Sbi Ppf Extension Form

What is the SBI PPF Extension Form?

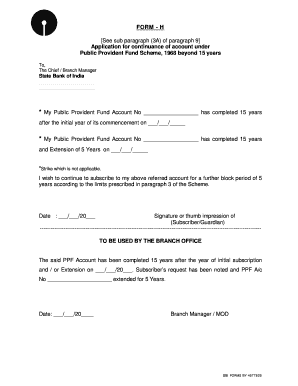

The SBI PPF extension form is a crucial document for individuals wishing to extend their Public Provident Fund (PPF) account with the State Bank of India (SBI). This form allows account holders to continue enjoying the benefits of their PPF account beyond the initial 15-year maturity period. The extension can be for an additional five years and is subject to certain conditions. By completing this form, account holders can ensure their investment continues to grow, taking advantage of the attractive interest rates offered by the PPF scheme.

How to Obtain the SBI PPF Extension Form

Obtaining the SBI PPF extension form is straightforward. Account holders can access the form through the following methods:

- Visit the official SBI website and navigate to the forms section.

- Request a physical copy at your nearest SBI branch.

- Download the form directly from the SBI mobile banking app, if available.

Ensure that you have the most recent version of the form to avoid any issues during submission.

Steps to Complete the SBI PPF Extension Form

Filling out the SBI PPF extension form requires attention to detail. Here are the steps to complete the form:

- Provide your personal details, including your name, address, and PPF account number.

- Indicate the desired extension period, which can be a minimum of five years.

- Sign and date the form to confirm your request.

- Attach any required documents, such as proof of identity or address, if necessary.

Once completed, submit the form at your local SBI branch or through the online banking portal, depending on the submission method you choose.

Legal Use of the SBI PPF Extension Form

The SBI PPF extension form is legally binding once it has been properly filled out and submitted. To ensure its validity, it is essential to comply with the regulatory requirements set forth by the Reserve Bank of India (RBI) and the Ministry of Finance. This includes adhering to the guidelines regarding the extension of PPF accounts, which stipulate that the extension can only be requested after the initial maturity period. By utilizing a reliable e-signature tool, such as signNow, you can enhance the legal standing of your submitted form.

Key Elements of the SBI PPF Extension Form

Understanding the key elements of the SBI PPF extension form is vital for successful completion. The form typically includes:

- Account Holder's Name

- PPF Account Number

- Extension Period Selection

- Signature of the Account Holder

- Date of Submission

Each of these elements plays a crucial role in processing your extension request, ensuring that all necessary information is accurately provided.

Form Submission Methods

There are several methods available for submitting the SBI PPF extension form:

- Online Submission: Log in to your SBI online banking account, navigate to the PPF section, and upload the completed form.

- In-Person Submission: Visit your nearest SBI branch and hand in the form directly to a bank representative.

- Mail Submission: Some branches may allow you to mail the form; check with your local branch for details.

Choosing the right submission method can help streamline the process and ensure timely processing of your extension request.

Quick guide on how to complete sbi ppf extension form

Complete Sbi Ppf Extension Form with ease on any device

Digital document management has gained signNow traction among both companies and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Manage Sbi Ppf Extension Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to modify and electronically sign Sbi Ppf Extension Form effortlessly

- Obtain Sbi Ppf Extension Form and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sharing your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or revising errors that require reprinting copies. airSlate SignNow caters to your document management needs in just a few clicks from your selected device. Modify and electronically sign Sbi Ppf Extension Form to ensure exceptional communication throughout any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sbi ppf extension form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form h ppf and how can it benefit my business?

The form h ppf is a specific document used for filing various forms related to taxation. Using airSlate SignNow, you can easily fill out, send, and eSign your form h ppf, streamlining your submission process and minimizing errors.

-

How can I create and manage the form h ppf using airSlate SignNow?

Creating and managing the form h ppf is simple with airSlate SignNow's user-friendly interface. You can upload your document, make necessary adjustments, and invite others to sign, all within one platform.

-

Is there a cost associated with using airSlate SignNow for the form h ppf?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can select the plan that allows you to use the form h ppf along with other document management features, ensuring cost-effectiveness.

-

Can I integrate airSlate SignNow with other applications for the form h ppf?

Absolutely! airSlate SignNow provides robust integrations with numerous applications, making it easy to utilize the form h ppf in conjunction with your existing software solutions. This enhances your workflow efficiency.

-

What security measures does airSlate SignNow implement for the form h ppf?

airSlate SignNow takes security seriously, employing advanced encryption for documents, including the form h ppf. Your data is protected, ensuring that all eSigned documents are safe and compliant with regulations.

-

Are there templates available for the form h ppf in airSlate SignNow?

Yes, airSlate SignNow offers various templates for the form h ppf, allowing you to save time and easily customize your documents for your specific needs. This feature enhances efficiency and helps avoid repetitive formatting.

-

Can I track the status of my form h ppf sent via airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to see the status of your form h ppf after sending it out for signatures. This ensures you are informed about the progress without any hassle.

Get more for Sbi Ppf Extension Form

Find out other Sbi Ppf Extension Form

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement