Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, the Commonwealth of the Northern Mariana 2022

Understanding Form 941 SS Rev June

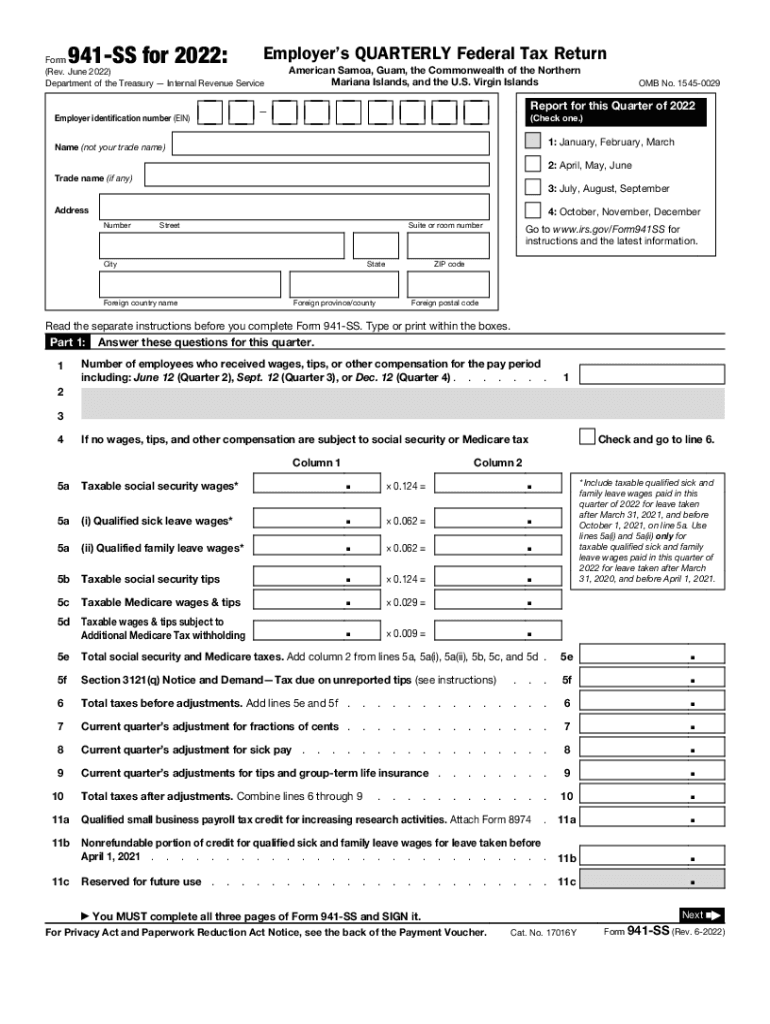

The Form 941 SS Rev June is the Employer's Quarterly Federal Tax Return specifically designed for employers operating in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands. This form is essential for reporting income taxes, Social Security tax, and Medicare tax withheld from employee wages, as well as the employer's portion of Social Security and Medicare taxes. It is crucial for businesses in these territories to accurately complete and submit this form to comply with federal tax regulations.

Steps to Complete Form 941 SS Rev June

Completing the Form 941 SS Rev June involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN), total wages paid, and taxes withheld.

- Fill out the form accurately, ensuring that all sections, such as employee counts and tax calculations, are complete.

- Review the completed form for any errors or omissions before submission.

- Sign and date the form to certify its accuracy.

Following these steps will help ensure that your submission is correct and timely, reducing the risk of penalties.

IRS Guidelines for Form 941 SS Rev June

The IRS provides specific guidelines for completing and submitting the Form 941 SS Rev June. These guidelines include:

- Ensuring that the form is submitted quarterly, with deadlines typically falling on the last day of the month following the end of each quarter.

- Providing accurate information regarding employee wages and tax withholdings to avoid discrepancies.

- Utilizing the correct version of the form, as updates may occur periodically.

Adhering to these guidelines is essential for compliance and to avoid potential issues with the IRS.

Filing Deadlines for Form 941 SS Rev June

Filing deadlines for the Form 941 SS Rev June are crucial for maintaining compliance with federal tax laws. The deadlines are as follows:

- For the first quarter (January to March), the deadline is April 30.

- For the second quarter (April to June), the deadline is July 31.

- For the third quarter (July to September), the deadline is October 31.

- For the fourth quarter (October to December), the deadline is January 31 of the following year.

Timely submission of the form helps avoid penalties and interest on unpaid taxes.

Penalties for Non-Compliance with Form 941 SS Rev June

Failure to file the Form 941 SS Rev June on time or inaccuracies in the form can result in significant penalties. Common penalties include:

- A failure-to-file penalty, which can be up to five percent of the unpaid tax for each month the return is late.

- A failure-to-pay penalty, which is generally 0.5 percent of the unpaid tax for each month it remains unpaid.

- Interest on unpaid taxes, which accrues from the due date of the return until the tax is paid in full.

Understanding these penalties emphasizes the importance of accurate and timely filing.

Obtaining Form 941 SS Rev June

The Form 941 SS Rev June can be obtained through various means:

- Downloading directly from the IRS website, where the most current version is available.

- Requesting a physical copy from the IRS by mail.

- Accessing the form through tax preparation software, which often includes the latest forms for ease of use.

Ensuring you have the correct and most up-to-date form is essential for compliance.

Quick guide on how to complete form 941 ss rev june 2022 employers quarterly federal tax return american samoa guam the commonwealth of the northern mariana

Complete Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, The Commonwealth Of The Northern Mariana effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, The Commonwealth Of The Northern Mariana on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric tasks today.

The easiest way to modify and eSign Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, The Commonwealth Of The Northern Mariana without stress

- Obtain Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, The Commonwealth Of The Northern Mariana and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form, either via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, The Commonwealth Of The Northern Mariana to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 ss rev june 2022 employers quarterly federal tax return american samoa guam the commonwealth of the northern mariana

Create this form in 5 minutes!

People also ask

-

What is Form 941?

Form 941 is a tax form used by employers to report payroll taxes. This form includes information on wages paid and the taxes withheld, specifically for Social Security and Medicare. Understanding Form 941 is crucial for ensuring compliance with tax regulations.

-

How can airSlate SignNow help with Form 941?

airSlate SignNow provides an easy-to-use platform for electronically signing and managing Form 941. With our solution, businesses can streamline the document preparation and eSignature process, making it quicker and more efficient to file taxes on time.

-

Is airSlate SignNow cost-effective for handling Form 941?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our cost-effective solution ensures you can manage your Form 941 efficiently without breaking your budget, making it an ideal choice for companies looking to simplify their payroll tax processes.

-

What features does airSlate SignNow offer for Form 941?

airSlate SignNow includes features like customizable templates, secure eSigning, and document tracking to streamline the Form 941 submission process. These tools enable users to create, share, and sign documents quickly, ensuring deadlines are met with ease.

-

Can I integrate airSlate SignNow with other tools for Form 941 management?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including popular accounting software and CRMs. This integration helps you effortlessly manage your Form 941 alongside your other financial tasks, enhancing overall workflow efficiency.

-

What are the benefits of using airSlate SignNow for Form 941 filing?

Using airSlate SignNow for Form 941 filing provides numerous benefits, including faster processing times, reduced paperwork, and enhanced security. Our platform ensures that your sensitive information is protected while simplifying the entire eSigning process.

-

How does airSlate SignNow enhance the security of Form 941 documents?

airSlate SignNow employs advanced encryption and secure storage to protect your Form 941 documents. Our platform ensures that only authorized users can access sensitive information, allowing you to safely manage your payroll tax filings.

Get more for Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, The Commonwealth Of The Northern Mariana

- Option to purchase package new jersey form

- Amendment of lease package new jersey form

- Annual financial checkup package new jersey form

- New jersey bill sale form

- Living wills and health care package new jersey form

- Last will and testament package new jersey form

- Subcontractors package new jersey form

- Nj minors form

Find out other Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, The Commonwealth Of The Northern Mariana

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later