Proof of Income for Self Employed Template Form

What is the self employed verification form?

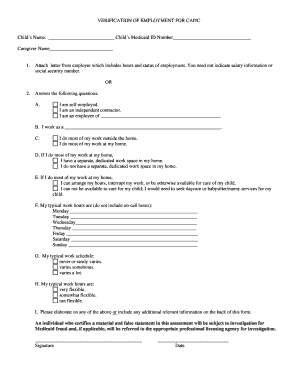

The self employed verification form is a crucial document used by individuals who operate their own businesses or work as freelancers. This form serves as proof of income, providing necessary details about earnings to lenders, landlords, or other entities that require verification of financial stability. It typically includes information such as the nature of the business, income sources, and any relevant financial statements. This form is essential for various applications, including loans, rental agreements, and government assistance programs.

Key elements of the self employed verification form

When completing the self employed verification form, several key elements must be included to ensure its validity. These elements typically encompass:

- Personal Information: Full name, contact details, and business address.

- Business Details: Type of business, date established, and business structure (e.g., LLC, sole proprietorship).

- Income Information: Monthly or annual income figures, along with any supporting documentation such as bank statements or tax returns.

- Signature: A signature is required to validate the information provided, confirming its accuracy.

Steps to complete the self employed verification form

Completing the self employed verification form involves a series of straightforward steps:

- Gather necessary documentation, including tax returns, bank statements, and any other proof of income documents for self employed.

- Fill in your personal and business information accurately, ensuring all details are current.

- Provide a clear breakdown of your income, including any additional sources.

- Review the completed form for accuracy and completeness.

- Sign and date the form to validate your information.

Legal use of the self employed verification form

The legal validity of the self employed verification form hinges on compliance with relevant regulations. For the form to be accepted, it must meet specific requirements, including:

- Adherence to eSignature laws, ensuring that electronic signatures are recognized.

- Inclusion of accurate and truthful information to avoid potential legal repercussions.

- Retention of supporting documents to substantiate the claims made in the form.

Examples of using the self employed verification form

The self employed verification form can be utilized in various scenarios, such as:

- Applying for a mortgage or personal loan, where lenders require proof of income.

- Securing a rental agreement, as landlords may request verification of financial stability.

- Accessing government assistance programs that require documentation of self employment income.

Who issues the self employed verification form?

While the self employed verification form does not have a standardized issuer like some official forms, it is typically created by the individual or their accountant. It is essential that the form is tailored to meet the specific requirements of the entity requesting it, ensuring that all necessary information is included for proper verification.

Quick guide on how to complete proof of income for self employed template

Prepare Proof Of Income For Self Employed Template effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Proof Of Income For Self Employed Template on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-based procedure today.

The easiest way to modify and electronically sign Proof Of Income For Self Employed Template with ease

- Find Proof Of Income For Self Employed Template and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential parts of the documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your preference. Edit and electronically sign Proof Of Income For Self Employed Template and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the proof of income for self employed template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NC Community Alternatives Program and how does it work?

The NC Community Alternatives Program is designed to offer supportive services and resources to individuals who prefer community-based living instead of institutional care. It provides a variety of options that help individuals receive necessary assistance while maintaining independence. This program can signNowly improve the quality of life for participants by fostering a connection to their community.

-

What features does the NC Community Alternatives Program include?

The NC Community Alternatives Program offers features such as personalized care plans, tailored support services, and access to community resources. It focuses on empowering participants through services that fit their unique needs, ensuring they receive comprehensive support. These features are crucial for enhancing the living experience of individuals involved in the program.

-

How can businesses leverage the NC Community Alternatives Program?

Businesses can leverage the NC Community Alternatives Program by partnering with local agencies to provide services that meet community needs. This collaboration can enhance service offerings and expand market signNow. Adopting a community-focused approach aligns with the program's mission and can result in a stronger connection with potential clients.

-

What are the benefits of the NC Community Alternatives Program?

The benefits of the NC Community Alternatives Program include improved individual well-being, better access to community resources, and the potential for increased independence. Participants often report higher satisfaction with their living situations and a stronger sense of belonging. By prioritizing community care, this program creates more inclusive environments for individuals.

-

Is there a cost associated with the NC Community Alternatives Program?

There may be costs associated with certain services offered under the NC Community Alternatives Program, but many resources are designed to be cost-effective. It is essential for individuals to explore available funding options and subsidies that can minimize out-of-pocket expenses. Understanding the financial structure of this program is key to maximizing its benefits.

-

Can the NC Community Alternatives Program be integrated with existing business operations?

Yes, the NC Community Alternatives Program can be integrated with existing business operations, especially for firms that focus on healthcare or community services. By aligning business goals with program objectives, companies can enhance their offerings and improve service delivery. Successful integration often leads to better outcomes for both the business and participants.

-

What types of individuals can benefit from the NC Community Alternatives Program?

The NC Community Alternatives Program is designed for individuals who require assistance but prefer community-based solutions over institutional care. This includes seniors, people with disabilities, and others seeking supportive living arrangements. The program tailors its offerings to meet diverse needs, making it suitable for a wide range of participants.

Get more for Proof Of Income For Self Employed Template

- Form 593 real estate withholding statement form 593 real estate withholding statement

- Spousal renunciation of rights affidavit omwbe omwbe wa form

- Bexar county constable pct form

- How to fill middlesex application form

- Form 3200 113 aquatic plant control mechanical manual permit application dnr wi

- Cans ny form

- Lease cum sale agreement plot doc form

- Landlord tenant contract template form

Find out other Proof Of Income For Self Employed Template

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement