Sample Tax Return Form

What is the Sample Tax Return

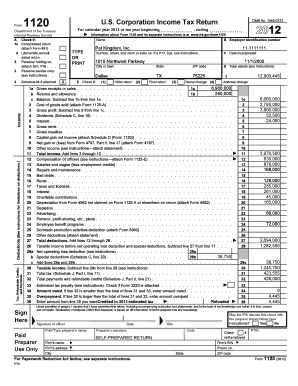

A sample tax return serves as a representation of how an actual tax return is structured and filled out. It provides taxpayers with a visual guide to understand the various sections and information required when filing their taxes. The sample typically includes fields for personal information, income details, deductions, and credits, mirroring the standard tax return forms used by the Internal Revenue Service (IRS). By reviewing a sample of income tax return, individuals can familiarize themselves with the information they need to gather and the format they must follow.

How to Use the Sample Tax Return

Using a sample tax return can help streamline the filing process. Taxpayers can reference the sample to identify necessary documents and data points, such as W-2 forms, 1099s, and other income statements. It is advisable to fill out the sample form with hypothetical figures to practice before completing the actual tax return. This exercise can clarify how to calculate taxable income, apply deductions, and determine potential refunds or liabilities. Additionally, understanding how to use a sample 2023 tax return can reduce errors and improve confidence when filing the real return.

Steps to Complete the Sample Tax Return

Completing a sample tax return involves several key steps:

- Gather Documentation: Collect all necessary documents, including income statements, prior tax returns, and receipts for deductions.

- Fill Out Personal Information: Enter your name, address, Social Security number, and filing status in the designated sections.

- Report Income: List all sources of income, such as wages, interest, and dividends, in the appropriate fields.

- Claim Deductions: Identify eligible deductions and credits, ensuring to fill out the relevant sections accurately.

- Review and Calculate: Double-check all entries for accuracy and calculate total taxable income and tax owed or refund due.

- Finalize the Form: Sign and date the sample return, ensuring all information is complete and correct.

Legal Use of the Sample Tax Return

While a sample tax return is primarily a learning tool, understanding its legal implications is essential. A completed tax return must adhere to IRS regulations to be considered valid. This includes accurate reporting of income and claiming only legitimate deductions. Using a sample of the 2024 tax return can help taxpayers grasp what is legally permissible and what documentation is required to support their claims. Additionally, ensuring compliance with IRS guidelines can prevent penalties or audits.

Key Elements of the Sample Tax Return

The key elements of a sample tax return include:

- Personal Information: Taxpayer’s name, address, and Social Security number.

- Filing Status: Indicates whether the taxpayer is single, married, or head of household.

- Income Section: Details all sources of income, including wages, self-employment income, and investment earnings.

- Deductions and Credits: Lists eligible deductions, such as mortgage interest and education credits.

- Tax Calculation: Shows how the tax owed or refund is determined based on income and deductions.

IRS Guidelines

The IRS provides specific guidelines for completing tax returns, which are crucial for ensuring compliance. These guidelines cover everything from filing deadlines to acceptable forms of documentation. Taxpayers should consult the IRS website or relevant publications for the most current rules and updates regarding tax return submissions. Understanding these guidelines can help avoid common mistakes and ensure that the tax return is filed correctly and on time.

Quick guide on how to complete sample tax return

Complete Sample Tax Return effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage Sample Tax Return on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and electronically sign Sample Tax Return without any hassle

- Locate Sample Tax Return and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Sample Tax Return and ensure excellent communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample 2023 tax return and how can it help me?

A sample 2023 tax return serves as a template that highlights how to properly fill out your tax forms for the year. Utilizing a sample 2023 tax return can help you understand the essential sections of the return, ensuring that you report your income accurately and claim all eligible deductions. This can ultimately save you time and minimize errors.

-

How can I access a sample 2023 tax return?

You can easily find a sample 2023 tax return online through various tax preparation websites or the official IRS website. These resources typically provide a downloadable format that you can print and fill out. Additionally, airSlate SignNow allows you to create and manage your tax documents electronically, making it a seamless part of your filing process.

-

Are there costs associated with obtaining a sample 2023 tax return?

Most sample 2023 tax return forms are free to access online through government sites or trusted tax resources. However, if you're looking for personalized guidance or additional services, platforms like airSlate SignNow offer affordable pricing. We empower businesses to eSign and manage documents efficiently, ensuring you have a cost-effective solution for all your tax needs.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers various features that simplify the management of tax documents, including secure eSigning, customizable templates, and cloud storage. These tools enable you to create, send, and sign your sample 2023 tax return without the hassle of paper forms. This streamlined process is designed to save you time while ensuring compliance.

-

Can I integrate airSlate SignNow with my current tax preparation software?

Yes, airSlate SignNow can be easily integrated with various tax preparation software platforms. This allows you to import your sample 2023 tax return directly into your preferred tax application, facilitating a smoother workflow. Our integrations help ensure that your documents are always up-to-date and accessible.

-

What are the benefits of using airSlate SignNow for my tax documents?

Using airSlate SignNow for your tax documents offers signNow benefits, including enhanced security, signature tracking, and a user-friendly interface. With our platform, you can confidently manage your sample 2023 tax return and other important documents while ensuring they are signed and stored securely. This not only simplifies your tax process but also increases overall productivity.

-

Is airSlate SignNow suitable for both individuals and businesses?

Absolutely! airSlate SignNow is designed to cater to both individuals and businesses, making it a versatile solution for all tax-related needs. Whether you're filling out a sample 2023 tax return for personal use or managing multiple returns for a business, our platform provides the right tools to accommodate your requirements.

Get more for Sample Tax Return

- Sc form 400

- Ph 1600 printable form

- Microblading consent form template pdf

- White lake township burn permit form

- Printable biological indicator log forms

- Ca7 form 16282516

- Fis 2053 515 department of insurance and financial services page 1 of 2 fiscal year end date financial statement disclosure form

- Contractor registration bcityofbonitaspringscdbborgb form

Find out other Sample Tax Return

- Redact eSignature PDF Online

- Erase eSignature Presentation Safe

- Redact eSignature Word Later

- How To Redact eSignature PDF

- How Do I Redact eSignature Document

- How Can I Redact eSignature Document

- Draw eSignature PDF Now

- Draw eSignature Word Mobile

- Draw eSignature Word Later

- Draw eSignature Form Online

- Draw eSignature Form Computer

- How To Draw eSignature Form

- Draw eSignature PPT Mac

- Draw eSignature Form Easy

- Encrypt eSignature PDF Online

- Draw eSignature Form iPad

- Encrypt eSignature PDF Simple

- How Do I Encrypt eSignature PDF

- Encrypt eSignature PDF Mac

- Send Electronic signature Word Online