Form MO 1040 Missouri Department of Revenue 2022

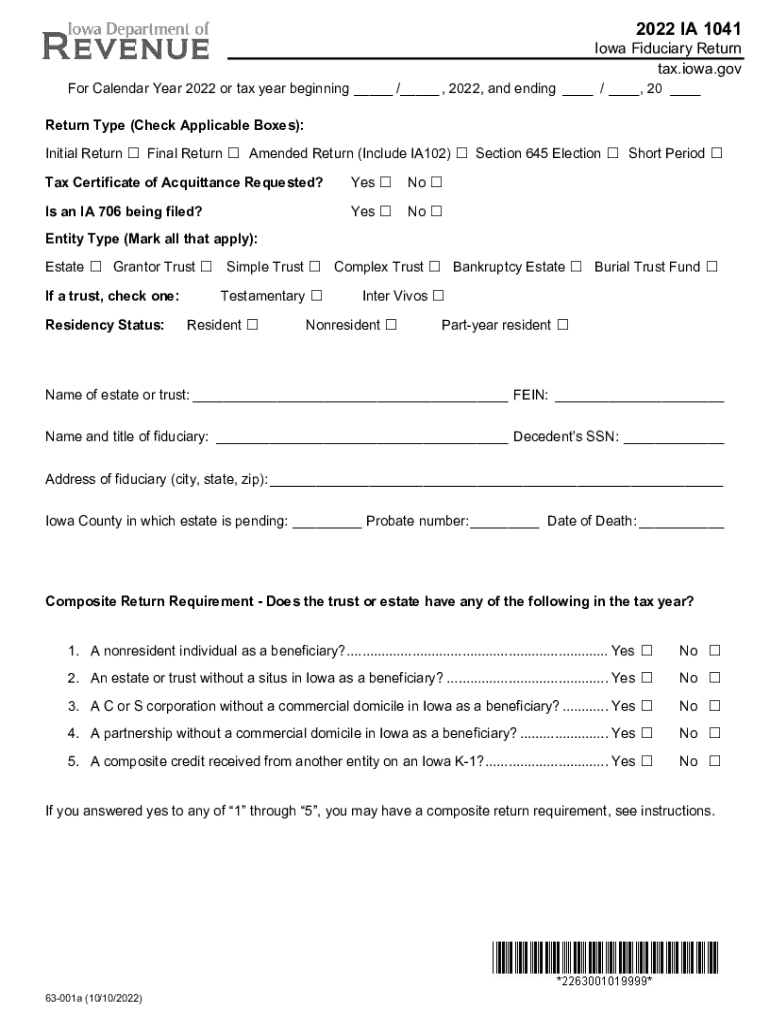

What is the IA 1041 Tax Form?

The IA 1041 form, also known as the Iowa Fiduciary Income Tax Return, is a tax document used by fiduciaries to report income generated by estates or trusts in Iowa. This form is essential for ensuring compliance with state tax laws and is specifically designed for entities that manage assets on behalf of beneficiaries. Understanding the purpose of the IA 1041 is crucial for fiduciaries, as it outlines the income, deductions, and credits applicable to the estate or trust.

Steps to Complete the IA 1041 Form

Completing the IA 1041 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the estate or trust, including income statements, deduction records, and any applicable tax credits. Next, fill out the form by entering the required information, such as the name of the estate or trust, the fiduciary's details, and the financial data. It is important to double-check all entries for accuracy. Once completed, the form must be signed by the fiduciary before submission.

Filing Deadlines for the IA 1041 Form

The filing deadline for the IA 1041 form typically aligns with the federal tax return deadlines. For most estates and trusts, the form must be filed by the fifteenth day of the fourth month following the close of the tax year. It is important to note that extensions may be available, but they must be requested in advance. Missing the deadline can result in penalties and interest on any unpaid tax liabilities.

Required Documents for Filing the IA 1041 Form

When preparing to file the IA 1041 form, certain documents are necessary to support the information provided. These include:

- Income statements for the estate or trust

- Documentation of deductions, such as expenses related to the management of the estate or trust

- Records of any tax credits that may apply

- Identification details for the fiduciary and beneficiaries

Having these documents ready will streamline the completion process and help ensure that the form is filed accurately.

Form Submission Methods for the IA 1041

The IA 1041 form can be submitted in various ways, depending on the preferences of the fiduciary. Options include:

- Online submission through the Iowa Department of Revenue's e-file system

- Mailing a paper copy of the completed form to the appropriate tax office

- In-person submission at designated tax offices

Choosing the right submission method is important for ensuring timely processing and compliance with state regulations.

Penalties for Non-Compliance with the IA 1041

Failure to file the IA 1041 form on time or inaccuracies in the submitted information can lead to significant penalties. These may include:

- Late filing penalties, which can accrue daily until the form is submitted

- Interest on any unpaid taxes, which compounds over time

- Potential legal consequences for fraudulent reporting

Understanding these penalties emphasizes the importance of timely and accurate filing of the IA 1041 form.

Quick guide on how to complete form mo 1040 missouri department of revenue

Prepare Form MO 1040 Missouri Department Of Revenue seamlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal sustainable alternative to traditional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and electronically sign your documents swiftly without interruptions. Manage Form MO 1040 Missouri Department Of Revenue on any platform using airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to modify and eSign Form MO 1040 Missouri Department Of Revenue effortlessly

- Find Form MO 1040 Missouri Department Of Revenue and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Form MO 1040 Missouri Department Of Revenue and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo 1040 missouri department of revenue

Create this form in 5 minutes!

How to create an eSignature for the form mo 1040 missouri department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 Iowa 1041 form and why do I need it?

The 2023 Iowa 1041 form is a state income tax return for estates and trusts. It is essential for anyone managing an estate or trust in Iowa to ensure compliance with state tax laws. Completing this form accurately helps in reporting the income and deductions related to the entity, thereby avoiding possible penalties.

-

How can airSlate SignNow help me streamline my 2023 Iowa 1041 filing process?

airSlate SignNow allows you to easily eSign and send necessary documents, including the 2023 Iowa 1041. This makes it more efficient to gather signatures from estate beneficiaries or trustees, reducing delays in filing. Our platform ensures that your documents are secure, accessible, and easy to manage.

-

What features does airSlate SignNow offer for eSigning my 2023 Iowa 1041 documents?

With airSlate SignNow, you can eSign your 2023 Iowa 1041 documents anytime and from any device. Our platform provides features such as templates for repetitive tasks, audit trails for tracking document status, and reminders for pending signatures. These features enhance convenience and ensure timely submission of your forms.

-

Are there any costs associated with using airSlate SignNow for the 2023 Iowa 1041?

Yes, while airSlate SignNow offers various pricing plans, you can choose the one that best fits your needs for managing the 2023 Iowa 1041. We provide cost-effective solutions whether you require a single-user license or a plan for a larger team. Exploring our pricing will help you determine the best value for your eSigning needs.

-

Can I integrate airSlate SignNow with other accounting software for my 2023 Iowa 1041?

Absolutely! airSlate SignNow can seamlessly integrate with popular accounting tools, making it easier for you to manage your 2023 Iowa 1041 submissions. Integrating these platforms allows for streamlined workflows, reducing manual data entry, and ensuring that your financial documents are in order.

-

How secure is airSlate SignNow for handling my 2023 Iowa 1041?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication protocols to ensure that your 2023 Iowa 1041 documents are protected from unauthorized access. You can trust our platform to safeguard your sensitive information throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for my 2023 Iowa 1041?

Using airSlate SignNow for your 2023 Iowa 1041 offers numerous advantages, including enhanced efficiency, time savings, and improved compliance. The ability to eSign documents quickly means you can submit your forms sooner, avoiding any last-minute rush. Additionally, our easy-to-use interface makes it simple for everyone involved to complete their tasks.

Get more for Form MO 1040 Missouri Department Of Revenue

- Commercial contractor package south dakota form

- Excavation contractor package south dakota form

- Renovation contractor package south dakota form

- Concrete mason contractor package south dakota form

- Demolition contractor package south dakota form

- Security contractor package south dakota form

- Insulation contractor package south dakota form

- Paving contractor package south dakota form

Find out other Form MO 1040 Missouri Department Of Revenue

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself