00 Judicial Expenses of the Testamentary or Intest 2018-2026

Understanding the bir form 1801

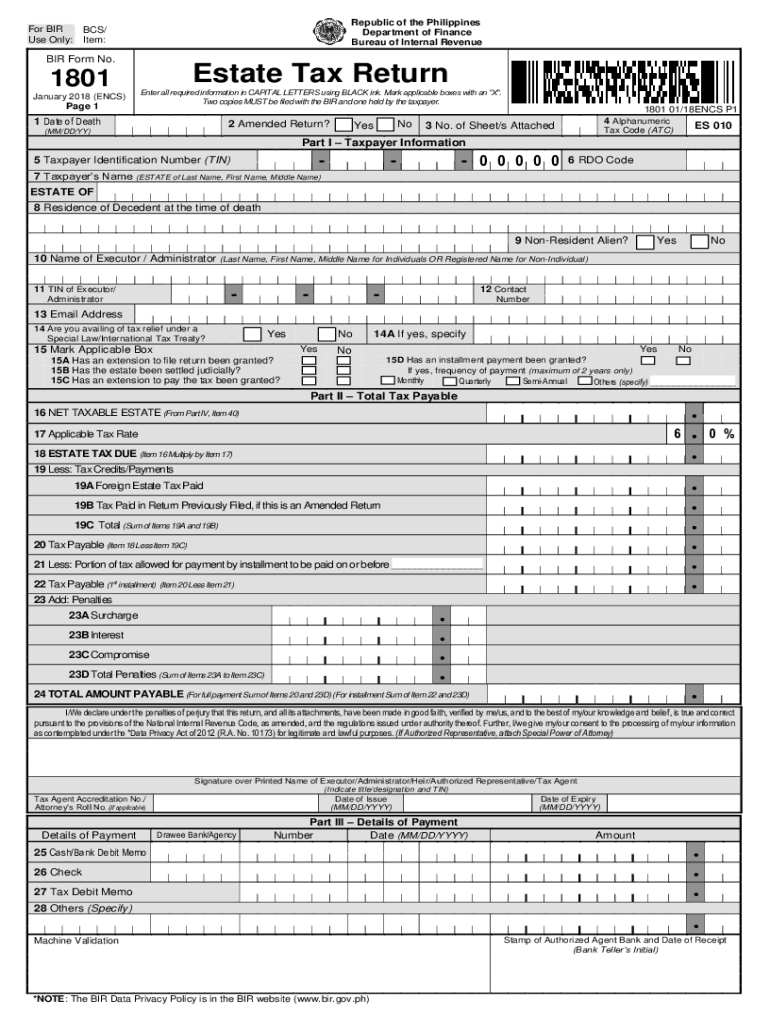

The bir form 1801 is an essential document used for filing estate tax returns in the Philippines. This form is specifically designed for individuals who are responsible for the estate of a deceased person. It allows the executor or administrator to report the estate's assets, liabilities, and the corresponding taxes owed to the Bureau of Internal Revenue (BIR). Proper completion of this form ensures compliance with tax obligations and helps avoid legal complications.

Steps to complete the bir form 1801

Filling out the bir form 1801 requires careful attention to detail. Here are the steps to guide you through the process:

- Gather all necessary documents, including the death certificate, inventory of assets, and any liabilities.

- Begin filling out the form by entering the decedent's information, including their full name, date of death, and tax identification number.

- List all assets owned by the decedent at the time of death, providing accurate valuations for each item.

- Include any outstanding debts or liabilities that the estate must settle.

- Calculate the total estate value and determine the applicable estate tax using the current tax rates.

- Sign and date the form, ensuring that all information is accurate and complete.

Legal use of the bir form 1801

The bir form 1801 serves a critical legal function in the estate settlement process. It must be filed within a specific timeframe following the decedent's death to avoid penalties. This form not only serves as a declaration of the estate's value but also as a formal request for the assessment of estate taxes. Ensuring that the form is completed correctly and submitted on time is vital for compliance with Philippine tax laws.

Filing deadlines for the bir form 1801

Timeliness is crucial when filing the bir form 1801. The form must be submitted within six months from the date of death of the decedent. If the deadline is missed, the estate may incur penalties and interest on the unpaid taxes. It is advisable to keep track of important dates and ensure that all necessary documentation is prepared well in advance of the deadline.

Required documents for the bir form 1801

To successfully complete the bir form 1801, several documents are required:

- Death certificate of the decedent

- Inventory of the estate's assets and liabilities

- Tax identification number of the decedent

- Any relevant legal documents, such as a will or court orders

Having these documents readily available will streamline the process and help ensure that the form is filled out accurately.

Penalties for non-compliance with the bir form 1801

Failure to file the bir form 1801 on time can lead to significant penalties. The Bureau of Internal Revenue may impose fines and interest on any unpaid estate taxes. Additionally, non-compliance can complicate the estate settlement process, potentially delaying the distribution of assets to beneficiaries. It is essential to adhere to filing requirements to avoid these consequences.

Quick guide on how to complete 00 judicial expenses of the testamentary or intest

Prepare 00 Judicial Expenses Of The Testamentary Or Intest seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle 00 Judicial Expenses Of The Testamentary Or Intest on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest method to alter and electronically sign 00 Judicial Expenses Of The Testamentary Or Intest effortlessly

- Locate 00 Judicial Expenses Of The Testamentary Or Intest and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from any device you prefer. Modify and electronically sign 00 Judicial Expenses Of The Testamentary Or Intest and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 00 judicial expenses of the testamentary or intest

Create this form in 5 minutes!

How to create an eSignature for the 00 judicial expenses of the testamentary or intest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bir form 1801 and why is it important?

The bir form 1801 is a crucial document required for accurate tax reporting in the Philippines. It serves as a declaration of income and expenses, ensuring compliance with local tax regulations. Understanding how to properly complete the bir form 1801 can help businesses avoid potential penalties.

-

How can airSlate SignNow help with the bir form 1801 process?

AirSlate SignNow simplifies the process of completing and signing the bir form 1801 electronically. Our platform allows users to fill out necessary fields, apply eSignatures, and send documents securely. This ensures a faster turnaround and makes tax compliance easier for businesses.

-

Is airSlate SignNow pricing affordable for small businesses needing to manage bir form 1801?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for small businesses. With our subscription models, businesses can access essential features for managing the bir form 1801 without breaking the bank. This makes it an ideal solution for companies looking to streamline their documentation process.

-

What features does airSlate SignNow provide for handling the bir form 1801?

AirSlate SignNow provides features such as easy document creation, collaborative editing, and customizable templates specifically for the bir form 1801. Additionally, users can track the document status and receive notifications when actions are completed. These features enhance efficiency and accuracy in document management.

-

Can I integrate airSlate SignNow with my existing accounting software for bir form 1801?

Absolutely! AirSlate SignNow offers seamless integrations with various accounting software systems. By integrating these tools, users can directly import financial data, making it easier to complete and submit the bir form 1801 accurately and efficiently.

-

What are the benefits of using airSlate SignNow for the bir form 1801?

Using airSlate SignNow for the bir form 1801 provides numerous benefits, including improved document security, reduced processing time, and enhanced collaboration among team members. The eco-friendly option of eSignatures also helps minimize paper usage. Overall, it streamlines the entire tax filing process for businesses.

-

Is electronic submission of the bir form 1801 allowed?

Yes, electronic submission of the bir form 1801 is allowed, provided it meets the requirements set by the Bureau of Internal Revenue (BIR). AirSlate SignNow ensures that all documents are properly formatted and securely submitted to comply with these regulations. This allows businesses to stay compliant while saving time.

Get more for 00 Judicial Expenses Of The Testamentary Or Intest

Find out other 00 Judicial Expenses Of The Testamentary Or Intest

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement