Form 8995 Qualified Business Income Deduction Simplified Computation 2022

What is the Form 8995 Qualified Business Income Deduction Simplified Computation

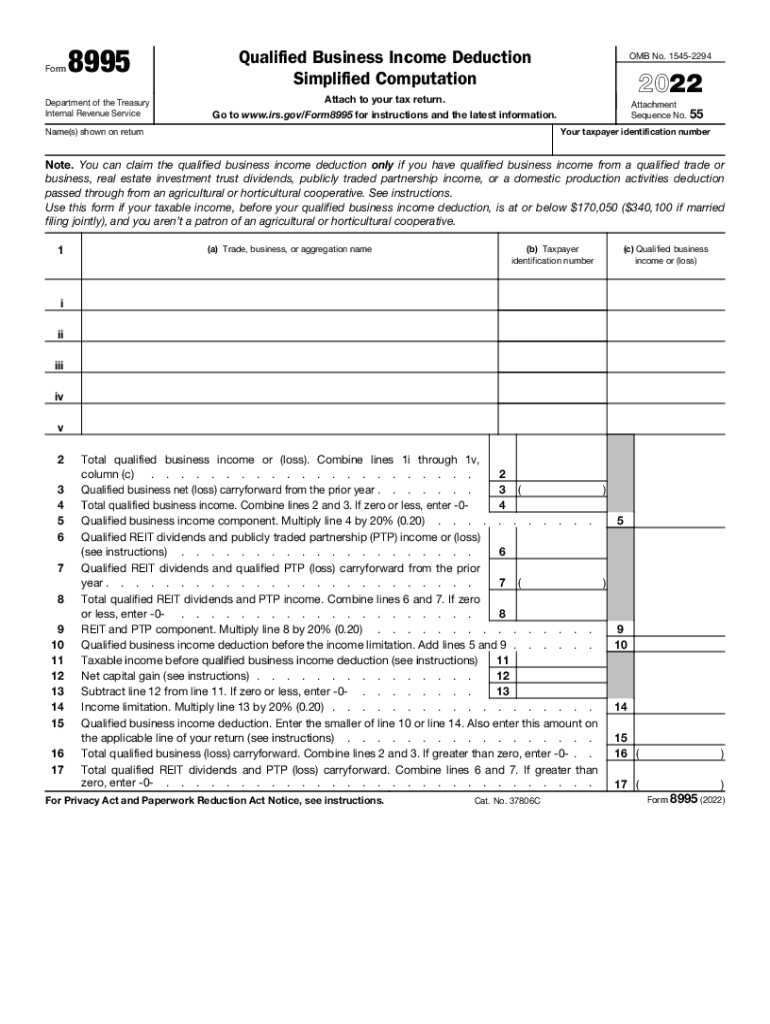

The Form 8995 is designed to help eligible taxpayers calculate the Qualified Business Income (QBI) deduction. This deduction allows individuals, estates, and trusts to deduct up to twenty percent of their qualified business income from their taxable income. The simplified computation provided by this form streamlines the process, making it easier for small business owners and self-employed individuals to take advantage of this tax benefit. The form is particularly beneficial for those with straightforward tax situations, as it eliminates the need for more complex calculations required by the longer Form 8995-A.

Steps to complete the Form 8995 Qualified Business Income Deduction Simplified Computation

Completing the Form 8995 involves several key steps to ensure accurate reporting of your qualified business income. First, gather all necessary financial records, including your business income and expenses. Next, fill out the form by entering your total qualified business income on the designated line. You will also need to provide information about any relevant deductions, such as wages paid to employees or the unadjusted basis of qualified property. After completing the calculations, transfer the final deduction amount to your tax return. It is important to review the form for accuracy before submission to avoid potential issues with the IRS.

IRS Guidelines

The IRS provides specific guidelines for using Form 8995, including eligibility criteria and documentation requirements. Taxpayers must ensure they meet the income thresholds and other requirements outlined by the IRS. Additionally, it is essential to maintain proper records that support the figures reported on the form. The IRS may request documentation during audits, so keeping detailed records of your business income and expenses is crucial. Familiarizing yourself with these guidelines can help you navigate the filing process more effectively and ensure compliance with tax regulations.

Eligibility Criteria

To qualify for the QBI deduction using Form 8995, taxpayers must meet certain eligibility criteria. Primarily, the deduction is available to individuals, estates, and trusts that have qualified business income from a qualified trade or business. The business must be a pass-through entity, such as a sole proprietorship, partnership, or S corporation. Additionally, taxpayers must be below specified taxable income thresholds to fully benefit from the deduction. Understanding these criteria is vital for determining your eligibility and ensuring you can take advantage of this tax benefit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8995 align with the standard tax return deadlines. For most individual taxpayers, the due date is April 15 of the following year. If you are unable to file by this date, you may request an extension, which typically extends the deadline to October 15. It is essential to adhere to these deadlines to avoid penalties and interest on any unpaid taxes. Keeping track of these important dates can help ensure timely and accurate filing of your tax return.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting Form 8995. The form can be filed electronically through various tax preparation software programs, which often provide step-by-step guidance. Alternatively, you can print the completed form and mail it to the appropriate IRS address based on your location. In-person submission is generally not available for this form, as the IRS encourages electronic filing for efficiency. Choosing the right submission method can help streamline the filing process and ensure your form is received by the IRS in a timely manner.

Quick guide on how to complete 2022 form 8995 qualified business income deduction simplified computation

Complete Form 8995 Qualified Business Income Deduction Simplified Computation effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8995 Qualified Business Income Deduction Simplified Computation on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The simplest way to modify and electronically sign Form 8995 Qualified Business Income Deduction Simplified Computation with ease

- Obtain Form 8995 Qualified Business Income Deduction Simplified Computation and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Form 8995 Qualified Business Income Deduction Simplified Computation and ensure excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 8995 qualified business income deduction simplified computation

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 8995 qualified business income deduction simplified computation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 8995 form, and how does airSlate SignNow help in its completion?

The 2022 8995 form is essential for taxpayers claiming a qualified business income deduction. airSlate SignNow streamlines the process of signing and submitting documents related to the 2022 8995 form, providing an efficient way to ensure all signatures are collected and documents are properly filed.

-

What are the pricing options available for airSlate SignNow for handling the 2022 8995?

airSlate SignNow offers competitive pricing plans that cater to various business needs when managing documents like the 2022 8995. Plans vary based on the features required, ensuring that businesses get the best value while efficiently managing their eSignatures and document workflows.

-

Can airSlate SignNow integrate with accounting software to assist with the 2022 8995?

Yes, airSlate SignNow integrates with popular accounting software, making it easier for users to manage their 2022 8995 forms alongside their financial documents. This feature helps streamline your workflow and ensure all documents stay organized and accessible.

-

What benefits does airSlate SignNow provide for businesses dealing with the 2022 8995?

airSlate SignNow offers numerous benefits for handling the 2022 8995, including enhanced security, user-friendly interface, and quick turnaround times. These features help businesses minimize errors and ensure compliance while saving valuable time.

-

How user-friendly is airSlate SignNow for new users dealing with the 2022 8995?

airSlate SignNow is designed with user-friendliness in mind, making it simple for new users to get started with the 2022 8995. The intuitive interface and guided setup process help ensure that even those without technical skills can easily navigate the platform.

-

Does airSlate SignNow provide templates for the 2022 8995?

Absolutely, airSlate SignNow offers customizable templates for the 2022 8995 form. This feature allows users to create, edit, and save templates quickly, facilitating efficient document processing and ensuring compliance with tax regulations.

-

Is there customer support available for users with questions about the 2022 8995?

Yes, airSlate SignNow provides dedicated customer support to assist users with any questions regarding the 2022 8995. Our team is available to help guide you through using the platform effectively to manage your eSignature needs.

Get more for Form 8995 Qualified Business Income Deduction Simplified Computation

Find out other Form 8995 Qualified Business Income Deduction Simplified Computation

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement