Broker Slip Form

What is the Broker Slip

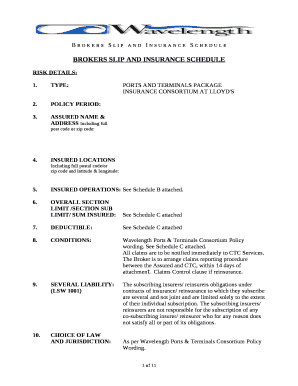

The broker slip, often referred to as the insurance slip, is a document used in the insurance industry to outline the terms of an insurance policy. This slip serves as a record of the agreement between the insurer and the insured, detailing the coverage, premiums, and other essential elements of the insurance contract. It is crucial for both parties as it provides clarity on the obligations and rights associated with the insurance policy.

Key Elements of the Broker Slip

Understanding the key elements of a broker slip is vital for effective use. The following components are typically included:

- Insurer Information: Details about the insurance company providing coverage.

- Insured Information: Information regarding the individual or entity being insured.

- Coverage Details: A description of the insurance coverage, including limits and exclusions.

- Premium Amount: The cost of the insurance policy, often broken down into payment schedules.

- Effective Dates: The start and end dates of the coverage period.

- Signatures: Required signatures from both parties to validate the agreement.

Steps to Complete the Broker Slip

Completing the broker slip involves several important steps to ensure accuracy and compliance. Follow these steps:

- Gather Information: Collect all necessary details about the insured and the coverage required.

- Fill Out the Slip: Carefully enter the gathered information into the slip, ensuring all fields are completed.

- Review for Accuracy: Double-check all entries for correctness to avoid any potential issues.

- Obtain Signatures: Ensure that all required parties sign the document to make it legally binding.

- Submit the Slip: Send the completed slip to the insurer for processing.

Legal Use of the Broker Slip

The broker slip must adhere to specific legal standards to be considered valid. In the United States, it is essential that the slip complies with regulations set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronically signed documents, including broker slips, are legally recognized. It is also important to maintain proper records and documentation to support the validity of the slip in case of disputes.

How to Obtain the Broker Slip

Obtaining a broker slip is a straightforward process. Typically, you can acquire the slip through the following methods:

- Insurance Broker: Contact your insurance broker directly, as they often provide the necessary slips for various policies.

- Insurance Company: Reach out to the insurance company for which you are seeking coverage; they may have downloadable forms available.

- Online Resources: Some insurance industry websites offer templates or examples of broker slips that can be filled out electronically.

Examples of Using the Broker Slip

Understanding how to use the broker slip can be enhanced by looking at practical examples. For instance, when securing a commercial property insurance policy, the broker slip will outline the specific coverage limits for property damage and liability. In another scenario, while obtaining reinsurance, the slip will detail the terms under which the reinsurer agrees to cover specific risks. These examples illustrate the versatility and importance of the broker slip in various insurance contexts.

Quick guide on how to complete broker slip

Manage Broker Slip effortlessly on any device

Digital document organization has grown in popularity among companies and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and store it securely online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents quickly without delays. Manage Broker Slip on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign Broker Slip with ease

- Find Broker Slip and then select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive data using tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow takes care of your document management needs with just a few clicks from any device you choose. Modify and electronically sign Broker Slip and ensure top-notch communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the broker slip

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an insurance slip example?

An insurance slip example is a document template that outlines the essential details of an insurance policy. It serves as a useful reference for both policyholders and insurers to understand coverage, terms, and conditions. Using airSlate SignNow, you can easily create and manage such documents for streamlined communication.

-

How can airSlate SignNow help me with insurance slip examples?

AirSlate SignNow allows you to create, customize, and send insurance slip examples quickly and efficiently. With our easy-to-use interface, you can reduce the time spent on document management and focus more on important tasks. Additionally, our platform facilitates eSigning, ensuring a fast and secure agreement process.

-

Is there a cost associated with using airSlate SignNow for insurance slip examples?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our affordable rates make it cost-effective for companies of all sizes to create and manage insurance slip examples. You can choose a plan that fits your specific requirements, with no hidden fees.

-

What features does airSlate SignNow provide for managing insurance slip examples?

AirSlate SignNow comes equipped with features such as document templates, eSigning, and cloud storage, making it an ideal choice for managing insurance slip examples. Users can also track document status and receive notifications, ensuring a smooth workflow. These features enhance productivity and reduce turnaround time.

-

Can I integrate airSlate SignNow with other applications for insurance slip examples?

Absolutely! AirSlate SignNow supports integrations with various applications, enabling you to streamline your processes related to insurance slip examples. Whether you use CRM systems, cloud storage, or project management tools, our platform can connect seamlessly, enhancing your document management capabilities.

-

What benefits can I expect from using airSlate SignNow for my insurance slip examples?

Using airSlate SignNow for your insurance slip examples offers numerous benefits, including enhanced efficiency, reduced paper usage, and improved security. The platform's electronic signing feature accelerates the document approval process, ensuring your clients receive timely service. Overall, this leads to increased customer satisfaction and loyalty.

-

Is it easy to customize insurance slip examples with airSlate SignNow?

Yes, customizing insurance slip examples with airSlate SignNow is straightforward and user-friendly. Our platform provides intuitive tools that allow users to modify templates to suit their specific needs. This flexibility ensures that your documents align perfectly with your branding and business requirements.

Get more for Broker Slip

Find out other Broker Slip

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement