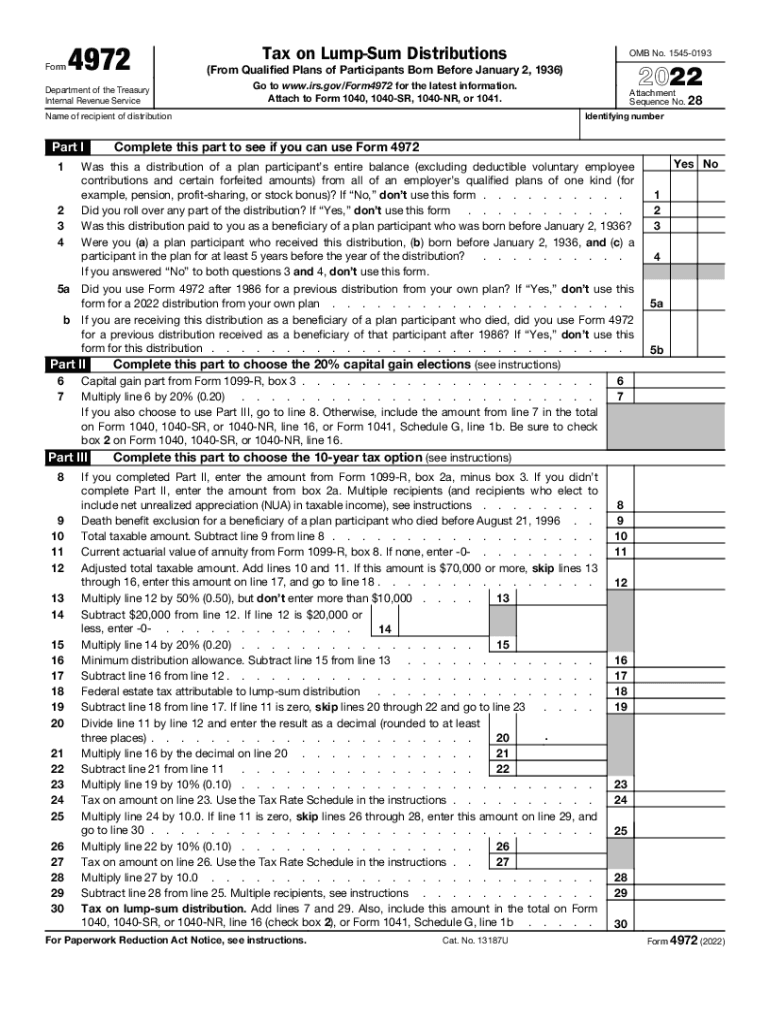

Form 4972 Tax on Lump Sum Distributions 2022

What is the Form 4972 Tax On Lump Sum Distributions

The Form 4972 is used to report tax on lump sum distributions from retirement plans. This form is specifically designed for individuals who receive a lump sum payment from a qualified retirement plan, such as a pension or profit-sharing plan. The tax implications of these distributions can be complex, as they may be subject to different tax rates compared to regular income. Understanding the purpose of Form 4972 is essential for taxpayers to ensure compliance with IRS regulations and to accurately calculate their tax liability.

How to use the Form 4972 Tax On Lump Sum Distributions

To use Form 4972 effectively, you need to gather all relevant information about your lump sum distribution. This includes the total amount received, any contributions made to the plan, and the applicable tax rates. The form allows you to calculate the tax owed on the distribution by applying the special tax treatment available for lump sum distributions. It is crucial to follow the instructions carefully to ensure that the form is filled out correctly, as errors can lead to delays or penalties.

Steps to complete the Form 4972 Tax On Lump Sum Distributions

Completing Form 4972 involves several key steps:

- Gather necessary documents, including your retirement plan statements and any prior tax returns.

- Determine the total lump sum distribution amount and any applicable tax withholding.

- Follow the form's instructions to calculate your tax liability based on the distribution amount.

- Complete all sections of the form, ensuring that all calculations are accurate.

- Review the form for completeness and accuracy before submission.

Key elements of the Form 4972 Tax On Lump Sum Distributions

Key elements of Form 4972 include the identification of the taxpayer, the total amount of the lump sum distribution, and the calculation of the tax owed. The form also requires information about any prior contributions to the retirement plan and the applicable tax rates. Understanding these elements is vital for ensuring that the form is completed correctly and that the taxpayer fulfills their obligations under the law.

Filing Deadlines / Important Dates

Filing deadlines for Form 4972 align with the general tax filing deadlines set by the IRS. Typically, the form must be submitted by April fifteenth of the year following the tax year in which the lump sum distribution was received. If you require additional time, you may file for an extension, but it is important to ensure that any taxes owed are paid by the original deadline to avoid penalties and interest.

Penalties for Non-Compliance

Failure to file Form 4972 or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late filing, and incorrect calculations may lead to additional taxes owed. It is essential for taxpayers to understand the importance of compliance with IRS regulations regarding lump sum distributions to avoid these penalties.

Quick guide on how to complete 2022 form 4972 tax on lump sum distributions

Complete Form 4972 Tax On Lump Sum Distributions effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 4972 Tax On Lump Sum Distributions on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign Form 4972 Tax On Lump Sum Distributions with ease

- Find Form 4972 Tax On Lump Sum Distributions and click Get Form to commence.

- Utilize the tools available to complete your document.

- Highlight relevant sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which only takes moments and holds the same legal authority as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign Form 4972 Tax On Lump Sum Distributions to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 4972 tax on lump sum distributions

Create this form in 5 minutes!

People also ask

-

What is the 2017 tax sum and why is it important?

The 2017 tax sum refers to the total amount taxed based on your earnings and deductions for the year 2017. Understanding this figure is crucial for preparing your tax returns and ensuring compliance with IRS regulations. It affects your tax liability and can help you identify potential tax refunds or payments.

-

How can airSlate SignNow help with my 2017 tax sum documentation?

airSlate SignNow provides a user-friendly platform for eSigning and managing tax documents related to your 2017 tax sum. With our solution, you can securely send, track, and manage your tax documents, ensuring that everything is organized and ready for submission. This helps streamline your tax filing process.

-

Is there a cost associated with using airSlate SignNow for 2017 tax documents?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, ensuring that you get the best value for managing your 2017 tax sum documents. Our pricing is competitive, and we provide an easy-to-use platform that saves you time and resources. You can choose a plan that suits your specific requirements.

-

What features does airSlate SignNow offer for managing my 2017 tax sum?

airSlate SignNow includes features like document templates, automated workflows, and secure cloud storage, all designed to simplify the handling of your 2017 tax sum documentation. Additionally, our platform allows for easy eSigning, which speeds up the approval process and helps you keep track of changes efficiently.

-

Can airSlate SignNow integrate with my existing accounting software for the 2017 tax sum?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, enabling you to manage your 2017 tax sum documentation and financial records in one place. By utilizing these integrations, you can enhance your workflow and improve the efficiency of your accounting tasks.

-

What are the benefits of using airSlate SignNow for my 2017 tax sum?

Using airSlate SignNow for your 2017 tax sum provides several benefits, including improved efficiency, reduced paperwork, and enhanced security for your documents. Our platform allows you to manage everything digitally, thus minimizing the risks of manual errors and ensuring an audit trail for your tax-related documents.

-

Is eSigning my 2017 tax sum documents legally binding?

Yes, eSigning your 2017 tax sum documents through airSlate SignNow is legally binding and complies with electronic signature laws. This means you can sign and manage your tax documents with confidence, knowing that your approval is recognized by legal standards, making your filing process secure and efficient.

Get more for Form 4972 Tax On Lump Sum Distributions

- New jersey mechanics form

- Nj assist form

- Storage business package new jersey form

- Child care services package new jersey form

- New jersey seller form

- Special or limited power of attorney for real estate purchase transaction by purchaser new jersey form

- Limited power of attorney where you specify powers with sample powers included new jersey form

- Limited power of attorney for stock transactions and corporate powers new jersey form

Find out other Form 4972 Tax On Lump Sum Distributions

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later