Publication 538 01, Accounting Periods and Methods2021 Instructions for Form FTB 3522 LLC Tax VoucherPublication 538 01, Account 2022

Understanding the 592f form

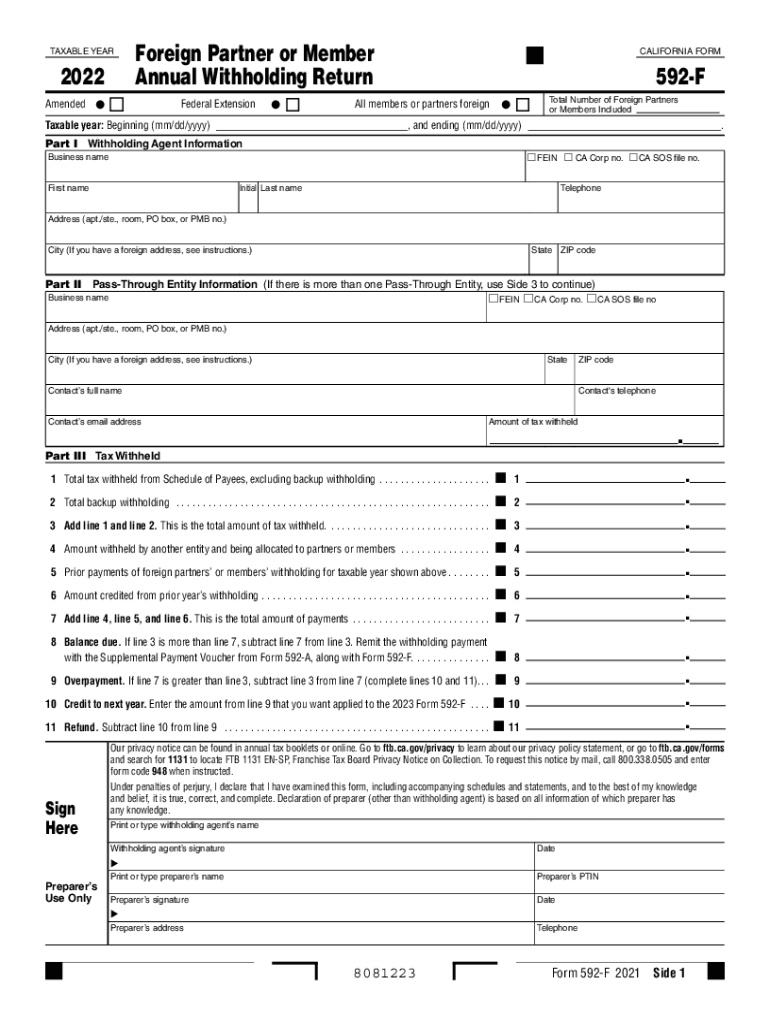

The 592f form is a crucial document used for reporting California source income paid to non-residents. This form is essential for ensuring compliance with state tax laws. It is typically utilized by businesses and individuals who make payments to non-residents for services rendered or other income-generating activities. Understanding the specific requirements and implications of the 592f form is vital for accurate tax reporting and avoiding potential penalties.

Steps to Complete the 592f Form

Filling out the 592f form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including the payee's details and the amounts paid. It is important to accurately report the type of income and provide the correct withholding amounts. Once all information is compiled, carefully complete each section of the form, ensuring that all entries are clear and legible. After completing the form, review it for any errors before submission.

Filing Deadlines for the 592f Form

Timely filing of the 592f form is essential to avoid penalties. The form must be submitted to the California Franchise Tax Board by the end of the month following the close of the calendar year in which the payments were made. Keeping track of these deadlines is crucial for compliance, especially for businesses that may have multiple payees to report.

Penalties for Non-Compliance

Failure to file the 592f form or inaccuracies in reporting can lead to significant penalties. The California Franchise Tax Board imposes fines for late submissions and incorrect information. Understanding these penalties emphasizes the importance of meticulous record-keeping and timely filing to safeguard against unnecessary financial repercussions.

Eligibility Criteria for Using the 592f Form

Not all payments require the use of the 592f form. Eligibility primarily depends on the residency status of the payee and the nature of the income. Payments made to non-residents for services performed in California generally necessitate the completion of this form. It is important to evaluate each payment to determine if the 592f form is applicable.

Digital vs. Paper Version of the 592f Form

The 592f form can be completed and submitted in both digital and paper formats. Electronic submission is often preferred for its efficiency and ease of tracking. However, some individuals or businesses may still opt for the traditional paper version. Understanding the advantages and requirements of each method can help streamline the filing process.

Required Documents for Filing the 592f Form

When preparing to file the 592f form, certain documents are necessary to ensure accurate reporting. These include records of payments made to non-residents, tax identification numbers, and any relevant contracts or agreements. Having these documents readily available can facilitate a smoother filing process and reduce the likelihood of errors.

Quick guide on how to complete publication 538 012019 accounting periods and methods2021 instructions for form ftb 3522 llc tax voucherpublication 538 012019

Finish Publication 538 01, Accounting Periods And Methods2021 Instructions For Form FTB 3522 LLC Tax VoucherPublication 538 01, Account effortlessly on any gadget

Digital document management has surged in popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can easily locate the required form and securelyKeep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Handle Publication 538 01, Accounting Periods And Methods2021 Instructions For Form FTB 3522 LLC Tax VoucherPublication 538 01, Account on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Publication 538 01, Accounting Periods And Methods2021 Instructions For Form FTB 3522 LLC Tax VoucherPublication 538 01, Account with ease

- Locate Publication 538 01, Accounting Periods And Methods2021 Instructions For Form FTB 3522 LLC Tax VoucherPublication 538 01, Account and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Accent important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Publication 538 01, Accounting Periods And Methods2021 Instructions For Form FTB 3522 LLC Tax VoucherPublication 538 01, Account and guarantee outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 538 012019 accounting periods and methods2021 instructions for form ftb 3522 llc tax voucherpublication 538 012019

Create this form in 5 minutes!

How to create an eSignature for the publication 538 012019 accounting periods and methods2021 instructions for form ftb 3522 llc tax voucherpublication 538 012019

How to generate an e-signature for a PDF file online

How to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to make an e-signature right from your mobile device

The best way to create an e-signature for a PDF file on iOS

How to make an e-signature for a PDF on Android devices

People also ask

-

What is the 592f form and how can it benefit my business?

The 592f form is a tax form used to report California-source income and claim any associated withholding. By utilizing the 592f form, businesses can ensure compliance with tax regulations, reducing the risk of penalties. airSlate SignNow simplifies this process, allowing you to send and sign the 592f form securely and efficiently.

-

How does airSlate SignNow integrate with the 592f form?

airSlate SignNow supports the 592f form by offering pre-built templates that streamline the signing process. Our platform allows users to customize and send the 592f form easily, ensuring signatures are obtained promptly. This integration reduces bottlenecks and enhances document management for busy professionals.

-

Can I use airSlate SignNow to eSign multiple 592f forms at once?

Yes, airSlate SignNow enables users to batch eSign multiple 592f forms simultaneously. This feature boosts productivity by minimizing the time spent on individual document signing. You can send out all needed 592f forms for eSignature at once, ensuring faster turnaround times.

-

What are the pricing plans for airSlate SignNow when using the 592f form?

airSlate SignNow offers several pricing plans tailored to different business needs, all of which support the 592f form. Each plan provides access to essential features, including template creation, document tracking, and team collaboration. We recommend reviewing our pricing page to find the best plan for your requirements when handling the 592f form.

-

Is airSlate SignNow secure for processing the 592f form?

Yes, airSlate SignNow prioritizes security and compliance, making it a reliable choice for processing the 592f form. Our platform utilizes advanced encryption protocols and complies with industry standards to protect sensitive information. You can trust that your 592f form will be handled securely.

-

What features does airSlate SignNow offer for the management of the 592f form?

airSlate SignNow provides several features specifically designed for the management of the 592f form, including document templates, real-time tracking, and notifications. These features help streamline the eSigning process and ensure that all parties are promptly updated on the status of the document. This efficiency is crucial for timely submissions of the 592f form.

-

How can I access the 592f form once it is signed with airSlate SignNow?

After signing the 592f form using airSlate SignNow, you will have immediate access to download or share the document. All signed documents are securely stored in your airSlate SignNow account, allowing for easy retrieval and reference. This ensures that you have the necessary documentation ready for your records or future tax filings.

Get more for Publication 538 01, Accounting Periods And Methods2021 Instructions For Form FTB 3522 LLC Tax VoucherPublication 538 01, Account

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497309856 form

- Massachusetts annual file form

- Notices resolutions simple stock ledger and certificate massachusetts form

- Minutes organizational meeting 497309859 form

- Massachusetts sample letter form

- Js 44 civil cover sheet federal district court massachusetts form

- Lead based paint disclosure for sales transaction massachusetts form

- Lead based paint disclosure for rental transaction massachusetts form

Find out other Publication 538 01, Accounting Periods And Methods2021 Instructions For Form FTB 3522 LLC Tax VoucherPublication 538 01, Account

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS