Idaho Tax Commission Medical Expense Statement Formefo00119 for 2010-2026

Understanding the Idaho Financial Tax Form

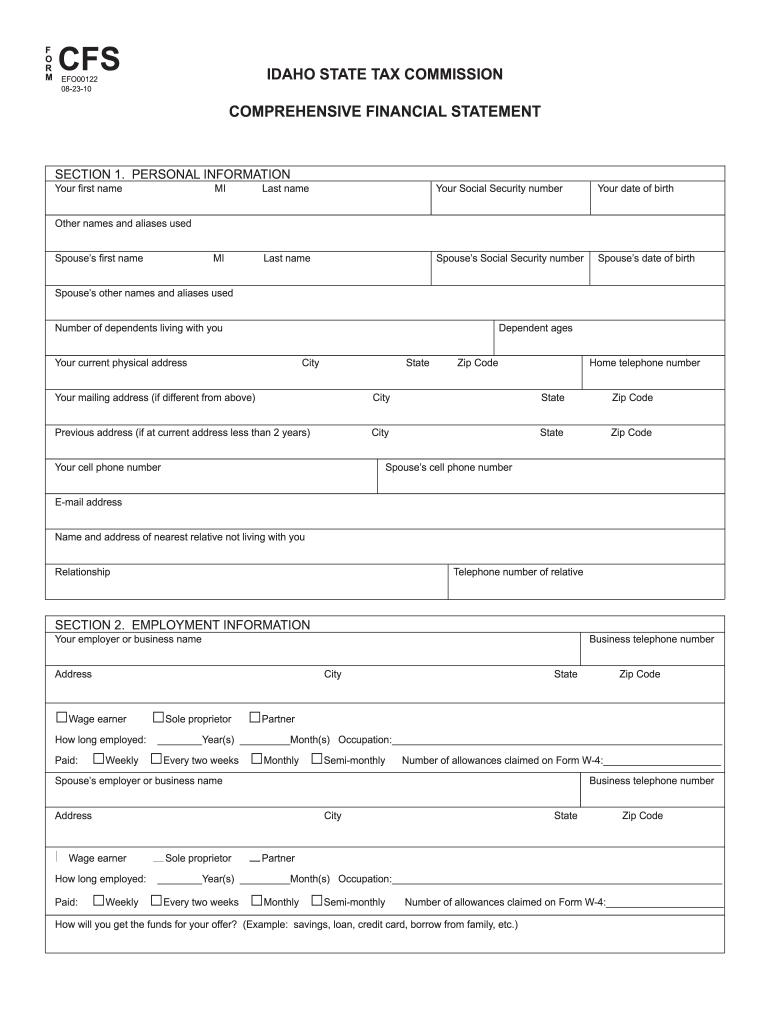

The Idaho financial tax form, often referred to as the Idaho efo00122, is essential for individuals and businesses to report their income and expenses accurately. This form is specifically designed to comply with state regulations and IRS guidelines, ensuring that all necessary information is captured for tax assessment. It is crucial for taxpayers to familiarize themselves with the specific requirements of this form to avoid any potential issues during the filing process.

Steps to Complete the Idaho Financial Tax Form

Completing the Idaho efo00122 form involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant financial documents, including income statements, receipts for deductions, and any previous tax returns. Next, fill out the form by entering your personal information, income details, and applicable deductions. Be sure to review the form for completeness and accuracy before signing. Once completed, you can submit the form electronically through a secure platform or print it for mailing.

Legal Use of the Idaho Financial Tax Form

The Idaho financial tax form is legally binding when completed and signed. It must adhere to the requirements set forth by the Idaho State Tax Commission and the IRS. Utilizing an electronic signature through a compliant eSignature solution enhances the form's validity, making it easier to submit while ensuring that all legal standards are met. It is important to retain a copy of the submitted form for your records, as it may be needed for future reference or audits.

Filing Deadlines and Important Dates

Timely filing of the Idaho financial tax form is crucial to avoid penalties. The typical deadline for submitting your tax return is April 15th, but this date may vary based on specific circumstances or extensions. It is advisable to stay informed about any changes to filing deadlines, especially those that may arise due to unique situations such as natural disasters or public health emergencies. Mark these dates on your calendar to ensure compliance.

Required Documents for Filing

When preparing to file the Idaho financial tax form, several documents are necessary. These include W-2 forms from employers, 1099 forms for any freelance or contract work, and documentation for any deductions you intend to claim, such as medical expenses or business-related costs. Having these documents organized will streamline the completion of the form and help ensure that all relevant information is accurately reported.

Form Submission Methods

The Idaho financial tax form can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file electronically using a secure online platform, which is often faster and more efficient. Alternatively, individuals can print the completed form and mail it directly to the Idaho State Tax Commission. In-person submissions may also be available at designated tax offices, providing additional flexibility for those who prefer face-to-face assistance.

Examples of Using the Idaho Financial Tax Form

Understanding how to effectively use the Idaho financial tax form can be illustrated through various scenarios. For instance, a self-employed individual would report their business income and expenses on the form, ensuring that they claim all allowable deductions. Similarly, a retiree might use the form to report pension income and any other sources of income, along with applicable deductions for medical expenses. Each taxpayer's situation is unique, and the form can be tailored to meet specific reporting needs.

Quick guide on how to complete cfs f o r m efo00122 idaho state tax commission 08 23 10 comprehensive financial statement section 1 tax idaho

Your assistance manual on how to prepare your Idaho Tax Commission Medical Expense Statement Formefo00119 For

If you’re interested in understanding how to complete and submit your Idaho Tax Commission Medical Expense Statement Formefo00119 For, below are a few brief instructions to simplify the process of tax declaring.

To get started, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, generate, and finalize your income tax forms with ease. With its editor, you can alternate between text, check boxes, and eSignatures and return to amend answers as necessary. Optimize your tax handling with advanced PDF editing, eSigning, and intuitive sharing capabilities.

Adhere to the steps below to complete your Idaho Tax Commission Medical Expense Statement Formefo00119 For in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to open your Idaho Tax Commission Medical Expense Statement Formefo00119 For in our editor.

- Populate the required fillable fields with your details (text, numbers, checkmarks).

- Use the Sign Tool to affix your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and delay refunds. Furthermore, before electronically filing your taxes, check the IRS website for filing regulations applicable in your state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cfs f o r m efo00122 idaho state tax commission 08 23 10 comprehensive financial statement section 1 tax idaho

How to create an eSignature for the Cfs F O R M Efo00122 Idaho State Tax Commission 08 23 10 Comprehensive Financial Statement Section 1 Tax Idaho online

How to generate an electronic signature for your Cfs F O R M Efo00122 Idaho State Tax Commission 08 23 10 Comprehensive Financial Statement Section 1 Tax Idaho in Chrome

How to generate an eSignature for signing the Cfs F O R M Efo00122 Idaho State Tax Commission 08 23 10 Comprehensive Financial Statement Section 1 Tax Idaho in Gmail

How to generate an eSignature for the Cfs F O R M Efo00122 Idaho State Tax Commission 08 23 10 Comprehensive Financial Statement Section 1 Tax Idaho right from your mobile device

How to generate an electronic signature for the Cfs F O R M Efo00122 Idaho State Tax Commission 08 23 10 Comprehensive Financial Statement Section 1 Tax Idaho on iOS

How to create an eSignature for the Cfs F O R M Efo00122 Idaho State Tax Commission 08 23 10 Comprehensive Financial Statement Section 1 Tax Idaho on Android OS

People also ask

-

What is airSlate SignNow and how can it assist with Idaho financial tax documents?

airSlate SignNow is an intuitive eSignature platform that helps businesses streamline document processes, including those related to Idaho financial tax. With its easy-to-use interface, you can prepare, send, and eSign tax documents securely, ensuring compliance and speed.

-

How does airSlate SignNow simplify the Idaho financial tax filing process?

The platform simplifies the Idaho financial tax filing process by allowing users to collect signatures digitally, which saves time and reduces paperwork. By minimizing the manual handling of documents, businesses can focus on accuracy and meet submission deadlines efficiently.

-

What are the pricing options for airSlate SignNow for Idaho businesses?

airSlate SignNow offers flexible pricing plans tailored to the needs of Idaho businesses handling financial tax documents. Competitive pricing ensures that companies of all sizes can access the eSignature features necessary for effective document management without breaking the bank.

-

Are there templates available for Idaho financial tax documents in airSlate SignNow?

Yes, airSlate SignNow provides customizable templates that are perfect for Idaho financial tax documents. These templates help ensure that all necessary fields are included, streamlining the preparation and signing process while adhering to state-specific requirements.

-

What security measures does airSlate SignNow have for Idaho financial tax documents?

airSlate SignNow prioritizes the security of your Idaho financial tax documents with advanced encryption and compliance with legal standards. This ensures that all sensitive information remains protected during transmission and storage, giving you peace of mind.

-

Can airSlate SignNow integrate with accounting software for Idaho financial tax filing?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easier for Idaho businesses to manage their financial tax documents. This integration helps synchronize data and streamlines workflows, reducing the chances of errors in tax filings.

-

What benefits does airSlate SignNow offer for managing Idaho financial tax documents?

The benefits of using airSlate SignNow for Idaho financial tax documents include enhanced efficiency, lower costs, and improved accuracy. By digitizing the signing process, businesses can facilitate quicker approvals and ensure that all necessary tax documents are processed without delays.

Get more for Idaho Tax Commission Medical Expense Statement Formefo00119 For

- Form mo 1040 missouri department of revenue

- Iowa alternative minimum taxiowa department of revenue form

- New york form it 238 claim for rehabilitation of historic

- Tax filing extensions for paper and electronically submitted form

- Form ct 605 claim for ez investment tax credit and ez

- Form it 631 claim for security officer training tax credit tax

- Individual income tax forms 2022maine revenue services

- Dor use tax wisconsin department of revenue form

Find out other Idaho Tax Commission Medical Expense Statement Formefo00119 For

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online