SCHEDULE NR STATE of SOUTH CAROLINA DEPARTMENT of 2024-2026

Understanding the South Carolina Schedule NR

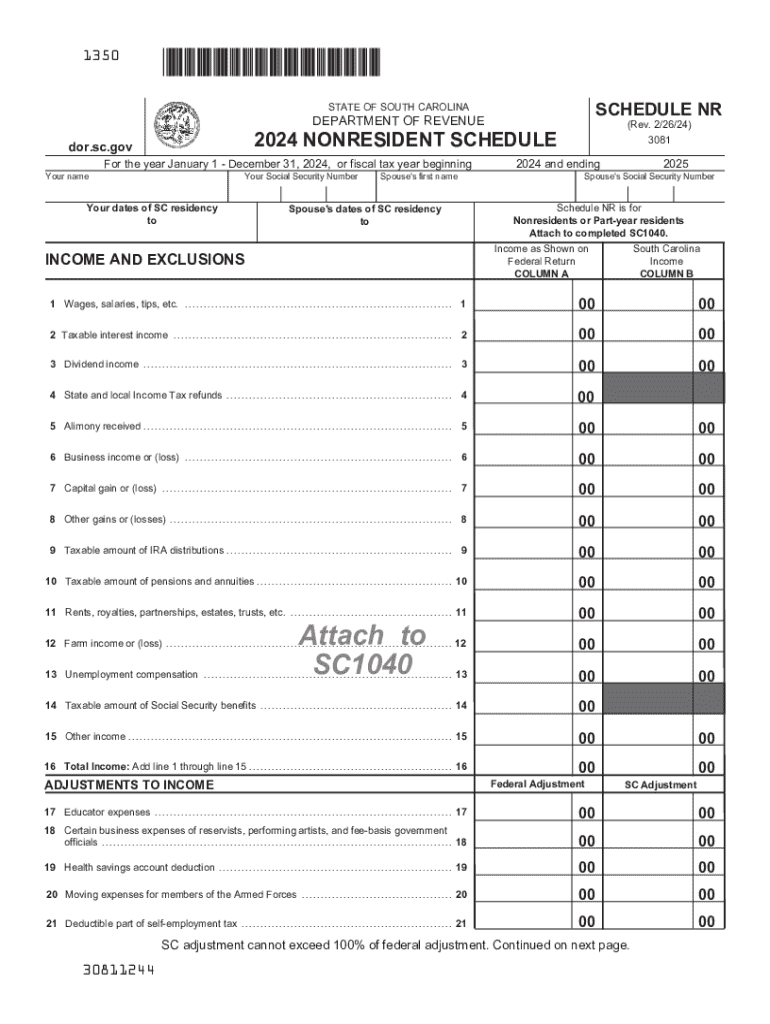

The South Carolina Schedule NR is a tax form specifically designed for non-residents who earn income in South Carolina. This form allows individuals to report income earned within the state while ensuring that they are only taxed on that income, rather than their total income from all sources. The Schedule NR is essential for non-residents to comply with state tax laws and accurately calculate their tax obligations.

Steps to Complete the South Carolina Schedule NR

Completing the South Carolina Schedule NR involves several key steps:

- Gather necessary financial documents, including W-2 forms, 1099 forms, and any other income statements.

- Determine the total income earned in South Carolina, as this will be the basis for your tax calculation.

- Fill out the Schedule NR form, ensuring that all sections are completed accurately, including personal information and income details.

- Calculate your tax liability based on the income reported and the applicable tax rates for non-residents.

- Review the completed form for accuracy before submission.

Required Documents for the South Carolina Schedule NR

To accurately complete the South Carolina Schedule NR, you will need several documents:

- W-2 forms from employers for income earned in South Carolina.

- 1099 forms for any freelance or contract work completed in the state.

- Records of any other income sources that are subject to South Carolina tax.

- Documentation of any deductions or credits you plan to claim.

Filing Deadlines for the South Carolina Schedule NR

It is crucial to be aware of the filing deadlines for the South Carolina Schedule NR to avoid penalties. Typically, the deadline for submitting the form aligns with the federal tax filing deadline, which is usually April 15. However, if you are unable to file by this date, you may apply for an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Legal Use of the South Carolina Schedule NR

The legal use of the South Carolina Schedule NR is to ensure compliance with state tax laws for non-residents. Filing this form accurately is a legal requirement for anyone who earns income in South Carolina but resides in another state. Failure to file or inaccuracies in reporting can lead to penalties, interest on unpaid taxes, and potential legal action from the South Carolina Department of Revenue.

Examples of Using the South Carolina Schedule NR

There are various scenarios where the South Carolina Schedule NR is applicable:

- A freelancer living in Georgia who provides services to clients in South Carolina must report that income using the Schedule NR.

- A non-resident employee working temporarily in South Carolina will need to file this form to report their earnings.

- Individuals who own rental property in South Carolina but reside in another state must report the rental income on the Schedule NR.

Create this form in 5 minutes or less

Find and fill out the correct schedule nr state of south carolina department of

Create this form in 5 minutes!

How to create an eSignature for the schedule nr state of south carolina department of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the South Carolina Schedule NR?

The South Carolina Schedule NR is a tax form used by non-residents to report income earned in South Carolina. It is essential for ensuring compliance with state tax laws. By using airSlate SignNow, you can easily eSign and submit your Schedule NR documents securely and efficiently.

-

How can airSlate SignNow help with the South Carolina Schedule NR?

airSlate SignNow simplifies the process of completing and submitting the South Carolina Schedule NR. Our platform allows you to fill out the form electronically, eSign it, and send it directly to the appropriate tax authorities. This streamlines your tax filing process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the South Carolina Schedule NR?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective while providing all the necessary features for managing documents like the South Carolina Schedule NR. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the South Carolina Schedule NR?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to manage your South Carolina Schedule NR and other important documents. Additionally, our user-friendly interface ensures a smooth experience for all users.

-

Can I integrate airSlate SignNow with other software for the South Carolina Schedule NR?

Absolutely! airSlate SignNow offers integrations with various software applications, including CRM and accounting tools. This allows you to seamlessly manage your South Carolina Schedule NR alongside other business processes, enhancing efficiency and productivity.

-

What are the benefits of using airSlate SignNow for the South Carolina Schedule NR?

Using airSlate SignNow for your South Carolina Schedule NR offers numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform ensures that your documents are signed and submitted quickly, reducing the stress associated with tax filing. Plus, your data is protected with advanced security measures.

-

Is airSlate SignNow user-friendly for filing the South Carolina Schedule NR?

Yes, airSlate SignNow is designed with user experience in mind. Our intuitive interface makes it easy for anyone to navigate the platform and complete their South Carolina Schedule NR without any technical expertise. You'll find that eSigning and managing documents is straightforward and efficient.

Get more for SCHEDULE NR STATE OF SOUTH CAROLINA DEPARTMENT OF

- 43 101 children eligible for adoption 1 except as otherwise form

- J edgar hoover part 19 of 22 fbi vault form

- Alaska notarial certificates notary stamp form

- Cp 410 request for appointed attorney childrens proceedings form

- In the district superior court for the state of alaska form

- Cr 140 request for temporary transfer 9 05doc form

- Cr 145 anch request for contiuance of arraignment 2 00 criminal forms

- In the district court for the state of alaska at state of form

Find out other SCHEDULE NR STATE OF SOUTH CAROLINA DEPARTMENT OF

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself