South Carolina Schedule NR Instructions 2018

Understanding the South Carolina Schedule NR Instructions

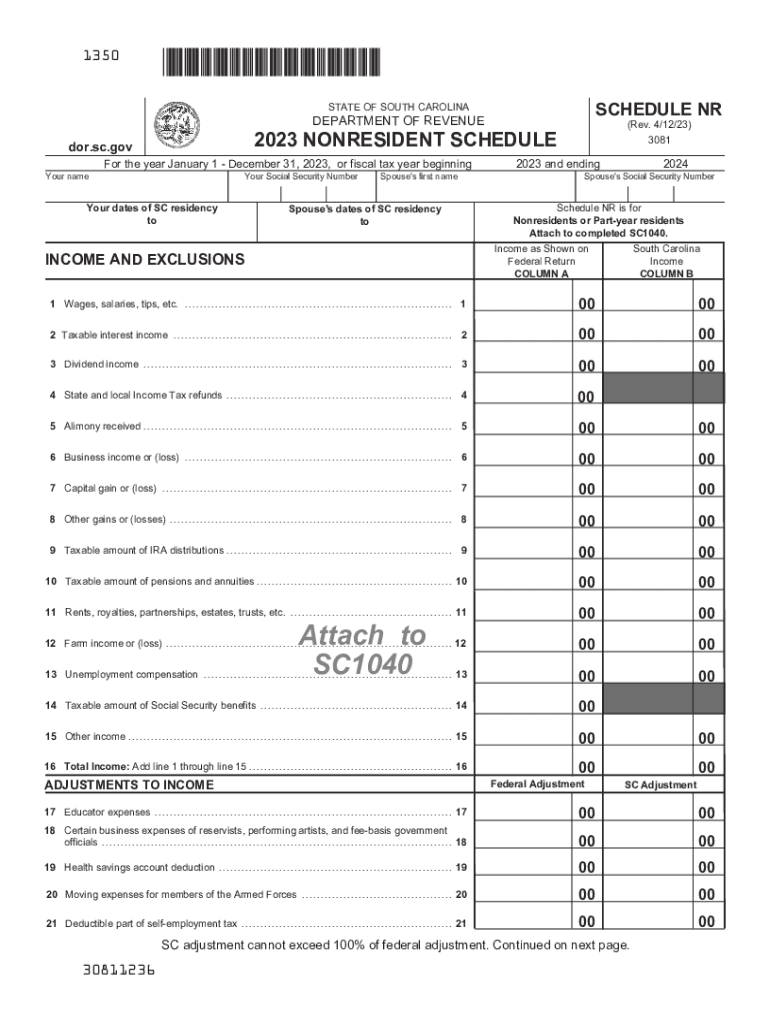

The South Carolina Schedule NR is a crucial form for nonresidents who earn income in South Carolina. It is specifically designed to report income earned from sources within the state while allowing taxpayers to claim deductions and credits applicable to their situation. Understanding the instructions for this form is essential for ensuring accurate reporting and compliance with state tax laws.

The instructions detail how to fill out the form, including sections for reporting income, deductions, and any applicable tax credits. They also provide information on how to determine residency status, which is vital for nonresidents. Familiarity with these instructions can help prevent errors that may lead to delays in processing or potential penalties.

Steps to Complete the South Carolina Schedule NR Instructions

Completing the South Carolina Schedule NR involves several key steps that ensure accurate reporting of income and deductions. Begin by gathering all necessary documents, including W-2s, 1099s, and any other income statements. Next, determine your residency status to confirm that you are eligible to use this form.

Follow the instructions closely, filling out each section accurately. Report your South Carolina-source income in the designated area, and include any adjustments or deductions you may qualify for. Finally, review the completed form for accuracy before submission to avoid any compliance issues.

Required Documents for the South Carolina Schedule NR

When completing the South Carolina Schedule NR, certain documents are necessary to ensure accurate reporting. These typically include:

- W-2 forms from employers showing income earned in South Carolina.

- 1099 forms for any freelance or contract work performed in the state.

- Records of any deductions or credits you plan to claim.

- Proof of residency status, if applicable.

Having these documents ready will streamline the process and help ensure that all information reported is accurate and complete.

Filing Deadlines for the South Carolina Schedule NR

It is important to be aware of the filing deadlines associated with the South Carolina Schedule NR to avoid penalties. Generally, the due date for filing this form coincides with the federal tax deadline, which is typically April 15. If this date falls on a weekend or holiday, the deadline may be adjusted accordingly.

Taxpayers should also consider any extensions that may be applicable, as well as the importance of timely submission to ensure compliance with state tax laws. Keeping track of these deadlines will help prevent any unnecessary complications.

Legal Use of the South Carolina Schedule NR Instructions

The South Carolina Schedule NR instructions are legally binding and must be followed to ensure compliance with state tax regulations. Misinterpretation or failure to adhere to these instructions can result in penalties or fines. It is essential for taxpayers to understand their obligations under the law and to use the form correctly to report income accurately.

Taxpayers should also be aware of the legal implications of incorrect filings, including potential audits or further scrutiny from the South Carolina Department of Revenue. Consulting a tax professional can provide additional guidance on legal requirements and best practices when completing the form.

Quick guide on how to complete south carolina schedule nr instructions

Complete South Carolina Schedule NR Instructions effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without any delays. Handle South Carolina Schedule NR Instructions on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign South Carolina Schedule NR Instructions with ease

- Find South Carolina Schedule NR Instructions and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign South Carolina Schedule NR Instructions to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct south carolina schedule nr instructions

Create this form in 5 minutes!

How to create an eSignature for the south carolina schedule nr instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the South Carolina schedule NR?

The South Carolina schedule NR is a specific form used to report non-resident income in South Carolina. It is essential for individuals who earn income in the state but reside elsewhere. By accurately completing this form, taxpayers can ensure compliance and avoid potential penalties.

-

How can airSlate SignNow assist with South Carolina schedule NR submissions?

AirSlate SignNow streamlines the process of completing and submitting your South Carolina schedule NR by allowing you to fill out, sign, and send documents electronically. This easy-to-use platform ensures that you can complete your tax forms swiftly and securely, increasing your efficiency during tax season.

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow provides a range of features for tax document management, including document templates, customizable workflows, and secure electronic signatures. These features help simplify the preparation and submission of various forms like the South Carolina schedule NR, making the process quick and hassle-free.

-

Is airSlate SignNow cost-effective for managing tax documents like the South Carolina schedule NR?

Yes, airSlate SignNow offers a cost-effective solution for managing tax documents, including the South Carolina schedule NR. With various pricing plans, businesses can choose an option that fits their needs and budget, ensuring they get the most value from their investment.

-

Can I integrate airSlate SignNow with other accounting software for handling South Carolina schedule NR?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and tax software, facilitating effortless document management and eSigning. This means you can easily handle your South Carolina schedule NR alongside other financial documents, streamlining your workflow.

-

What are the benefits of using airSlate SignNow for eSigning the South Carolina schedule NR?

Using airSlate SignNow to eSign your South Carolina schedule NR offers several benefits, including convenience, speed, and enhanced security. The platform allows you to sign documents anytime and anywhere, signNowly reducing turnaround time and ensuring that your submission is secure and encrypted.

-

How secure is the data I share on airSlate SignNow when handling the South Carolina schedule NR?

AirSlate SignNow prioritizes security with robust encryption protocols and compliance with data protection regulations. When handling sensitive information related to your South Carolina schedule NR, you can rest assured that your data is protected throughout the entire signing process.

Get more for South Carolina Schedule NR Instructions

- Pursuant to the utah uniform probate code title 75 chapter 2 the undersigned

- Amount due in accordance with the laws of the state of utah form

- Previous section 57 17 3 utah legislature utahgov form

- Motion and affidavit requesting satisfaction of judgment form

- 1 defendant owes me form

- Cover sheet for civil filing actions 662019 utah courts form

- If so with regard to form

- Free utah quit claim deed formeformsfree fillable forms

Find out other South Carolina Schedule NR Instructions

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free