State Rundown 15 State Taxes Coming in Hot in New Year 2022

Understanding the SC1040 Form

The SC1040 form is the South Carolina Individual Income Tax Return, which residents and nonresidents must file to report their income and calculate their state tax liability. This form is essential for individuals who earn income in South Carolina, whether they live in the state or are nonresidents working there. The SC1040 includes various sections that help taxpayers detail their income, deductions, and credits, ensuring accurate tax reporting.

Steps to Complete the SC1040 Form

Completing the SC1040 form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the appropriate lines of the form.

- Claim any deductions and credits for which you qualify to reduce your taxable income.

- Calculate your total tax liability and any payments made throughout the year.

- Sign and date the form before submitting it to the South Carolina Department of Revenue.

Filing Deadlines for the SC1040 Form

It is crucial to be aware of the filing deadlines for the SC1040 form to avoid penalties. Typically, the deadline for filing your South Carolina income tax return aligns with the federal deadline, which is April 15. However, if this date falls on a weekend or holiday, the deadline may extend to the next business day. Taxpayers should also consider extensions if they need additional time to prepare their returns.

Required Documents for the SC1040 Form

To accurately complete the SC1040 form, taxpayers must gather specific documents, including:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical expenses or charitable donations.

- Any other relevant income documentation, such as interest statements or dividend reports.

Penalties for Non-Compliance with the SC1040 Form

Failure to file the SC1040 form or pay the taxes owed can result in significant penalties. South Carolina imposes a failure-to-file penalty, which is typically five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, interest accrues on unpaid taxes, increasing the total amount owed over time. It is essential to file on time and pay any taxes due to avoid these penalties.

Digital vs. Paper Version of the SC1040 Form

Taxpayers have the option to file the SC1040 form either digitally or via paper submission. Filing electronically is often faster and more secure, allowing for quicker processing and refunds. The digital version typically includes built-in error checks to help ensure accuracy. Conversely, paper filing may be preferred by those who are more comfortable with traditional methods. Regardless of the method chosen, it is important to keep copies of all submitted documents for personal records.

Eligibility Criteria for the SC1040 Form

Eligibility to file the SC1040 form generally includes individuals who are residents of South Carolina or nonresidents who earn income within the state. Specific criteria may apply based on income levels, filing status, and other factors. For example, certain individuals may qualify for special deductions or credits based on their circumstances, such as age or disability status. Understanding these eligibility requirements is critical for accurate tax filing.

Quick guide on how to complete state rundown 15 state taxes coming in hot in new year

Effortlessly Prepare State Rundown 15 State Taxes Coming In Hot In New Year on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle State Rundown 15 State Taxes Coming In Hot In New Year on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

How to Modify and eSign State Rundown 15 State Taxes Coming In Hot In New Year with Ease

- Obtain State Rundown 15 State Taxes Coming In Hot In New Year and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Choose how you would like to send your form – via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign State Rundown 15 State Taxes Coming In Hot In New Year to ensure effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state rundown 15 state taxes coming in hot in new year

Create this form in 5 minutes!

How to create an eSignature for the state rundown 15 state taxes coming in hot in new year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

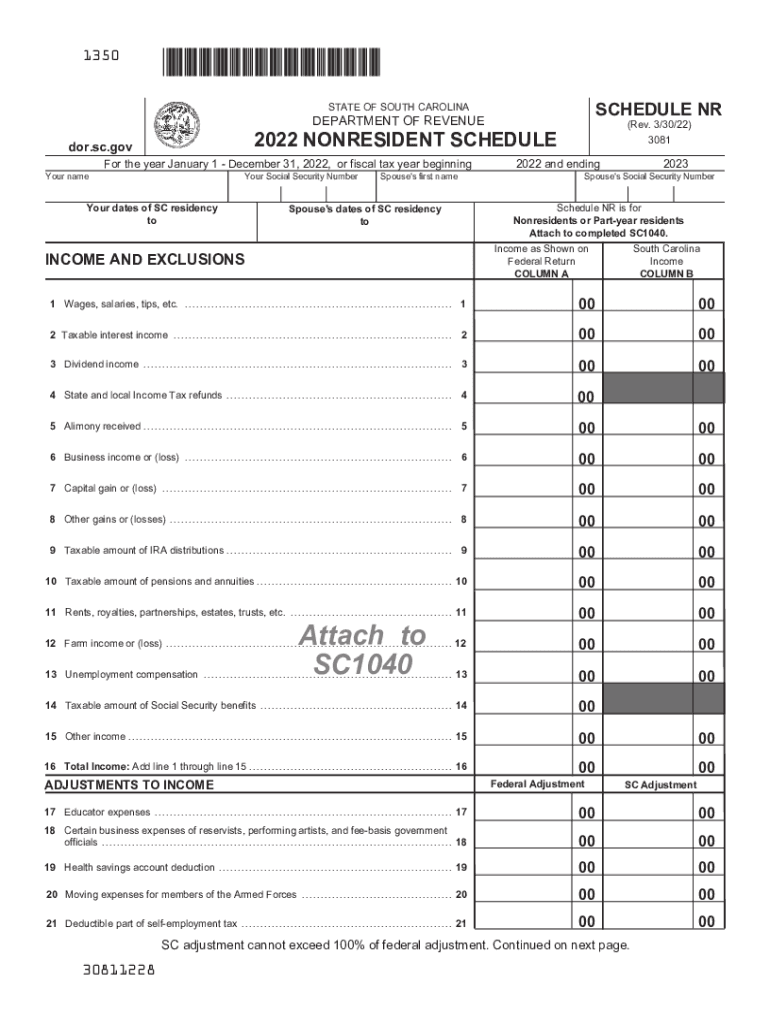

What is the South Carolina Schedule NR form?

The South Carolina Schedule NR form is used by non-residents to report their income that is sourced from South Carolina. It ensures proper tax calculation and compliance for individuals who earn income in the state but reside elsewhere. Completing this form accurately helps avoid potential tax issues with the South Carolina Department of Revenue.

-

How can airSlate SignNow help with the South Carolina Schedule NR form?

airSlate SignNow streamlines the process of completing and eSigning the South Carolina Schedule NR form, making it easier for users to manage their tax documents. Our platform offers templates and integration options, allowing for a seamless workflow. This efficiency helps prevent mistakes and saves valuable time during tax season.

-

Is there a cost associated with using airSlate SignNow for the South Carolina Schedule NR form?

Yes, airSlate SignNow offers various pricing plans based on user needs, including features for handling the South Carolina Schedule NR form. The cost is competitive, and users can choose a plan that aligns with their requirements. Additionally, the investment in our solution can save time and improve accuracy in document handling.

-

What features does airSlate SignNow offer for eSigning the South Carolina Schedule NR form?

airSlate SignNow provides several features for eSigning the South Carolina Schedule NR form, including customizable templates, secure signing options, and real-time tracking. Users can easily invite others to sign, set reminders, and integrate with other applications for a smooth experience. These features enhance collaboration and ensure compliance.

-

Can I integrate airSlate SignNow with other tools for managing the South Carolina Schedule NR form?

Absolutely! airSlate SignNow can seamlessly integrate with a variety of tools such as Google Drive, Salesforce, and more. This capability allows users to streamline their processes when managing the South Carolina Schedule NR form and other documents. Integration enhances workflow efficiency and data management.

-

What are the benefits of using airSlate SignNow for the South Carolina Schedule NR form?

Using airSlate SignNow for the South Carolina Schedule NR form offers benefits like greater accuracy, time savings, and enhanced security. Our platform minimizes the risks of errors that can occur with traditional paper forms. Additionally, users can access their documents from anywhere, making tax preparation more convenient.

-

Is airSlate SignNow secure for handling the South Carolina Schedule NR form?

Yes, airSlate SignNow employs advanced security protocols to ensure that all documents, including the South Carolina Schedule NR form, are protected. Our platform uses encryption, secure access, and compliance with industry standards to safeguard user information. Users can confidently eSign and share sensitive documents.

Get more for State Rundown 15 State Taxes Coming In Hot In New Year

Find out other State Rundown 15 State Taxes Coming In Hot In New Year

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document