Form 8995 Department of the Treasury 2024-2026

What is the IRS Form 8995?

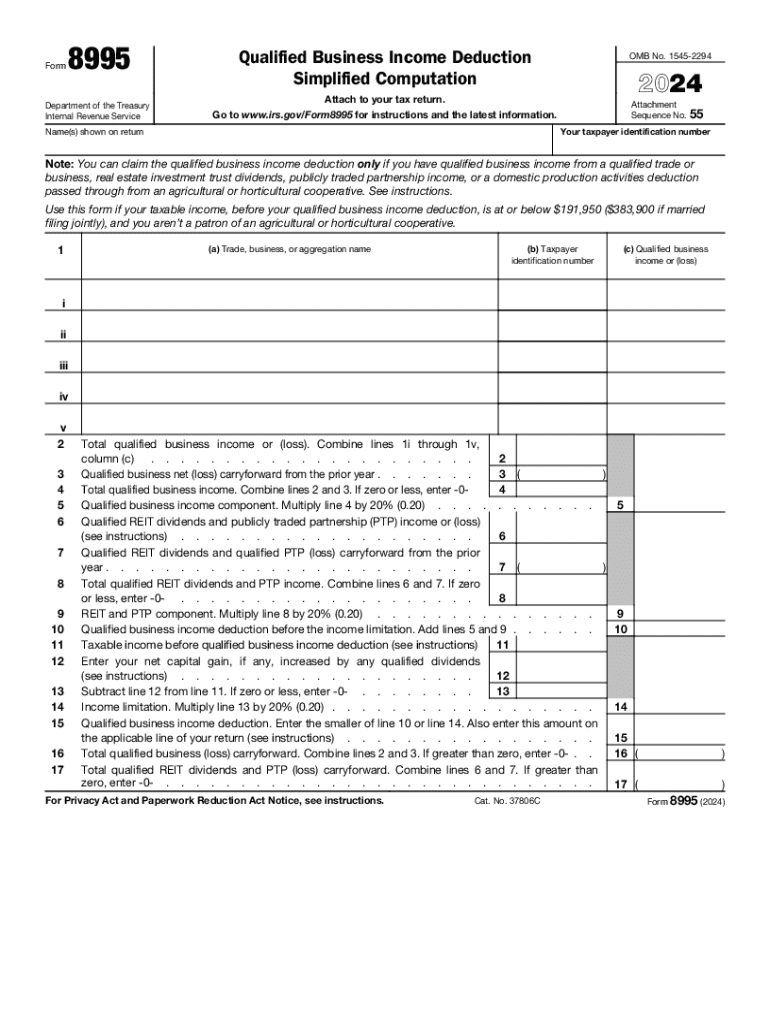

The IRS Form 8995 is a tax form used by eligible taxpayers to claim the Qualified Business Income (QBI) deduction. This deduction allows individuals, partnerships, S corporations, and certain trusts to deduct up to twenty percent of their qualified business income from their taxable income. The form provides a simplified computation for the QBI deduction, making it easier for taxpayers to determine the amount they can claim. It is particularly beneficial for small business owners and self-employed individuals, as it streamlines the process of calculating potential tax savings.

How to Complete the IRS Form 8995

Completing the IRS Form 8995 involves several key steps. First, gather all necessary financial documents, including income statements and expense records related to your business. Next, input your qualified business income on the form, ensuring that you accurately report any deductions or losses. The form will guide you through the calculation of your QBI deduction, including any limitations based on your taxable income. It is essential to review the instructions carefully to ensure compliance with IRS regulations and to avoid errors that could lead to penalties.

Eligibility Criteria for the IRS Form 8995

To qualify for the use of Form 8995, taxpayers must meet specific eligibility criteria. The primary requirement is that the taxpayer must have qualified business income from a qualified trade or business. Additionally, the taxpayer's taxable income must fall below certain thresholds set by the IRS, which can change annually. If your taxable income exceeds these limits, you may need to use Form 8995-A instead, which involves a more complex calculation. Understanding these criteria is crucial for determining your eligibility for the QBI deduction.

Filing Deadlines for the IRS Form 8995

Filing deadlines for the IRS Form 8995 align with the standard tax return deadlines. For most individual taxpayers, the deadline to file is April 15 of the following year. If you require additional time, you can file for an extension, which typically allows you until October 15 to submit your return. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties. Keeping track of these dates ensures compliance and helps prevent issues with the IRS.

Required Documents for the IRS Form 8995

When preparing to file the IRS Form 8995, certain documents are necessary to support your claims. These include records of your business income, such as profit and loss statements, as well as documentation of any business expenses that may affect your QBI. Additionally, if you have multiple businesses, you may need to provide separate documentation for each entity. Keeping organized records will facilitate a smoother filing process and help ensure accuracy in your calculations.

IRS Guidelines for Form 8995

The IRS provides specific guidelines for completing Form 8995, which are outlined in the form's instructions. These guidelines detail how to report your qualified business income, calculate your deduction, and disclose any relevant information. It is essential to follow these instructions closely to ensure that your form is completed accurately and in compliance with IRS regulations. Familiarizing yourself with these guidelines can help you avoid common mistakes and potential audits.

Create this form in 5 minutes or less

Find and fill out the correct form 8995 department of the treasury

Create this form in 5 minutes!

How to create an eSignature for the form 8995 department of the treasury

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8995?

IRS Form 8995 is used to calculate the Qualified Business Income Deduction for eligible taxpayers. This form helps individuals and businesses determine the amount of their deduction based on their qualified business income. Understanding how to fill out IRS Form 8995 correctly can signNowly impact your tax savings.

-

How can airSlate SignNow help with IRS Form 8995?

airSlate SignNow provides a seamless way to eSign and send IRS Form 8995 and other tax documents securely. With our user-friendly interface, you can easily prepare and manage your forms, ensuring compliance and accuracy. This makes handling IRS Form 8995 more efficient and less stressful.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8995?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective, allowing you to manage IRS Form 8995 and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for IRS Form 8995?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing IRS Form 8995. These features streamline the process, making it easier to complete and submit your forms accurately. Additionally, our platform ensures that your documents are stored securely.

-

Can I integrate airSlate SignNow with other software for IRS Form 8995?

Absolutely! airSlate SignNow integrates with various software applications, enhancing your workflow for IRS Form 8995. Whether you use accounting software or CRM systems, our integrations allow for seamless data transfer and improved efficiency in managing your documents.

-

What are the benefits of using airSlate SignNow for IRS Form 8995?

Using airSlate SignNow for IRS Form 8995 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the eSigning process, allowing you to focus on your business while ensuring that your tax documents are handled correctly. This can lead to signNow time and cost savings.

-

Is airSlate SignNow secure for handling IRS Form 8995?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling IRS Form 8995. We utilize advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are secure while using our platform.

Get more for Form 8995 Department Of The Treasury

Find out other Form 8995 Department Of The Treasury

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document