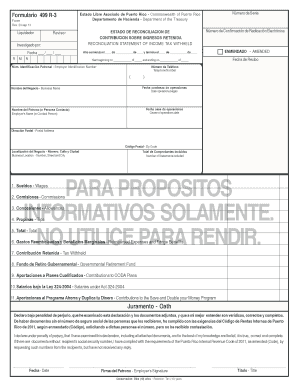

499 R 3 Form

What is the forma 499 R 3?

The forma 499 R 3 is a tax form used in Puerto Rico to report income and withholding for individuals and businesses. This form is essential for those who need to declare income earned within Puerto Rico and ensure compliance with local tax regulations. The 499 R 3 form serves as a declaration of income and provides the necessary details for the Puerto Rico Department of Treasury to assess tax liabilities accurately.

How to obtain the forma 499 R 3?

To obtain the forma 499 R 3, individuals and businesses can visit the official website of the Puerto Rico Department of Treasury. The form is typically available for download in a PDF format, allowing users to print and fill it out manually. Additionally, some tax preparation software may offer the option to generate this form electronically, streamlining the process for users.

Steps to complete the forma 499 R 3

Completing the forma 499 R 3 involves several key steps:

- Gather all necessary financial documents, including income statements and any relevant tax documents.

- Begin filling out the form by entering personal information, such as your name, address, and taxpayer identification number.

- Report all income earned in Puerto Rico, ensuring to include any applicable deductions or credits.

- Review the completed form for accuracy and ensure all required fields are filled out.

- Sign and date the form before submission.

Legal use of the forma 499 R 3

The forma 499 R 3 is legally binding when completed accurately and submitted within the designated time frame. It is crucial to adhere to the guidelines set forth by the Puerto Rico Department of Treasury to avoid penalties. The form must be signed by the taxpayer or an authorized representative to validate its contents and ensure compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the forma 499 R 3 typically align with the annual tax filing season in Puerto Rico. Taxpayers should be aware of specific dates, such as the deadline for submitting the form to avoid late fees or penalties. It is advisable to check the Puerto Rico Department of Treasury's official announcements for any updates on filing deadlines.

Required Documents

When completing the forma 499 R 3, certain documents are necessary to ensure accurate reporting. These may include:

- Wage statements or 1099 forms that detail income received.

- Documentation of any deductions or credits claimed.

- Identification documents, such as a Social Security number or taxpayer identification number.

Form Submission Methods

The forma 499 R 3 can be submitted through various methods. Taxpayers may choose to file the form electronically using approved tax software, which can facilitate a quicker processing time. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own guidelines, so it is essential to follow the instructions provided by the Puerto Rico Department of Treasury.

Quick guide on how to complete 499 r 3

Prepare 499 R 3 effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hassle. Manage 499 R 3 on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign 499 R 3 with ease

- Find 499 R 3 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to deliver your form: via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Adjust and eSign 499 R 3 and promote outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 499 r 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is forma 499 r 3 and how does it work with airSlate SignNow?

Forma 499 r 3 is a specific document format used in certain business processes. With airSlate SignNow, you can effortlessly create, send, and eSign forma 499 r 3 documents, ensuring compliance and streamlined operations. The platform simplifies the management of these forms, saving you time and reducing errors.

-

What features does airSlate SignNow offer for managing forma 499 r 3 documents?

AirSlate SignNow provides robust features for managing forma 499 r 3, including customizable templates, document sharing, and real-time collaboration. Users can easily track the status of their documents and receive notifications when they are signed. This enhances efficiency and keeps you informed about your document workflow.

-

Is airSlate SignNow a cost-effective solution for sending forma 499 r 3?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs, making it a cost-effective solution for sending forma 499 r 3. By streamlining your document signing process, you can save on operational costs while improving your overall productivity. Evaluate our plans to find the best fit for your organization.

-

What are the benefits of using airSlate SignNow for forma 499 r 3?

Using airSlate SignNow for forma 499 r 3 provides numerous benefits, including faster turnaround times for document signing and enhanced security features. The platform allows you to track changes and manage multiple signatories effortlessly, ensuring a smooth workflow. Additionally, electronic signatures are legally binding, giving your documents added credibility.

-

Can I integrate airSlate SignNow with other tools for forma 499 r 3?

Absolutely! airSlate SignNow offers various integrations with popular tools and applications, enabling you to manage forma 499 r 3 documents seamlessly. This connectivity allows for better data flow between your systems, enhancing overall efficiency and making it easier to incorporate document signing into your existing processes.

-

Is it easy to create a forma 499 r 3 document using airSlate SignNow?

Yes, creating a forma 499 r 3 document with airSlate SignNow is a straightforward process. The platform offers intuitive drag-and-drop features, allowing you to customize your forms quickly and easily. You can add fields, text boxes, and other elements needed for your specific document requirements.

-

What security measures does airSlate SignNow implement for forma 499 r 3?

AirSlate SignNow prioritizes security, implementing measures such as encryption and secure cloud storage for forma 499 r 3 documents. All signatures are protected, and the platform complies with various legal standards to ensure your documents remain safe. You can trust airSlate SignNow to handle your sensitive information with care.

Get more for 499 R 3

Find out other 499 R 3

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple