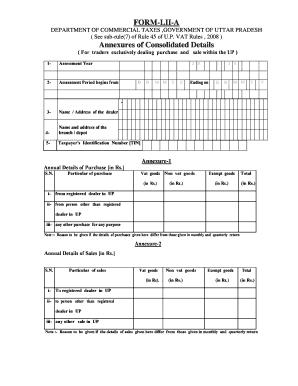

Lii a Form

What is the Lii A

The Lii A form is a crucial document used for various purposes, primarily related to tax reporting and compliance. It serves as a means for individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). Understanding the nature of this form is essential for anyone required to complete it, as it ensures compliance with federal regulations and helps avoid potential penalties.

How to use the Lii A

Using the Lii A form involves several steps to ensure accurate completion. First, gather all necessary financial documents and information pertinent to the reporting period. Next, access the form, which can be filled out digitally or printed for manual completion. Carefully follow the instructions provided on the form, ensuring that all entries are accurate and reflect your financial situation. Once completed, review the form for any errors before submission.

Steps to complete the Lii A

Completing the Lii A form requires attention to detail and adherence to specific guidelines. Follow these steps:

- Collect all relevant financial documents, such as income statements and receipts.

- Obtain the latest version of the Lii A form from a reliable source.

- Fill in your personal information accurately, including your name, address, and taxpayer identification number.

- Provide detailed financial information as required by the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Lii A

The Lii A form is legally binding when completed correctly and submitted in accordance with IRS regulations. It is vital to ensure that all information provided is truthful and accurate, as discrepancies can lead to legal issues or penalties. The use of electronic signatures through platforms like signNow can enhance the legal validity of the form, ensuring compliance with eSignature laws.

Required Documents

To complete the Lii A form, certain documents are necessary to provide the required information. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous year’s tax returns for reference.

- Any additional documentation requested by the IRS.

Form Submission Methods

The Lii A form can be submitted through various methods, providing flexibility for users. Common submission options include:

- Online submission through the IRS e-file system.

- Mailing a printed copy of the form to the designated IRS address.

- In-person submission at local IRS offices, if applicable.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Lii A form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to understand the importance of timely and accurate submission to avoid these consequences.

Quick guide on how to complete lii a

Effortlessly Prepare Lii A on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Lii A on any platform using the airSlate SignNow applications for Android or iOS and enhance any documentation process today.

The easiest way to modify and electronically sign Lii A with ease

- Find Lii A and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Select relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form—via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Lii A to ensure seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lii a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form lii and how does it work with airSlate SignNow?

Form lii is a type of online form that allows users to create, send, and eSign documents seamlessly. With airSlate SignNow, form lii features enable businesses to streamline document management and improve workflow efficiency, ensuring that important forms are signed and processed quickly.

-

How much does it cost to use form lii with airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to various business needs, including specific options for form lii usage. Our competitive pricing ensures you get the most value, with plans that include essential features for document management and electronic signing.

-

What are the key features of form lii in airSlate SignNow?

The form lii functionality includes customizable templates, real-time tracking, and secure storage options. These features enhance user experience by allowing businesses to quickly create professional documents, monitor the signing process, and keep all data securely stored.

-

How can I benefit from using form lii in my business?

Using form lii in your business can signNowly reduce the time spent on document management processes. airSlate SignNow helps automate workflows, minimizes manual errors, and ensures that contracts and agreements are signed in a timely manner, enhancing overall productivity.

-

Does airSlate SignNow integrate with other tools for form lii management?

Yes, airSlate SignNow is designed to integrate seamlessly with various tools and applications, enhancing the functionality of form lii. This means you can connect with popular software solutions for customer relationship management, cloud storage, and more, to optimize your document management processes.

-

Is the form lii feature secure in airSlate SignNow?

Absolutely, security is a top priority for airSlate SignNow. The form lii feature utilizes advanced encryption and complies with industry standards, ensuring that all documents are protected during transmission and storage, giving you peace of mind while handling sensitive information.

-

Can I track the status of my form lii documents?

Yes, with airSlate SignNow, you can easily track the status of your form lii documents in real-time. This feature allows you to see when a document has been sent, viewed, signed, or completed, which helps you manage your workflow effectively.

Get more for Lii A

- Living trust for husband and wife with no children rhode island form

- Rhode island trust 497325287 form

- Rhode island single divorced form

- Living trust for husband and wife with one child rhode island form

- Living trust for husband and wife with minor and or adult children rhode island form

- Amendment to living trust rhode island form

- Living trust property record rhode island form

- Financial account transfer to living trust rhode island form

Find out other Lii A

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors