Client Tax Information Sheet Brookwood Tax Service

What is the Client Tax Information Sheet

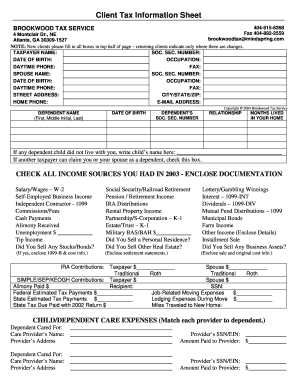

The Client Tax Information Sheet is a crucial document used by individuals and businesses to gather essential tax-related information. This form is designed to streamline the process of collecting data necessary for accurate tax reporting and compliance. It typically includes fields for personal identification details, income sources, deductions, and other relevant financial information. By utilizing this tax sheet, clients can ensure that their tax filings are complete and accurate, minimizing the risk of errors that could lead to penalties or audits.

How to use the Client Tax Information Sheet

Using the Client Tax Information Sheet involves several straightforward steps. First, gather all necessary financial documents, such as W-2s, 1099s, and receipts for deductions. Next, fill out the form by entering your personal information and financial details accurately. It's important to double-check the entries for any mistakes. Once completed, the tax sheet can be submitted to your tax preparer or used as a reference for filing your taxes electronically. This organized approach helps ensure that all pertinent information is accounted for, facilitating a smoother tax preparation process.

Steps to complete the Client Tax Information Sheet

Completing the Client Tax Information Sheet requires attention to detail. Follow these steps for effective completion:

- Gather all relevant financial documents, including income statements and expense receipts.

- Carefully read each section of the tax sheet to understand what information is required.

- Fill in your personal details, including your name, address, and Social Security number.

- Provide accurate income information, including wages, self-employment income, and any other earnings.

- List any deductions or credits you may be eligible for, such as mortgage interest or educational expenses.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Client Tax Information Sheet

The legal use of the Client Tax Information Sheet is governed by various regulations that ensure its validity and compliance. When filled out correctly, this form serves as a legally binding document that can be used in tax filings. It is important to comply with the Internal Revenue Service (IRS) guidelines and any state-specific regulations when using this tax sheet. Additionally, maintaining accurate records and securely storing the completed form can help protect against potential audits or disputes regarding tax obligations.

IRS Guidelines

The IRS provides specific guidelines regarding the use of tax sheets and related documentation. These guidelines outline the necessary information required for tax filings, deadlines for submission, and the importance of accuracy in reporting income and deductions. Adhering to these guidelines is essential for avoiding penalties and ensuring compliance with federal tax laws. Taxpayers should regularly consult the IRS website or seek advice from tax professionals to stay informed about any updates or changes to these guidelines.

Filing Deadlines / Important Dates

Understanding filing deadlines is critical for effective tax management. The IRS typically sets April fifteenth as the deadline for individual tax returns. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing situations. Keeping track of these important dates can help ensure timely submissions and avoid penalties. It is advisable to mark these deadlines on a calendar and prepare all necessary documents well in advance to facilitate a smooth filing process.

Quick guide on how to complete client tax information sheet brookwood tax service

Manage Client Tax Information Sheet Brookwood Tax Service effortlessly on any gadget

Digital document handling has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary format and securely archive it online. airSlate SignNow equips you with all the functionalities needed to formulate, modify, and electronically sign your documents promptly without inconveniences. Handle Client Tax Information Sheet Brookwood Tax Service on any gadget using airSlate SignNow applications for Android or iOS and enhance any document-centric task today.

The simplest approach to modify and eSign Client Tax Information Sheet Brookwood Tax Service with ease

- Obtain Client Tax Information Sheet Brookwood Tax Service and then click Get Form to begin.

- Utilize the instruments we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then hit the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Alter and eSign Client Tax Information Sheet Brookwood Tax Service and ensure exceptional communication at any point in your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the client tax information sheet brookwood tax service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax sheet and how is it used with airSlate SignNow?

A tax sheet is a document that outlines your financial information for tax purposes. With airSlate SignNow, you can easily upload, send, and eSign your tax sheets efficiently, ensuring that all necessary signatures are collected effortlessly.

-

How does airSlate SignNow ensure the security of my tax sheet?

airSlate SignNow takes data security seriously by implementing industry-standard encryption and secure servers. Your tax sheet is protected throughout the signing process, giving you peace of mind when handling sensitive financial documents.

-

What are the pricing options for using airSlate SignNow to manage tax sheets?

airSlate SignNow offers various pricing plans tailored to fit your business needs, starting with a free trial. Whether you need basic features for personal tax sheets or advanced tools for business use, there's a plan that suits you.

-

Can I integrate airSlate SignNow with other applications for managing tax sheets?

Yes, airSlate SignNow integrates seamlessly with multiple applications like Google Drive, Dropbox, and Microsoft Office. This integration allows you to manage your tax sheets alongside other documents, streamlining your workflow.

-

What features does airSlate SignNow offer for editing tax sheets?

airSlate SignNow allows you to edit and annotate your tax sheets directly within the platform. You can add text, checkers, and signatures, making it easy to prepare your tax sheets for submission.

-

How does eSigning a tax sheet work with airSlate SignNow?

eSigning a tax sheet using airSlate SignNow is straightforward. Once your tax sheet is uploaded, you can invite signers via email, and they can eSign it securely, saving time and ensuring compliance.

-

Is there customer support available for issues with tax sheets?

Absolutely! airSlate SignNow offers robust customer support to assist you with any issues related to your tax sheets. Whether you’re encountering technical difficulties or have questions about features, our support team is ready to help.

Get more for Client Tax Information Sheet Brookwood Tax Service

- Instructions for schedule h form 990 2020internalfederal 990 schedule d supplemental financial statements 20212020 schedule h

- Form 941 ss rev june 2022 employers quarterly federal tax return american samoa guam the commonwealth of the northern mariana

- 2022 form 5498 esa coverdell esa contribution information

- 2022 form 4972 tax on lump sum distributions

- About form 8898 statement for individuals who begin or end bona fide

- Schedules k 2 and k 3 frequently asked questions forms 1065 1120s

- Wwwirsgovpubirs prior2020 form w 3pr irs tax forms

- Instructions for form 5472 122021internal revenue service

Find out other Client Tax Information Sheet Brookwood Tax Service

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed