Net Profit Tax Forms Boone County, KY 2022-2026

What is the Net Profit Tax Forms Boone County, KY

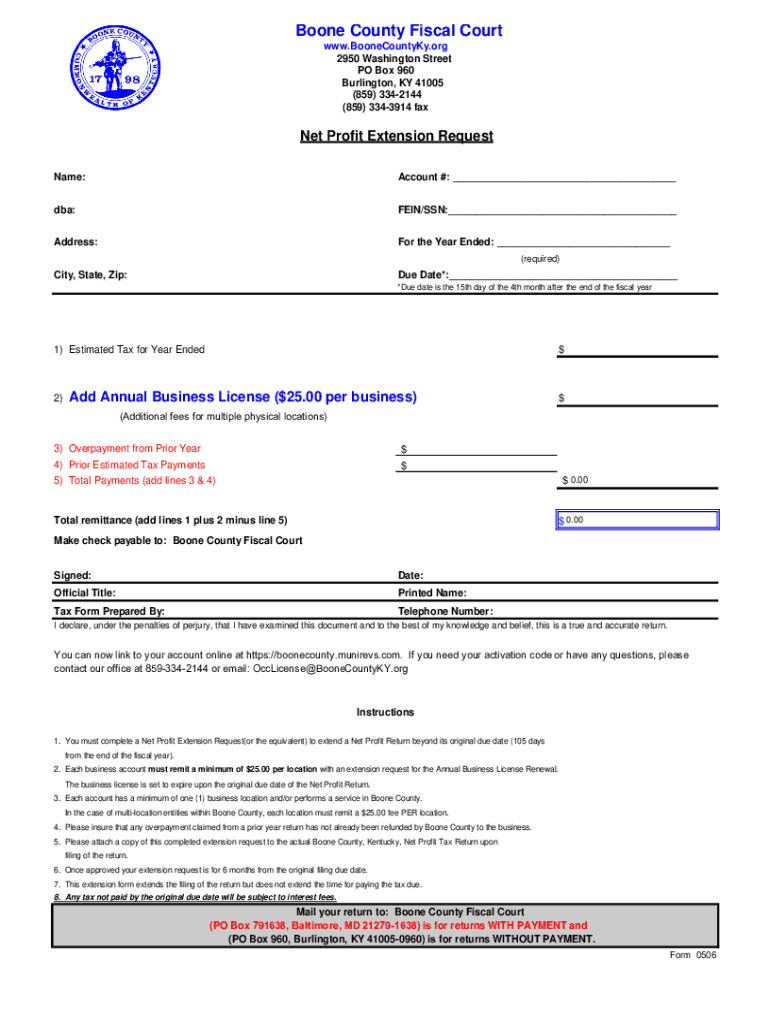

The net profit tax forms for Boone County, Kentucky, are essential documents that businesses must complete to report their income and calculate the taxes owed. These forms are specifically designed for various business entities, including corporations, partnerships, and sole proprietorships. The primary form used is the 0506 Profit form, which details the net profit earned during the tax year. Understanding these forms is crucial for compliance with local tax regulations and ensuring accurate reporting of business income.

Steps to complete the Net Profit Tax Forms Boone County, KY

Completing the net profit tax forms for Boone County involves several key steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill out the 0506 Profit form accurately, ensuring all income and deductions are reported.

- Calculate the net profit by subtracting total expenses from total income.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Following these steps will help ensure that the form is completed correctly and submitted on time.

Legal use of the Net Profit Tax Forms Boone County, KY

The legal use of the net profit tax forms in Boone County is governed by local tax laws and regulations. These forms must be completed and submitted by the designated deadlines to avoid penalties. Electronic signatures are accepted, provided they comply with the ESIGN and UETA acts, ensuring that the submitted documents are legally binding. Businesses should also maintain copies of their submitted forms for record-keeping and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Boone County net profit tax forms are crucial for compliance. Typically, the forms must be submitted by April fifteenth of the following tax year. However, if an extension is requested, the deadline may be extended to October fifteenth. It is essential for businesses to be aware of these dates to avoid late fees and penalties.

Required Documents

To complete the net profit tax forms for Boone County, several documents are required:

- Income statements detailing all revenue generated during the year.

- Expense reports that outline all business-related expenditures.

- Previous year's tax returns for reference and consistency.

- Any additional schedules or forms that may be required based on the business structure.

Having these documents ready will streamline the process of filling out the forms and ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The Boone County net profit tax forms can be submitted through various methods:

- Online submission via the official Boone County tax website, which allows for quick processing.

- Mailing the completed forms to the designated tax office address.

- In-person submission at the local tax office, which may be beneficial for those needing assistance.

Choosing the right submission method can enhance efficiency and ensure timely filing.

Quick guide on how to complete net profit tax forms boone county ky

Complete Net Profit Tax Forms Boone County, KY effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it digitally. airSlate SignNow provides you with all the resources necessary to create, adjust, and electronically sign your documents quickly without delays. Handle Net Profit Tax Forms Boone County, KY on any device with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The most efficient way to modify and electronically sign Net Profit Tax Forms Boone County, KY with ease

- Find Net Profit Tax Forms Boone County, KY and click Get Form to initiate the process.

- Utilize the tools available to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow manages all your document-related needs with just a few clicks from any device of your choosing. Alter and electronically sign Net Profit Tax Forms Boone County, KY to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct net profit tax forms boone county ky

Create this form in 5 minutes!

How to create an eSignature for the net profit tax forms boone county ky

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Boone County net profit tax return 2023?

The Boone County net profit tax return 2023 is a tax form that businesses must file to report their net profit to the Boone County government. This return helps determine the tax obligations based on the business's income from the previous year. Understanding this form is essential for compliance and can help businesses avoid penalties.

-

How can airSlate SignNow assist with the Boone County net profit tax return 2023?

AirSlate SignNow provides an easy-to-use solution for businesses to electronically sign and send documents, making it simpler to manage your Boone County net profit tax return 2023. With its intuitive interface, you can prepare and finalize your tax return quickly and efficiently, ensuring that all necessary signatures are obtained promptly.

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow offers a variety of features designed for effective document management, including customizable templates and secure storage options. These features simplify the process of preparing your Boone County net profit tax return 2023, allowing you to streamline workflow and maintain organization throughout tax season.

-

Is airSlate SignNow cost-effective for managing the Boone County net profit tax return 2023?

Yes, airSlate SignNow is a cost-effective solution for managing documents like the Boone County net profit tax return 2023. With a range of pricing options tailored to businesses of all sizes, companies can efficiently handle their tax documentation without incurring high expenses. This scalability makes it accessible for both small businesses and large enterprises.

-

Can I integrate airSlate SignNow with my existing software for tax preparation?

Absolutely! AirSlate SignNow offers seamless integrations with various accounting and tax preparation software, which can simplify the process of filing your Boone County net profit tax return 2023. This capability allows you to manage all your financial documents in one place, enhancing efficiency and minimizing errors.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for your tax documentation, including the Boone County net profit tax return 2023, provides multiple benefits like increased efficiency, enhanced security, and improved collaboration. Digital signing eliminates the need for physical paperwork, while encryption ensures your sensitive information is protected. Additionally, real-time tracking allows you to monitor the status of your documents.

-

Is there customer support available for using airSlate SignNow?

Yes, airSlate SignNow offers comprehensive customer support to assist users with questions regarding their Boone County net profit tax return 2023 and more. Our knowledgeable support team is available via chat, email, or phone to help you navigate any challenges. This ensures a smooth experience while using the platform for your tax needs.

Get more for Net Profit Tax Forms Boone County, KY

- Warning notice due to complaint from neighbors texas form

- Lease subordination agreement texas form

- Apartment rules and regulations texas form

- Tx cancellation form

- Texas original petition divorce form

- Amendment of residential lease texas form

- Texas form court

- Agreement for payment of unpaid rent texas form

Find out other Net Profit Tax Forms Boone County, KY

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors