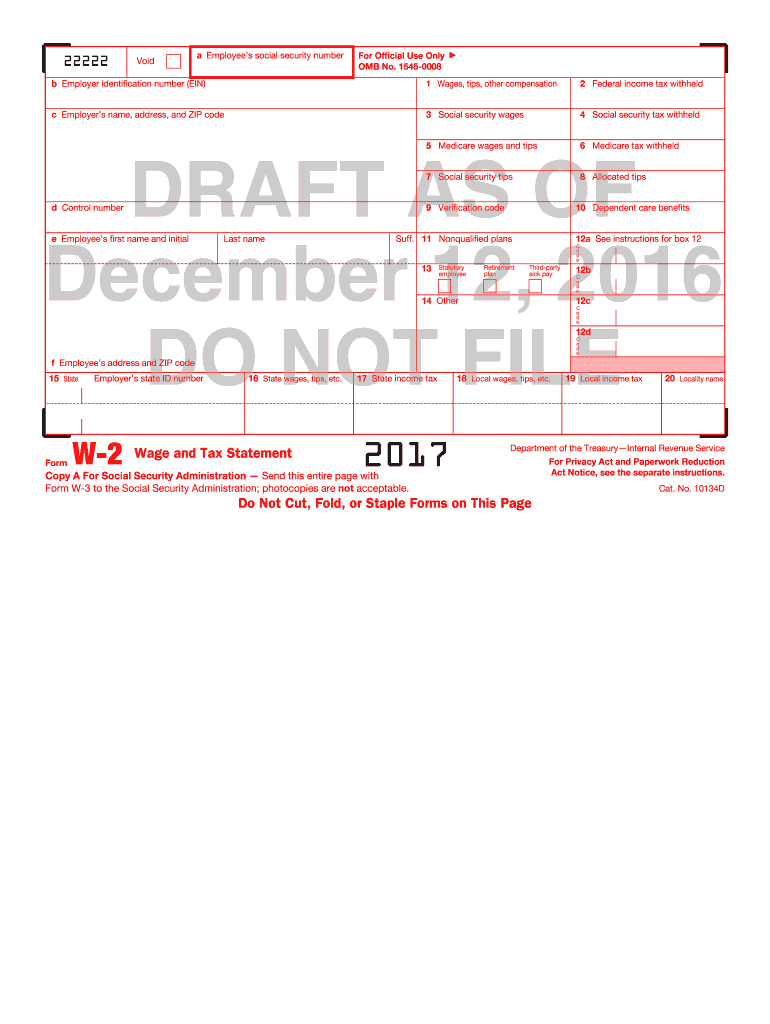

Form W 2 Wage and Tax Statement Irs

What makes the 2016 form w 2 wage and tax statement irs legally binding?

As the society ditches in-office working conditions, the completion of documents increasingly takes place electronically. The 2016 form w 2 wage and tax statement irs isn’t an any different. Dealing with it utilizing electronic tools is different from doing so in the physical world.

An eDocument can be viewed as legally binding given that certain needs are met. They are especially critical when it comes to stipulations and signatures associated with them. Entering your initials or full name alone will not guarantee that the organization requesting the form or a court would consider it accomplished. You need a trustworthy tool, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - major legal frameworks for eSignatures.

How to protect your 2016 form w 2 wage and tax statement irs when completing it online?

Compliance with eSignature regulations is only a portion of what airSlate SignNow can offer to make document execution legal and secure. Furthermore, it offers a lot of possibilities for smooth completion security smart. Let's rapidly run through them so that you can stay assured that your 2016 form w 2 wage and tax statement irs remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: key privacy standards in the USA and Europe.

- Two-factor authentication: provides an extra layer of security and validates other parties' identities through additional means, such as an SMS or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the data securely to the servers.

Submitting the 2016 form w 2 wage and tax statement irs with airSlate SignNow will give better confidence that the output form will be legally binding and safeguarded.

Quick guide on how to complete 2016 form w 2 wage and tax statement irs

Effortlessly prepare Form W 2 Wage And Tax Statement Irs on any device

Digital document management has become increasingly favored by both companies and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents swiftly without delays. Manage Form W 2 Wage And Tax Statement Irs on any device using the airSlate SignNow applications for Android or iOS and streamline your document-oriented processes today.

The simplest way to modify and eSign Form W 2 Wage And Tax Statement Irs with ease

- Find Form W 2 Wage And Tax Statement Irs and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose your preferred method for delivering your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Form W 2 Wage And Tax Statement Irs to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I get a copy of my wage and tax statements (Form W-2)?

Ask your employer (or former employer). They were obligated to provide it to you by now. If they haven’t, perhaps they do not have your current address.If they know where to find you but are refusing to provide you your W-2, they are breaking the law. You should report them to the IRS as they may not be paying the taxes they have withheld from your wages which would be stealing from you (as well as the government). Report them immediately. You might even get a reward for turning them in.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What is the IRS form W-10 and how is it correctly filled out?

While you may have never heard of IRS Form W-10, you will if you’re currently paying or planning to pay someone to care for a child, dependent, or spouse? If you are, then you may qualify to claim what’s called the Child and Dependent Care credit on your federal income tax return. To claim this credit, your care provider must fill out a W-10. You may also need to fill out the form if you receive benefits from an employer sponsored dependent care plan.It’s certainly worth it to see if you qualify (and for this we recommend that you consult with a tax professional). The child and dependent care credit can be up to 35 percent of qualifying expenses, depending on adjusted gross income. For 2011, filers may use up to $3,000 of expenses paid in a year for one qualifying individual or $6,000 for two or more qualifying individuals. (When it comes time to figure your qualifying expenses, remember that they must be reduced by the amount of any dependent care benefits provided by your employer, if those benefits were deducted or excluded from your income.)Do You Qualify for the Credit?To see if you need to have your care provider fill out a W-10, first determine if you qualify for the credit for child and dependent care expenses. To qualify, the care must have been provided for one or more qualifying persons, generally a dependent child age 12 or younger when the care was provided. Certain other individuals, spouses and those who are incapable of self-care, may also be considered qualifying persons. (Note: each qualifying individual must be listed on your tax return.)Remember also that the amount you can claim as a credit is reduced as your income rises. According to the Tax Policy Center, “Families with income below $15,000 qualify for the 35 percent credit. That rate falls by 1 percentage point for each additional $2,000 of income (or part thereof) until it signNowes 20 percent for families with income of $43,000 or more.”Next, consider why the care was provided. To qualify, the person (or couple, if married and filing jointly) claiming the credit must have sought care so they could work or search for employment. Further, the individual or couple filing must be considered earned income earners. Wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment all qualify individuals as having earned income. For married filers, one spouse may be considered as having earned income if they were a full-time student, or if they were unable to care for themselves.Who did you pay for care? Qualifying funds spent for care cannot be paid to a filer’s spouse, a dependent of the filer, or to the filer’s child, unless that child will signNow age 19 or older by the end of the year. (The rule for payments to the filer’s child does not change, even if the child is not the filer’s dependent.) Filers must identify care providers on their tax return.There are just a few more qualifying details. To qualify, filing status must be single, married filing jointly, head of household or qualifying widow(er) with a dependent child. The qualifying person must have lived with the person filing for over one half of the year. There are exceptions, for the birth or death of a qualifying person, and for children of divorced or separated parents.IRS Form W-10So, if you meet those criteria, then its time to make sure your care provider fills out a W-10. The form is simple to fill out, requiring only the provider’s name, address, signature and taxpayer identification number (usually their social security number). The form is only for your records; details about the provider will come when you fill out form 2441 for Child and Dependent Care Expenses.Source: The Child and Dependent Care Credit and IRS W-10 Form

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

Create this form in 5 minutes!

How to create an eSignature for the 2016 form w 2 wage and tax statement irs

How to generate an electronic signature for the 2016 Form W 2 Wage And Tax Statement Irs in the online mode

How to make an electronic signature for the 2016 Form W 2 Wage And Tax Statement Irs in Google Chrome

How to generate an electronic signature for signing the 2016 Form W 2 Wage And Tax Statement Irs in Gmail

How to generate an electronic signature for the 2016 Form W 2 Wage And Tax Statement Irs right from your mobile device

How to make an eSignature for the 2016 Form W 2 Wage And Tax Statement Irs on iOS

How to create an eSignature for the 2016 Form W 2 Wage And Tax Statement Irs on Android OS

People also ask

-

What is a W-2 form 2016 and why is it important?

The W-2 form 2016 is a tax document that employers in the United States must provide to their employees, summarizing their earnings and withholdings for the year. It's crucial for accurately filing income taxes and ensuring compliance with federal regulations.

-

How does airSlate SignNow simplify the signing of W-2 forms 2016?

airSlate SignNow streamlines the process of signing W-2 forms 2016 by providing an intuitive interface for eSigning. This eliminates the need for printing, scanning, or faxing, making it faster and more efficient for both employers and employees.

-

What are the pricing options for airSlate SignNow when handling W-2 forms 2016?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Each plan includes features specifically designed for managing documents like the W-2 form 2016, ensuring that you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for handling W-2 forms 2016?

Yes, airSlate SignNow integrates seamlessly with various accounting and HR software, making it easy to manage W-2 forms 2016 alongside your other business operations. This integration enhances productivity by streamlining your workflow.

-

What security features does airSlate SignNow offer for W-2 forms 2016?

Security is a priority at airSlate SignNow. The platform employs advanced encryption and authentication measures to ensure that your W-2 forms 2016 are safely stored and transmitted, protecting sensitive information from unauthorized access.

-

How can airSlate SignNow help with compliance for W-2 forms 2016?

Using airSlate SignNow for W-2 forms 2016 ensures that your eSigned documents meet all legal requirements for tax reporting. This helps maintain compliance with IRS regulations, minimizing the risk of penalties associated with improper filing.

-

Is there a mobile app for signing W-2 forms 2016 with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to sign W-2 forms 2016 on the go. This flexibility is perfect for busy professionals who need to manage their documents from anywhere at any time.

Get more for Form W 2 Wage And Tax Statement Irs

- Form 725 k i entucky ndividually department of revenue

- Social security number account number if applicable form

- Utah car dealer licensing forms ampamp paperworkdmvorg

- Tc 661 certificate of inspection forms ampamp publications

- Tc 90cb renter refund application circuit breaker forms ampamp publications

- Tc 569a ownership statement forms ampamp publications 625163003

- Zoning use certificate application city of pompano beach form

- Tc 69 utah state business and tax registration form

Find out other Form W 2 Wage And Tax Statement Irs

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF