Tax Credit Tax Year 2022

What is the Form IT 607 Claim for Excelsior Jobs Program Tax Credit?

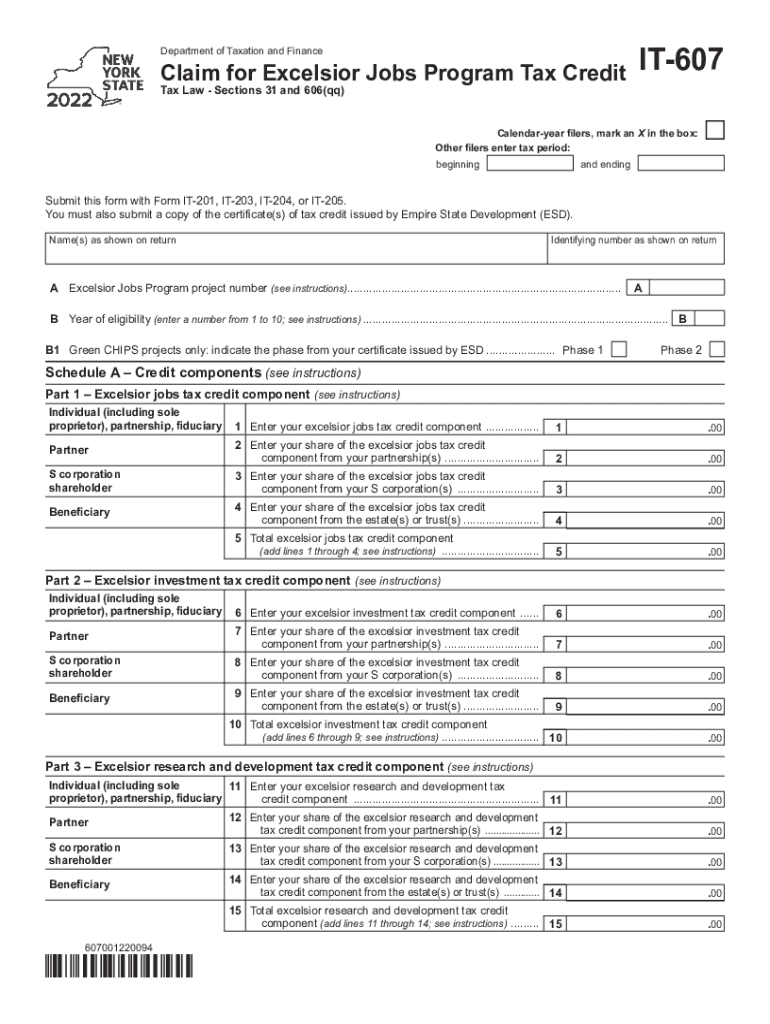

The Form IT 607 is a tax document utilized by businesses in New York to claim the Excelsior Jobs Program Tax Credit. This program is designed to incentivize businesses to create and maintain jobs in specific sectors, including manufacturing, technology, and life sciences. The tax credit is aimed at fostering economic growth by supporting job creation in New York State. To qualify, businesses must meet certain eligibility criteria and demonstrate their commitment to expanding their workforce.

Steps to Complete the Form IT 607

Completing the Form IT 607 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of employment and payroll records. Next, accurately fill out the required sections of the form, detailing the number of new jobs created and the associated payroll costs. It is essential to provide precise information to avoid delays in processing. After completing the form, review it thoroughly for any errors before submission. Finally, ensure that you submit the form by the specified deadlines to claim your credits effectively.

Eligibility Criteria for the Form IT 607

To qualify for the Excelsior Jobs Program Tax Credit using the Form IT 607, businesses must meet specific eligibility criteria. These include operating in designated industries, such as advanced manufacturing or biotechnology, and creating a minimum number of new jobs within a specified timeframe. Additionally, businesses must maintain these jobs for a certain period to retain the tax credit. It is important to review the detailed requirements to ensure compliance and maximize the benefits of the program.

Required Documents for the Form IT 607

When preparing to file the Form IT 607, businesses must gather several essential documents. These typically include payroll records that verify the number of new jobs created, tax identification numbers, and any supporting documentation that demonstrates compliance with the eligibility criteria. Additional records, such as financial statements or business plans, may also be necessary to substantiate the claim. Having these documents ready can streamline the filing process and help ensure a successful application.

Form Submission Methods for the IT 607

The Form IT 607 can be submitted through various methods, providing flexibility for businesses. Options include online submission through the New York State Department of Taxation and Finance website, mailing a physical copy of the form, or delivering it in person to designated offices. Each method has its own guidelines and deadlines, so it is important to choose the one that best fits your business needs while ensuring compliance with submission requirements.

Filing Deadlines for the Form IT 607

Filing deadlines for the Form IT 607 are critical for businesses seeking to claim the Excelsior Jobs Program Tax Credit. Typically, the form must be submitted within a specific timeframe following the end of the tax year in which the new jobs were created. It is essential to stay informed about these deadlines to avoid missing out on potential tax credits. Regularly checking the New York State Department of Taxation and Finance website can provide updates on any changes to filing dates.

Quick guide on how to complete form it 607 claim for excelsior jobs program tax credit tax year 2022

Prepare Form IT 607 Claim For Excelsior Jobs Program Tax Credit Tax Year effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents promptly and without delays. Manage Form IT 607 Claim For Excelsior Jobs Program Tax Credit Tax Year on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to edit and eSign Form IT 607 Claim For Excelsior Jobs Program Tax Credit Tax Year with ease

- Find Form IT 607 Claim For Excelsior Jobs Program Tax Credit Tax Year and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Form IT 607 Claim For Excelsior Jobs Program Tax Credit Tax Year and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 607 claim for excelsior jobs program tax credit tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form it 607 claim for excelsior jobs program tax credit tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 607 form and how is it used in airSlate SignNow?

The 607 form is a vital document that businesses can easily create and sign using airSlate SignNow. This form facilitates official transactions, allowing users to send and eSign documents seamlessly. By utilizing airSlate SignNow, businesses can ensure that their 607 forms are securely managed and efficiently processed.

-

How does airSlate SignNow handle pricing for eSigning the 607 form?

airSlate SignNow offers flexible pricing plans that accommodate businesses of all sizes looking to eSign the 607 form. Customers can choose from various subscriptions, ensuring they find a plan that suits their budget while providing full access to features. This cost-effective solution makes signing the 607 form accessible and straightforward.

-

What features does airSlate SignNow offer for managing 607 forms?

airSlate SignNow includes several features specifically designed for managing the 607 form. These features range from document templates and reusable fields to advanced tracking and notifications, making it easy to create, send, and sign forms. The intuitive interface ensures that users can manage their 607 forms efficiently without technical complications.

-

Can I integrate airSlate SignNow with other applications for managing the 607 form?

Yes, airSlate SignNow offers various integrations with popular applications to streamline the process of managing the 607 form. These integrations enable users to connect with CRM systems, cloud storage, and productivity tools, allowing for a seamless workflow. This helps ensure that your 607 forms are always accessible and up-to-date across all platforms.

-

What are the benefits of using airSlate SignNow for the 607 form?

Using airSlate SignNow for the 607 form brings several benefits, including increased efficiency, cost savings, and enhanced security. The platform allows users to sign documents quickly, reducing turnaround time signNowly. Additionally, airSlate SignNow ensures that all eSigned 607 forms are stored securely, maintaining compliance with legal standards.

-

Is there a mobile option for signing the 607 form with airSlate SignNow?

Yes, airSlate SignNow offers a mobile application that allows users to sign the 607 form on-the-go. This mobile solution ensures that businesses can operate flexibly and handle documents anytime, anywhere. With the app, you can swiftly send and receive eSigned 607 forms directly from your device.

-

How does airSlate SignNow ensure the security of the 607 form?

airSlate SignNow prioritizes the security of all documents, including the 607 form. The platform employs advanced encryption and secure data storage methods to protect sensitive information. Users can trust that their signed 607 forms are kept confidential and that the signing process is legally binding.

Get more for Form IT 607 Claim For Excelsior Jobs Program Tax Credit Tax Year

- Tennessee occupancy form

- Complex will with credit shelter marital trust for large estates tennessee form

- Tn marital form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497326921 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497326922 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497326923 form

- Marital property children form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497326925 form

Find out other Form IT 607 Claim For Excelsior Jobs Program Tax Credit Tax Year

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later