Ct Au 960 Form

What is the Connecticut Nonresident Contractor Tax Bond?

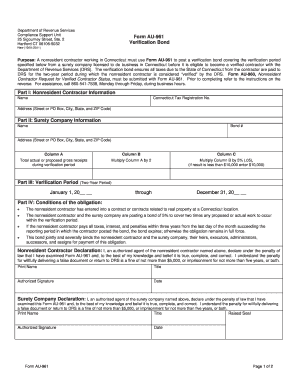

The Connecticut nonresident contractor tax bond is a financial guarantee required for nonresident contractors operating in Connecticut. This bond ensures that the contractor will comply with state tax laws, particularly concerning income tax obligations. By obtaining this bond, contractors demonstrate their commitment to fulfilling tax responsibilities, which helps protect the state from potential revenue losses. The bond amount is typically set at a specific dollar value, which may vary based on the contractor's scope of work and the regulations in place.

Steps to Complete the Connecticut Nonresident Contractor Tax Bond

Completing the Connecticut nonresident contractor tax bond involves several key steps. First, contractors must gather necessary documentation, which may include proof of business registration and tax identification numbers. Next, they should fill out the bond application form accurately, ensuring all details are correct to avoid delays. Once the application is complete, contractors must submit it along with any required fees to the appropriate state agency. Finally, after approval, the contractor will receive the bond, which must be kept on file for compliance purposes.

Legal Use of the Connecticut Nonresident Contractor Tax Bond

The legal use of the Connecticut nonresident contractor tax bond is crucial for ensuring compliance with state regulations. This bond serves as a protective measure for the state, allowing it to recover any unpaid taxes from the contractor. In the event of non-compliance, the state can make a claim against the bond. Contractors must understand that this bond is not just a formality; it is a legal requirement that must be adhered to in order to operate legally within Connecticut.

Required Documents for the Connecticut Nonresident Contractor Tax Bond

To obtain the Connecticut nonresident contractor tax bond, contractors must prepare several required documents. These typically include:

- Proof of business registration in Connecticut.

- Tax identification number (TIN) or Social Security number.

- Completed bond application form.

- Payment for any applicable fees.

Having these documents ready can streamline the application process and help ensure compliance with state requirements.

Form Submission Methods

Contractors can submit the Connecticut nonresident contractor tax bond through various methods. The most common methods include:

- Online submission via the state’s official website.

- Mailing the completed form and documents to the designated state agency.

- In-person submission at local government offices.

Each method has its own processing times and requirements, so contractors should choose the one that best fits their needs.

Penalties for Non-Compliance

Failure to comply with the requirements of the Connecticut nonresident contractor tax bond can result in significant penalties. These may include:

- Fines imposed by the state for operating without a valid bond.

- Legal action taken against the contractor for unpaid taxes.

- Potential revocation of the contractor's ability to work in Connecticut.

Understanding these penalties emphasizes the importance of maintaining compliance with all bonding requirements.

Quick guide on how to complete au 961 connecticut

Complete au 961 connecticut effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage connecticut nonresident contractor tax bond on any platform with the airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

How to adjust and electronically sign ct form au 960 with ease

- Obtain form au 960 fill and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet-ink signature.

- Review the information and click on the Done button to save your adjustments.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from your chosen device. Modify and electronically sign ct au 960 form to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the au 961 connecticut

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask ct form au 960

-

What is the ct form au 960 and how can airSlate SignNow assist with it?

The ct form au 960 is a crucial document for Australian businesses, and airSlate SignNow simplifies its management. With our platform, you can easily upload, send, and eSign the ct form au 960 electronically. This streamlines the process, reduces paperwork, and ensures compliance with industry standards.

-

How much does airSlate SignNow cost for using ct form au 960?

airSlate SignNow offers competitive pricing for its services, including features specifically designed for the ct form au 960. You can choose from various plans based on your business needs, ensuring you only pay for what you use. Additionally, all plans come with a free trial so you can assess how it fits your requirements.

-

What features does airSlate SignNow provide for handling ct form au 960?

airSlate SignNow provides a range of features that enhance the handling of the ct form au 960, including customizable templates, in-app notifications, and secure cloud storage. These features ensure that you can manage the document efficiently while maintaining the necessary security protocols. Furthermore, the user-friendly interface makes it accessible for all users.

-

What are the benefits of using airSlate SignNow for the ct form au 960?

Using airSlate SignNow for the ct form au 960 offers numerous benefits, including faster processing times, reduced paperwork, and enhanced security. Your teams can collaborate in real-time, ensuring that updates and changes are reflected instantaneously. This not only boosts productivity but also minimizes the risk of errors.

-

Can airSlate SignNow integrate with other tools for managing ct form au 960?

Yes, airSlate SignNow supports integration with various tools and software that can assist in managing the ct form au 960. This compatibility allows for seamless workflows and ensures that your data is synchronized across platforms. By integrating with your existing applications, you can streamline your operations further.

-

Is airSlate SignNow compliant with Australian regulations for the ct form au 960?

Absolutely, airSlate SignNow is designed to comply with Australian regulations related to the ct form au 960. Our platform adheres to strict security standards and practices, ensuring that your documents are handled according to legal requirements. This compliance not only protects your business but also builds trust with your clients.

-

How secure is the data when using airSlate SignNow for the ct form au 960?

Data security is a top priority at airSlate SignNow when dealing with the ct form au 960. We utilize advanced encryption protocols, secure cloud storage, and user authentication measures to protect your sensitive information. This ensures that your documents remain confidential and are accessible only to authorized users.

Get more for form au 960 fill

Find out other ct au 960 form

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure