Www Irs Govpubirs Prior2020 Form W 3PR IRS Tax Forms 2022

Understanding Form 499R 2 W 2PR 2022

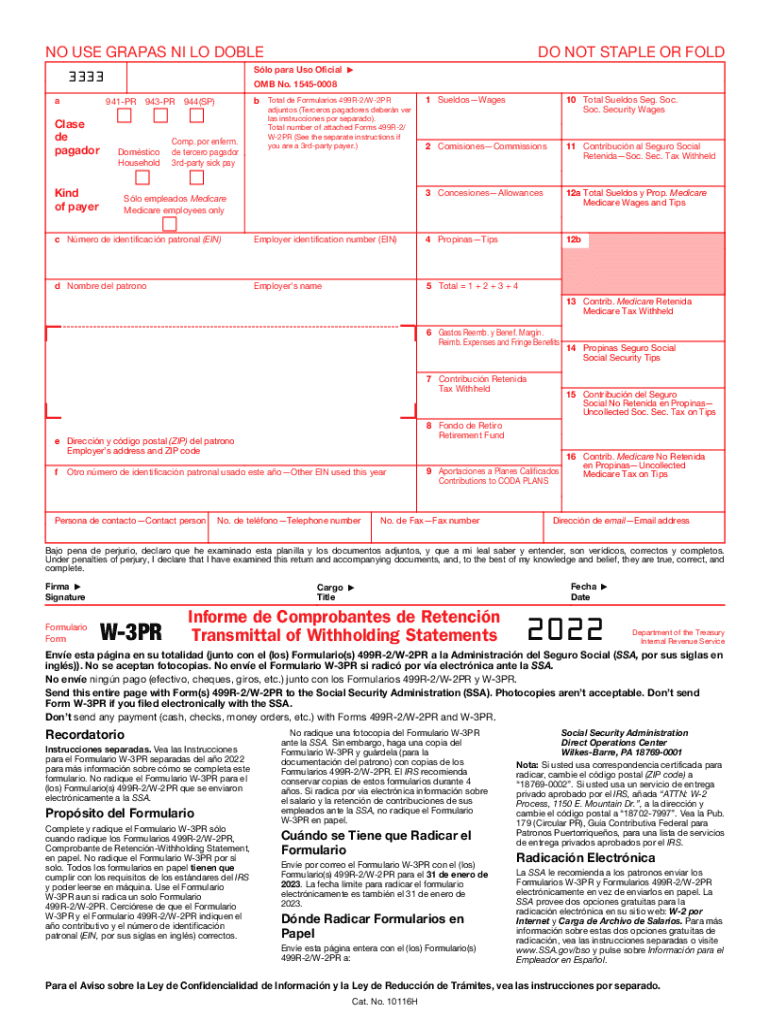

The Form 499R 2 W 2PR 2022 is a tax document used primarily in Puerto Rico to report income and withholdings for employees. This form is essential for employers and employees alike, as it provides a summary of wages paid and taxes withheld during the tax year. Understanding this form is crucial for accurate tax filing and compliance with local regulations.

Steps to Complete Form 499R 2 W 2PR 2022

Completing the Form 499R 2 W 2PR 2022 involves several key steps:

- Gather necessary information, including employee details and wage data.

- Fill in the employer's information, including the employer identification number (EIN).

- Report total wages paid to each employee during the year.

- Include the total amount of taxes withheld from employee wages.

- Review the form for accuracy before submission.

Legal Use of Form 499R 2 W 2PR 2022

The legal use of Form 499R 2 W 2PR 2022 is governed by the tax laws of Puerto Rico. This form must be filed accurately to comply with local tax regulations. Failure to submit this form correctly may result in penalties or legal issues. It is important for both employers and employees to ensure that all information is complete and accurate to avoid complications.

Filing Deadlines for Form 499R 2 W 2PR 2022

Filing deadlines for the Form 499R 2 W 2PR 2022 typically align with the annual tax filing season. Employers should be aware of specific dates to ensure timely submission. Generally, forms must be filed by the end of January following the tax year. Staying informed about these deadlines helps avoid late fees and penalties.

Form Submission Methods for Form 499R 2 W 2PR 2022

Form 499R 2 W 2PR 2022 can be submitted through various methods:

- Online submission via the Puerto Rico Department of Treasury's website.

- Mailing a physical copy of the form to the appropriate tax office.

- In-person submission at designated tax offices.

Key Elements of Form 499R 2 W 2PR 2022

Key elements of the Form 499R 2 W 2PR 2022 include:

- Employer's name and identification number.

- Employee's name and Social Security number.

- Total wages paid and taxes withheld.

- Signature of the employer or authorized representative.

Penalties for Non-Compliance with Form 499R 2 W 2PR 2022

Non-compliance with the filing requirements for Form 499R 2 W 2PR 2022 can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for employers to understand their obligations and ensure timely and accurate filings to avoid these consequences.

Quick guide on how to complete wwwirsgovpubirs prior2020 form w 3pr irs tax forms

Complete Www irs govpubirs prior2020 Form W 3PR IRS Tax Forms smoothly on any gadget

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without holdups. Administer Www irs govpubirs prior2020 Form W 3PR IRS Tax Forms on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to modify and electronically sign Www irs govpubirs prior2020 Form W 3PR IRS Tax Forms effortlessly

- Locate Www irs govpubirs prior2020 Form W 3PR IRS Tax Forms and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to confirm your changes.

- Select how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from a device of your selection. Edit and electronically sign Www irs govpubirs prior2020 Form W 3PR IRS Tax Forms and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs prior2020 form w 3pr irs tax forms

Create this form in 5 minutes!

People also ask

-

What is the purpose of form 499r 2 w 2pr 2022?

Form 499R 2 W 2PR 2022 is essential for employers in Puerto Rico to report employee wages, withholding taxes, and other pertinent financial information. This form ensures compliance with local tax regulations and facilitates accurate payroll processing.

-

How can airSlate SignNow help with form 499r 2 w 2pr 2022?

airSlate SignNow simplifies the process of eSigning and managing documents like form 499R 2 W 2PR 2022. Our platform allows you to quickly send, sign, and store your forms securely, ensuring that your important documents are easily accessible and legally binding.

-

What are the costs associated with using airSlate SignNow for form 499r 2 w 2pr 2022?

airSlate SignNow offers a variety of pricing plans tailored to fit different business needs, starting with a free trial to explore features. By choosing our service, you can efficiently manage form 499R 2 W 2PR 2022 and other documents without incurring high costs associated with traditional signing methods.

-

Is airSlate SignNow compliant with legal regulations for form 499r 2 w 2pr 2022?

Yes, airSlate SignNow is fully compliant with eSignature laws and regulations, ensuring that documents such as form 499R 2 W 2PR 2022 carry the same legal weight as traditionally signed papers. This compliance helps protect your business while maintaining the integrity of your documents.

-

Can I integrate airSlate SignNow with my existing tools for form 499r 2 w 2pr 2022?

Absolutely! airSlate SignNow offers seamless integration with various business applications, allowing you to streamline your workflow. By integrating with tools you already use, you can enhance the efficiency of processing form 499R 2 W 2PR 2022 and other essential documents.

-

What features does airSlate SignNow offer for managing form 499r 2 w 2pr 2022?

airSlate SignNow provides a range of features including document templates, real-time tracking, and secure sharing options for managing form 499R 2 W 2PR 2022. These tools ensure that you can handle your documentation needs efficiently and effectively while maintaining control over the signing process.

-

How does airSlate SignNow enhance the security of form 499r 2 w 2pr 2022?

Security is a top priority for airSlate SignNow, which employs top-tier encryption and secure cloud storage protocols to protect documents like form 499R 2 W 2PR 2022. This ensures that your sensitive information remains confidential and safeguards against unauthorized access.

Get more for Www irs govpubirs prior2020 Form W 3PR IRS Tax Forms

- Warranty deed from limited partnership or llc is the grantor or grantee new jersey form

- Deed correction 497319683 form

- Sale covenants form

- Limited liability company 497319685 form

- New jersey joint form

- Quitclaim deed from two individuals to one individual new jersey form

- New jersey quitclaim form

- Deed jersey state form

Find out other Www irs govpubirs prior2020 Form W 3PR IRS Tax Forms

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now