Form 8995 Qualified Business Income Deduction Simplified Computation 2023

What is the Form 8995 Qualified Business Income Deduction Simplified Computation

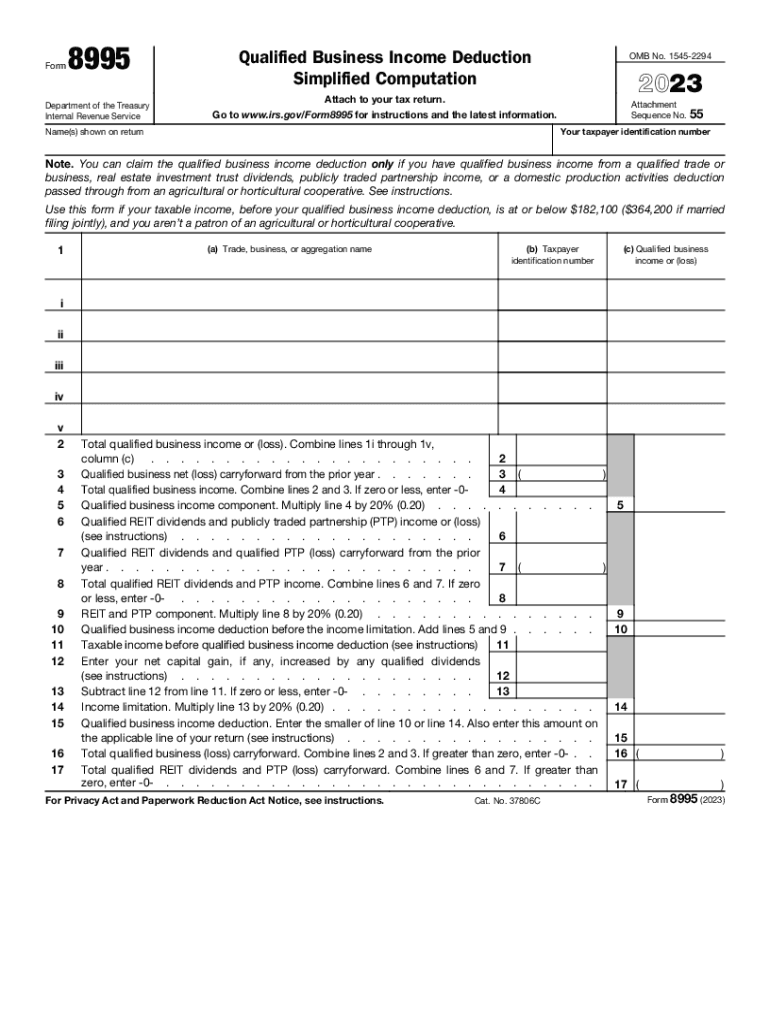

The Form 8995 is designed for taxpayers to calculate their Qualified Business Income (QBI) deduction in a simplified manner. This form allows eligible taxpayers to determine the amount of deduction they can claim based on their qualified business income, which can significantly reduce their taxable income. The simplified computation is particularly beneficial for those with income below certain thresholds, making the process more straightforward and accessible.

How to use the Form 8995 Qualified Business Income Deduction Simplified Computation

To use the Form 8995, taxpayers should first ensure they meet the eligibility criteria for the QBI deduction. Once eligibility is confirmed, the form must be filled out by inputting the total qualified business income, which includes income from sole proprietorships, partnerships, S corporations, and certain trusts. The form requires basic information about the business and the taxpayer, allowing for a clear calculation of the deduction based on the provided income figures.

Steps to complete the Form 8995 Qualified Business Income Deduction Simplified Computation

Completing the Form 8995 involves several key steps:

- Gather all necessary documents related to your business income.

- Input your total qualified business income in the designated section of the form.

- Calculate the deduction amount based on the applicable percentage of your qualified business income.

- Ensure all calculations are accurate and double-check for any potential errors.

- Submit the completed form along with your tax return.

Eligibility Criteria

Eligibility for using Form 8995 is primarily based on the taxpayer's income level and the nature of the business. Individuals and entities must have qualified business income to qualify for the deduction. Additionally, taxpayers whose taxable income exceeds certain thresholds may need to use the more complex Form 8995-A instead. It is essential to review the IRS guidelines to confirm eligibility before proceeding with the form.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form 8995. Typically, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to file the form timely to avoid penalties and ensure that the QBI deduction is applied to the correct tax year.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 8995. These guidelines include instructions on eligibility, required documentation, and how to accurately calculate the QBI deduction. Taxpayers should refer to the latest IRS publications and instructions for the most current information and ensure compliance with all regulatory requirements.

Quick guide on how to complete form 8995 qualified business income deduction simplified computation

Complete Form 8995 Qualified Business Income Deduction Simplified Computation effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Form 8995 Qualified Business Income Deduction Simplified Computation on any device with airSlate SignNow's Android or iOS applications and simplify any document-oriented task today.

How to modify and eSign Form 8995 Qualified Business Income Deduction Simplified Computation with ease

- Locate Form 8995 Qualified Business Income Deduction Simplified Computation and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes only moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your updates.

- Choose how you wish to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8995 Qualified Business Income Deduction Simplified Computation and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8995 qualified business income deduction simplified computation

Create this form in 5 minutes!

How to create an eSignature for the form 8995 qualified business income deduction simplified computation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 IRS computation process?

The 2023 IRS computation process involves calculating your tax obligations based on your income, deductions, and credits for the year. Utilizing tools like airSlate SignNow can simplify document management during this process. With our platform, you can easily sign and send necessary tax documents securely, making your 2023 IRS computation smoother.

-

How can airSlate SignNow assist with my 2023 IRS computation?

airSlate SignNow offers an efficient way to manage and sign documents that are essential for your 2023 IRS computation. Whether you need to send tax forms or receive documents from clients or employees, our eSignature solutions streamline the process. This helps ensure that your computations are accurate and timely.

-

Are there any fees associated with using airSlate SignNow for 2023 IRS computation?

airSlate SignNow offers a range of pricing plans to cater to various business needs. While the costs may vary, the value of efficient document management for your 2023 IRS computation process is substantial. By choosing our service, you can save both time and money, avoiding potential penalties for late submissions.

-

What features does airSlate SignNow provide for managing documents during the 2023 IRS computation?

Our platform includes features such as secure eSigning, document templates, and automated workflows. These functionalities are designed to make your 2023 IRS computation process easier and more compliant. With airSlate SignNow, you can ensure that all documents are signed and filed correctly and promptly.

-

Can I integrate airSlate SignNow with other accounting software for my 2023 IRS computation?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, enhancing your workflow for the 2023 IRS computation. This integration allows for a more unified approach to document management, ensuring that your tax calculations and submissions are accurate.

-

What benefits does airSlate SignNow offer for businesses focusing on 2023 IRS computation?

Using airSlate SignNow for your 2023 IRS computation brings numerous benefits, including time savings, improved accuracy, and enhanced security. Our solution is designed to simplify document workflows, making tax season less stressful for businesses. Experience efficient document handling that optimizes your overall computation process.

-

Is airSlate SignNow user-friendly for those unfamiliar with 2023 IRS computation?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with the 2023 IRS computation process. Our intuitive interface helps users navigate document management effortlessly. With comprehensive support resources, you can quickly get up to speed.

Get more for Form 8995 Qualified Business Income Deduction Simplified Computation

- Interrogatories to defendant for motor vehicle accident maine form

- Llc notices resolutions and other operations forms package maine

- Notice of dishonored check civil keywords bad check bounced check maine form

- Mutual wills containing last will and testaments for unmarried persons living together with no children maine form

- Mutual wills package of last wills and testaments for unmarried persons living together not married with adult children maine form

- Mutual wills or last will and testaments for unmarried persons living together with minor children maine form

- Non marital cohabitation living together agreement maine form

- Paternity law and procedure handbook maine form

Find out other Form 8995 Qualified Business Income Deduction Simplified Computation

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself