15g H Form Central Bank of India

What is the 15G H Form Central Bank of India

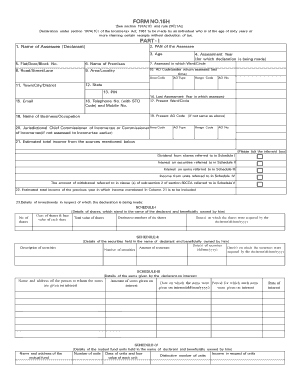

The 15G H form is a declaration form used in India to ensure that individuals or entities do not have tax deducted at source (TDS) on their income. This form is particularly relevant for those whose total income is below the taxable limit. By submitting the 15G H form, taxpayers can inform the bank or financial institution that their income is not taxable, thereby avoiding unnecessary deductions. This form is essential for maintaining cash flow and ensuring that individuals receive their full income without TDS deductions.

How to Use the 15G H Form Central Bank of India

Using the 15G H form involves a straightforward process. First, individuals must obtain the form from the Central Bank of India or download it from their official website. Once the form is acquired, it should be filled out with accurate personal details, including name, address, and PAN (Permanent Account Number). After completing the form, it must be submitted to the bank or financial institution where the income is generated. This submission can often be done online or in person, depending on the institution's policies.

Steps to Complete the 15G H Form Central Bank of India

Completing the 15G H form requires careful attention to detail. Here are the steps to follow:

- Download or collect the 15G H form from the Central Bank of India.

- Fill in your personal information, including your full name, address, and contact details.

- Provide your PAN, as it is essential for tax identification.

- Declare your total income for the financial year to confirm it is below the taxable limit.

- Sign and date the form to authenticate your declaration.

- Submit the completed form to the relevant bank or financial institution.

Legal Use of the 15G H Form Central Bank of India

The legal framework surrounding the 15G H form is crucial for its validity. This form is recognized under Indian tax laws, allowing individuals to declare their income status to avoid TDS. It is important to ensure that all information provided is accurate and truthful, as submitting false information could lead to penalties or legal repercussions. The form must be submitted annually, and it is advisable to keep a copy for personal records.

Eligibility Criteria for the 15G H Form Central Bank of India

To be eligible to submit the 15G H form, individuals must meet specific criteria. Primarily, the total income for the financial year must be below the taxable threshold set by the Income Tax Department of India. Additionally, the form can be submitted by residents of India, including individuals and certain entities, provided they meet the income criteria. It is important to verify eligibility before submitting the form to avoid complications.

Form Submission Methods (Online / Mail / In-Person)

The 15G H form can be submitted through various methods, depending on the policies of the Central Bank of India. Common submission methods include:

- Online Submission: Many banks offer online portals where individuals can upload their completed forms securely.

- Mail Submission: The form can be mailed to the bank's designated address, ensuring it is sent well before any deadlines.

- In-Person Submission: Individuals may also visit their local branch to submit the form directly, allowing for immediate confirmation of receipt.

Quick guide on how to complete 15g h form central bank of india

Effortlessly Prepare 15g H Form Central Bank Of India on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents quickly and efficiently. Handle 15g H Form Central Bank Of India on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Edit and Electronically Sign 15g H Form Central Bank Of India with Ease

- Find 15g H Form Central Bank Of India and click on Get Form to initiate the process.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred delivery method for the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign 15g H Form Central Bank Of India to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 15g h form central bank of india

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the central bank of india 15g form?

The central bank of india 15g form is a declaration form that individuals can submit to ensure that TDS (Tax Deducted at Source) is not deducted on their interest income. This form is essential for individuals whose total income is below the taxable limit and helps in straightforward financial management.

-

How can I complete the central bank of india 15g form using airSlate SignNow?

With airSlate SignNow, you can easily fill out the central bank of india 15g form online. Our intuitive platform allows you to input your details, save your progress, and eSign the document electronically—streamlining the process and ensuring compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the central bank of india 15g form?

airSlate SignNow offers competitive pricing plans that provide access to all features, including the ability to complete and eSign the central bank of india 15g form. There are various subscription options to fit different business needs, and many users find it cost-effective compared to traditional methods.

-

What are the benefits of using airSlate SignNow for tax documents like the central bank of india 15g form?

Using airSlate SignNow for tax documents like the central bank of india 15g form provides several benefits, including increased efficiency, reduced printing costs, and enhanced document security. Additionally, the platform allows for easy tracking and management of your forms, ensuring you can access them anytime.

-

Can I collaborate with others on the central bank of india 15g form using airSlate SignNow?

Yes, airSlate SignNow allows you to collaborate with others on the central bank of india 15g form. You can invite team members or stakeholders to review, edit, or eSign the document, ensuring a smooth and cooperative workflow.

-

Are there any integrations available with airSlate SignNow for handling the central bank of india 15g form?

airSlate SignNow supports various integrations that enhance the handling of the central bank of india 15g form. Whether you need to connect with CRM systems, cloud storage solutions, or other productivity apps, airSlate SignNow has the tools to integrate seamlessly with your existing workflows.

-

How secure is my information when filling the central bank of india 15g form on airSlate SignNow?

Security is a top priority at airSlate SignNow. When you fill out the central bank of india 15g form on our platform, your data is encrypted and protected, ensuring that your sensitive financial information remains confidential and secure.

Get more for 15g H Form Central Bank Of India

- Currency transaction report omb no 1506 0064 form

- Criminal record check ar920100z arkansas department of human humanservices arkansas form

- Eec form

- Mn dhs background study form

- Cori form general town of lexington lexingtonma

- Commercial tenancy agreement template form

- Commission advance agreement template form

- Commissary agreement template form

Find out other 15g H Form Central Bank Of India

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online