Sc Schedule Nr 2018

What is the SC Schedule NR?

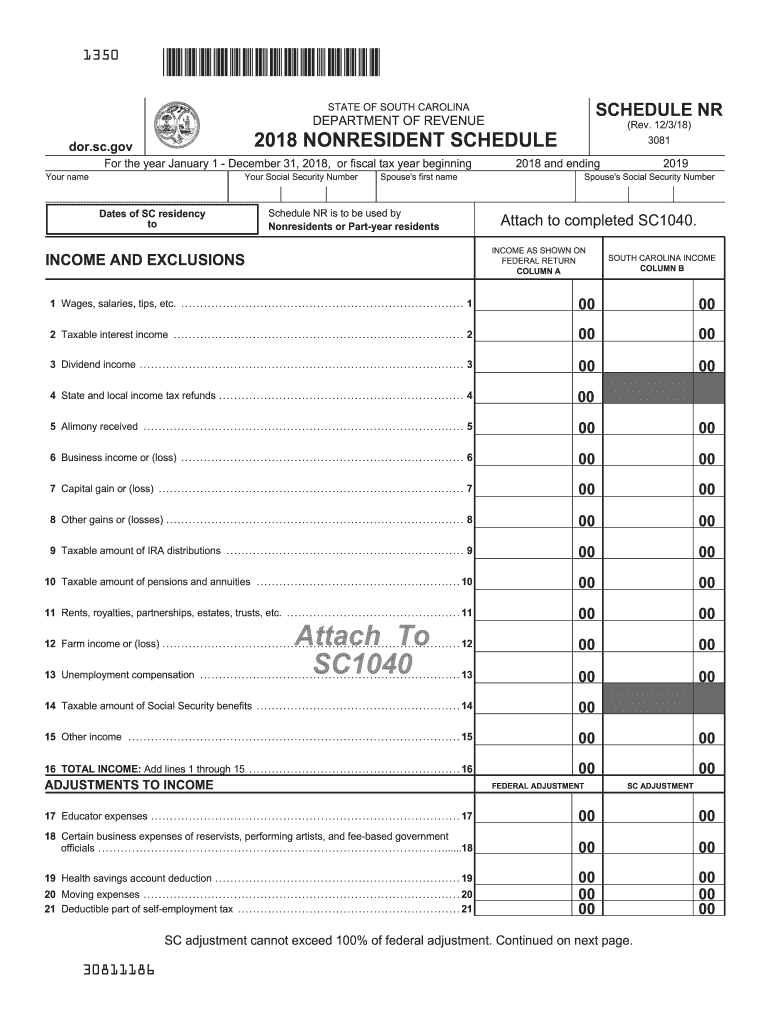

The SC Schedule NR is a tax form used by non-resident individuals who earn income in South Carolina. It allows these taxpayers to report their income and calculate their tax liability for the income earned within the state. This form is part of the South Carolina individual income tax return process and is specifically designed for those who do not reside in South Carolina but have state-sourced income. Understanding this form is essential for compliance with state tax regulations.

Steps to Complete the SC Schedule NR

Filling out the SC Schedule NR requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including your W-2s, 1099s, and any other income statements.

- Start with your total income earned in South Carolina, ensuring to include all sources of income.

- Complete the sections of the form that pertain to deductions and credits applicable to non-residents.

- Calculate your tax liability based on the income reported and the applicable tax rates.

- Review the completed form for accuracy before signing and dating it.

Legal Use of the SC Schedule NR

The SC Schedule NR is legally recognized by the South Carolina Department of Revenue for tax reporting purposes. It must be completed accurately to ensure compliance with state tax laws. Filing this form allows non-residents to fulfill their tax obligations while also taking advantage of any deductions or credits they may qualify for. It is essential to adhere to the guidelines provided by the IRS and the South Carolina Department of Revenue to avoid penalties.

Filing Deadlines / Important Dates

Timely filing of the SC Schedule NR is crucial to avoid penalties. The typical deadline for submitting this form coincides with the federal tax return deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the South Carolina Department of Revenue website for any updates or changes to filing deadlines.

Required Documents

To complete the SC Schedule NR, certain documents are necessary. These include:

- W-2 forms from employers for income earned in South Carolina.

- 1099 forms for any freelance or contract work performed in the state.

- Documentation of any deductions or credits you plan to claim.

- Records of any estimated tax payments made during the year.

Who Issues the Form

The SC Schedule NR is issued by the South Carolina Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. It is important to obtain the most current version of the form directly from the Department of Revenue to ensure accuracy and compliance with state regulations.

Quick guide on how to complete sc 1040 schedule nr 2016 2018 2019 form

Your assistance manual on how to prepare your Sc Schedule Nr

If you’re seeking to understand how to finish and submit your Sc Schedule Nr, below are a few brief guidelines on how to simplify tax submission.

To start, you simply need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, create, and finalize your tax forms with ease. Utilizing its editor, you can navigate between text, checkboxes, and eSignatures, and return to modify information when necessary. Enhance your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Sc Schedule Nr in minutes:

- Establish your account and begin working on PDFs in no time.

- Use our repository to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to access your Sc Schedule Nr in our editor.

- Fill in the mandatory fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and rectify any discrepancies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper can raise return mistakes and extend refund processing. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct sc 1040 schedule nr 2016 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

How do I fill out the IGNOU admission form for the B.Sc in physics 2019 July session?

Now-a-days admission in IGNOU is very easy. Everything is online now.. you have to visit IGNOU website for the same. Go to admission section and follow step by step process to fill online application form.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

Create this form in 5 minutes!

How to create an eSignature for the sc 1040 schedule nr 2016 2018 2019 form

How to make an eSignature for your Sc 1040 Schedule Nr 2016 2018 2019 Form in the online mode

How to create an eSignature for your Sc 1040 Schedule Nr 2016 2018 2019 Form in Google Chrome

How to create an electronic signature for putting it on the Sc 1040 Schedule Nr 2016 2018 2019 Form in Gmail

How to generate an eSignature for the Sc 1040 Schedule Nr 2016 2018 2019 Form right from your smart phone

How to create an electronic signature for the Sc 1040 Schedule Nr 2016 2018 2019 Form on iOS

How to make an eSignature for the Sc 1040 Schedule Nr 2016 2018 2019 Form on Android

People also ask

-

What are the SC Schedule NR instructions for 2018?

The SC Schedule NR instructions for 2018 are detailed guidelines provided for individuals who have a non-resident status. Understanding these instructions is crucial for accurate tax reporting. They help ensure compliance with state laws and enable taxpayers to benefit from available deductions and credits.

-

How does airSlate SignNow facilitate document eSigning for SC Schedule NR instructions 2018?

airSlate SignNow simplifies the process of eSigning documents related to SC Schedule NR instructions 2018. Users can quickly prepare and send forms for signatures electronically, reducing the time and effort required compared to traditional methods. Our platform ensures that compliance is maintained throughout the eSigning process.

-

What features does airSlate SignNow offer for managing SC Schedule NR instructions 2018 documents?

airSlate SignNow offers several features specifically designed for managing SC Schedule NR instructions 2018 documents. These include customizable templates, secure storage, and an intuitive interface for easy navigation. These features allow users to streamline their document workflows efficiently.

-

Is airSlate SignNow affordable for small businesses handling SC Schedule NR instructions 2018?

Yes, airSlate SignNow is a cost-effective solution suitable for small businesses managing SC Schedule NR instructions 2018. Our pricing plans are designed to fit varying budgets, allowing small companies to utilize premium eSigning solutions without breaking the bank. Additionally, the time savings can translate into signNow cost reductions.

-

Can I integrate airSlate SignNow with other tools for SC Schedule NR instructions 2018?

Absolutely! airSlate SignNow easily integrates with various tools and software to enhance the management of SC Schedule NR instructions 2018. Our platform offers seamless connections with popular applications like Google Drive, Dropbox, and CRM systems, allowing for an integrated document workflow.

-

What benefits does airSlate SignNow provide for handling SC Schedule NR instructions 2018?

Using airSlate SignNow for SC Schedule NR instructions 2018 brings numerous benefits, including enhanced efficiency and accuracy in document handling. The electronic signature process eliminates the need for printing, scanning, and mailing, saving time. Additionally, our solution ensures that all transactions are securely stored and easily accessible.

-

What support does airSlate SignNow offer for SC Schedule NR instructions 2018 users?

airSlate SignNow provides robust support for users dealing with SC Schedule NR instructions 2018. Our team is available through various channels, including live chat, email, and support documentation to assist with any inquiries. We aim to ensure that users can optimize their experience and fully utilize our platform's features.

Get more for Sc Schedule Nr

- Criminal thinking curriculum pdf form

- Students application form english language east midlands

- Htcs summer camp for youth applicaton form for venkateswara

- Special determination secure ssa form

- Braeburn glen acc request form

- Saar n fillable form

- Get methodist church internal organisations report form

- Form 201v 2021application to vary a firearm certif

Find out other Sc Schedule Nr

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format