BLANK T Account Form

What is the blank t account form

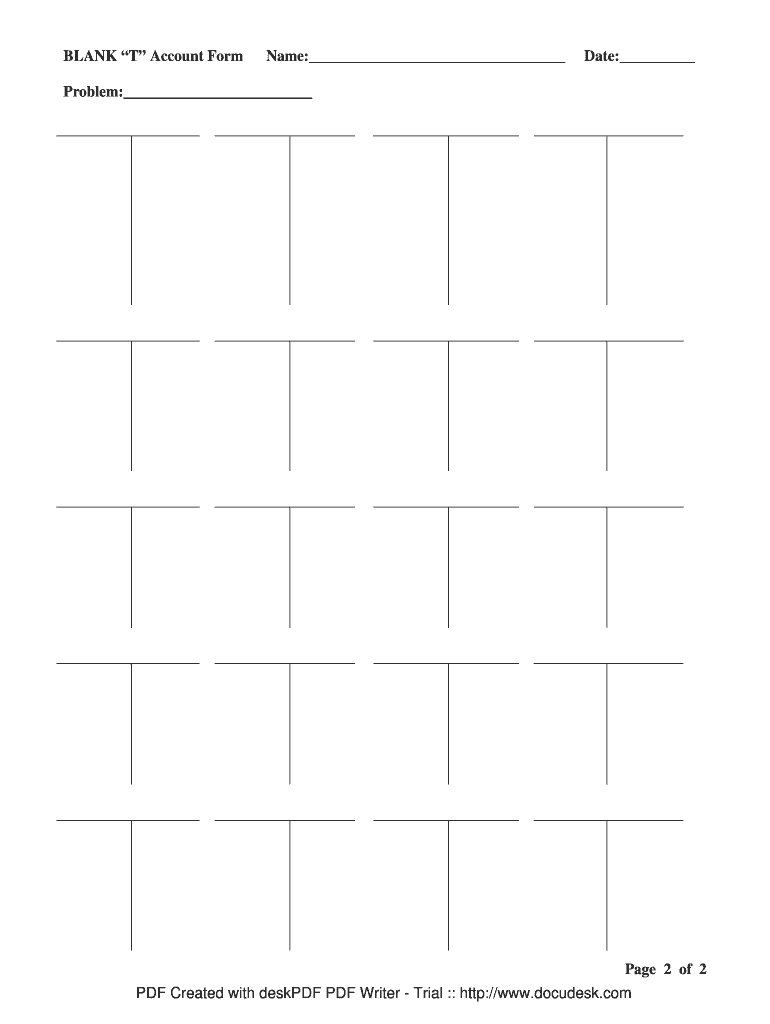

The blank t account form is a fundamental accounting tool used to visualize and record financial transactions. This form is structured in a "T" shape, where the left side represents debits and the right side represents credits. It helps individuals and businesses track their financial activities, ensuring that every transaction is properly documented. By using a blank t account template, users can easily organize their accounts, making it simpler to analyze financial data and prepare for reporting periods.

How to use the blank t account form

Using the blank t account form involves several straightforward steps. First, identify the accounts affected by a transaction. Next, determine whether each account will be debited or credited. Record the amounts in the appropriate sections of the t account. For example, if cash is received, the cash account is credited, while the revenue account is debited. This method allows users to maintain a clear and organized record of all transactions, facilitating easier reconciliation and financial analysis.

Key elements of the blank t account form

Several key elements are essential when working with a blank t account form. These include:

- Account Name: Clearly label the account at the top of the "T".

- Debit Side: The left side of the "T" where debits are recorded.

- Credit Side: The right side of the "T" where credits are recorded.

- Transaction Date: Include the date of each transaction for accurate tracking.

- Transaction Amount: Clearly note the amount for each debit and credit.

These elements ensure that the t account is comprehensive and easy to understand, aiding in effective financial management.

Steps to complete the blank t account form

Completing a blank t account form involves a systematic approach:

- Identify the transaction and the accounts involved.

- Determine whether each account will be debited or credited based on the nature of the transaction.

- Record the date of the transaction at the top of the t account.

- Enter the amounts in the appropriate debit or credit section.

- Review the entries to ensure accuracy.

Following these steps will help maintain accurate financial records and provide clarity in tracking financial performance.

Legal use of the blank t account form

The blank t account form is legally recognized as a valid method for documenting financial transactions. When filled out correctly, it can serve as a reliable record for audits and financial reviews. It is important to ensure that all entries are accurate and supported by appropriate documentation, as this can affect the legal standing of the records. Compliance with accounting standards and regulations is crucial to maintain the integrity of financial reporting.

Digital vs. paper version of the blank t account form

Both digital and paper versions of the blank t account form have their advantages. The digital version allows for easier editing, sharing, and storage, making it convenient for remote work and collaboration. In contrast, the paper version can be beneficial for those who prefer a tangible format or need to work in environments without electronic devices. Regardless of the format chosen, the essential function of the t account remains the same: to provide a clear and organized way to track financial transactions.

Quick guide on how to complete blank t account form

Complete BLANK T Account Form effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents quickly without interruptions. Handle BLANK T Account Form on any gadget with airSlate SignNow Android or iOS applications and elevate any document-centric process today.

The easiest way to edit and eSign BLANK T Account Form without difficulty

- Locate BLANK T Account Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you would prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or disorganized documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Edit and eSign BLANK T Account Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank t account form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a blank T account template?

A blank T account template is a visual tool used in accounting to help organize and track financial transactions. This template represents debits and credits in a simple T-shaped format, making it easy to understand the flow of money in and out of different accounts. Using a blank T account template can signNowly enhance your accounting accuracy.

-

How can I use a blank T account template for my business?

You can use a blank T account template to record financial transactions, making it easier to maintain accurate financial records. By filling in your transactions in the T account structure, you can quickly see the overall impact on your accounts, which helps improve decision-making. This method is particularly helpful during month-end closings and financial reporting.

-

Is there a cost associated with obtaining a blank T account template from airSlate SignNow?

airSlate SignNow offers various pricing plans that may include access to customizable templates, including the blank T account template. Depending on the plan you choose, costs may vary, but our service is designed to be cost-effective, providing value for ease of use and reliable document management. Be sure to check our pricing page for the most current information.

-

What features does the blank T account template offer?

The blank T account template from airSlate SignNow includes customizable fields, ensuring it meets your specific accounting needs. It allows for easy input of data, supporting a streamlined approach to recording transactions. The template’s user-friendly design helps reduce errors and improves financial clarity for your business.

-

Are there any integrations available with the blank T account template?

Yes, airSlate SignNow allows seamless integration with various accounting software and tools, enhancing the functionality of your blank T account template. These integrations simplify the process of transferring data between platforms, making your accounting workflow more efficient. It's easy to connect your existing systems for a comprehensive solution.

-

What are the benefits of using a blank T account template?

Using a blank T account template provides several benefits, including enhanced clarity in financial tracking and improved organization of accounts. It simplifies the process of debits and credits, making it easier to spot discrepancies and maintain accurate records. As a result, businesses can make more informed financial decisions.

-

Can I customize the blank T account template according to my needs?

Absolutely! The blank T account template is fully customizable, allowing you to adapt it to suit your specific accounting practices. You can adjust the layout, headings, and even add columns if necessary, ensuring that the template aligns perfectly with your business needs and accounting style.

Get more for BLANK T Account Form

Find out other BLANK T Account Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors