Self Employment Report Form Dhs 3336

What is the Self Employment Report Form DHS 3336

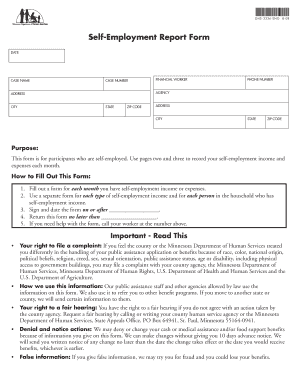

The Self Employment Report Form DHS 3336 is a crucial document used by individuals who are self-employed and need to report their income and business activities to the Department of Human Services (DHS). This form is essential for determining eligibility for various assistance programs and ensuring compliance with state regulations. It captures detailed information about the nature of the business, income generated, and any relevant expenses incurred during the reporting period.

How to use the Self Employment Report Form DHS 3336

Using the Self Employment Report Form DHS 3336 involves several steps to ensure accurate reporting of your self-employment status. First, gather all necessary financial records, including income statements and expense receipts. Next, complete the form by providing detailed information about your business activities, income, and expenses. It is important to be thorough and precise, as inaccuracies may lead to delays or issues with your assistance eligibility. Once completed, submit the form according to your local DHS guidelines.

Steps to complete the Self Employment Report Form DHS 3336

Completing the Self Employment Report Form DHS 3336 requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, such as income statements and expense receipts.

- Begin filling out the form by entering your personal information, including your name, address, and contact details.

- Provide a detailed description of your self-employment activities, including the type of business and services offered.

- Report your total income for the reporting period, ensuring to include all sources of revenue.

- List all allowable business expenses, as these can affect your net income calculation.

- Review the completed form for accuracy and completeness.

- Submit the form as directed by your local DHS office, either online or via mail.

Legal use of the Self Employment Report Form DHS 3336

The Self Employment Report Form DHS 3336 is legally binding when completed and submitted in accordance with state regulations. This form serves as a declaration of your self-employment status and income, which is critical for determining eligibility for assistance programs. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies may lead to legal consequences, including penalties or loss of benefits.

Key elements of the Self Employment Report Form DHS 3336

Several key elements must be included in the Self Employment Report Form DHS 3336 to ensure it is complete and compliant:

- Personal Information: Name, address, and contact details of the self-employed individual.

- Business Description: A clear description of the business activities and services offered.

- Income Reporting: Total income generated during the reporting period, including all revenue sources.

- Expense Reporting: Detailed list of business-related expenses that can be deducted from income.

- Signature: The form must be signed and dated to validate the information provided.

Form Submission Methods

The Self Employment Report Form DHS 3336 can be submitted through various methods, depending on the guidelines of your local DHS office. Common submission methods include:

- Online Submission: Many states offer an online portal for submitting forms electronically, which can expedite processing.

- Mail: You can print the completed form and send it via postal mail to the designated DHS office.

- In-Person Submission: Some individuals may prefer to deliver the form in person at their local DHS office for immediate confirmation of receipt.

Quick guide on how to complete self employment report form dhs 3336

Effortlessly prepare Self Employment Report Form Dhs 3336 on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely archive them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Self Employment Report Form Dhs 3336 on any system with airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

The easiest way to edit and electronically sign Self Employment Report Form Dhs 3336 effortlessly

- Obtain Self Employment Report Form Dhs 3336 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive data with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Self Employment Report Form Dhs 3336 to ensure excellent communication throughout every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the self employment report form dhs 3336

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the self employment report form dhs 3336?

The self employment report form dhs 3336 is a document used for reporting income when you are self-employed. This form is essential for individuals receiving assistance from the Department of Human Services (DHS) to ensure accurate reporting of earnings and compliance with program requirements. Completing this form correctly helps maintain your eligibility for benefits.

-

How can airSlate SignNow simplify the process of submitting the self employment report form dhs 3336?

airSlate SignNow streamlines the submission of the self employment report form dhs 3336 by allowing users to easily fill out and eSign the document online. This eliminates the need for printing, scanning, or mailing, saving you time and ensuring that your submission is secure and tracked. Plus, it provides a user-friendly interface that simplifies document handling.

-

Is there a cost associated with using airSlate SignNow for the self employment report form dhs 3336?

Yes, while airSlate SignNow offers competitive pricing plans, using the platform to manage the self employment report form dhs 3336 may incur costs depending on the features you need. SignNow provides various subscription options that cater to different budgets, ensuring you find a plan that best fits your needs. You can also try it out with a free trial to see if it meets your expectations.

-

What features does airSlate SignNow offer for managing the self employment report form dhs 3336?

airSlate SignNow offers a variety of features for the self employment report form dhs 3336, including eSignature capabilities, document templates, and collaborative tools. These features enable multiple users to review, edit, and sign documents in real-time, ensuring a smooth process. Additionally, automated workflows can help streamline document routing and approval.

-

Can airSlate SignNow integrate with other applications for handling the self employment report form dhs 3336?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when dealing with the self employment report form dhs 3336. Whether it’s CRM systems, cloud storage solutions, or productivity apps, these integrations enable you to streamline your documentation process and manage your forms more efficiently.

-

What are the benefits of using airSlate SignNow for the self employment report form dhs 3336?

Using airSlate SignNow for the self employment report form dhs 3336 offers numerous benefits, including time savings and enhanced security. The platform ensures that your documents are securely stored and easily accessible whenever you need them. Furthermore, the convenience of eSigning helps speed up the process, reducing waiting times and improving overall efficiency.

-

How does airSlate SignNow ensure the security of the self employment report form dhs 3336?

airSlate SignNow prioritizes the security of documents like the self employment report form dhs 3336. It employs advanced encryption protocols and secure cloud storage to protect your sensitive information. Regular audits and compliance with international security standards also contribute to a safe signing and document management process.

Get more for Self Employment Report Form Dhs 3336

- Usla champions premier registration packetfall2017spring2018 form

- Adult genetics clinic form

- Hospital claim form

- Life death benefit claim form v0819docx

- Investigation form template

- Patient request to accessdisclose a designated record set form

- Castellvi spine form

- Instructions incomplete forms will be

Find out other Self Employment Report Form Dhs 3336

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free