Hmrcgovukforms2005ca3916pdf 2012

What is the Hmrcgovukforms2005ca3916pdf

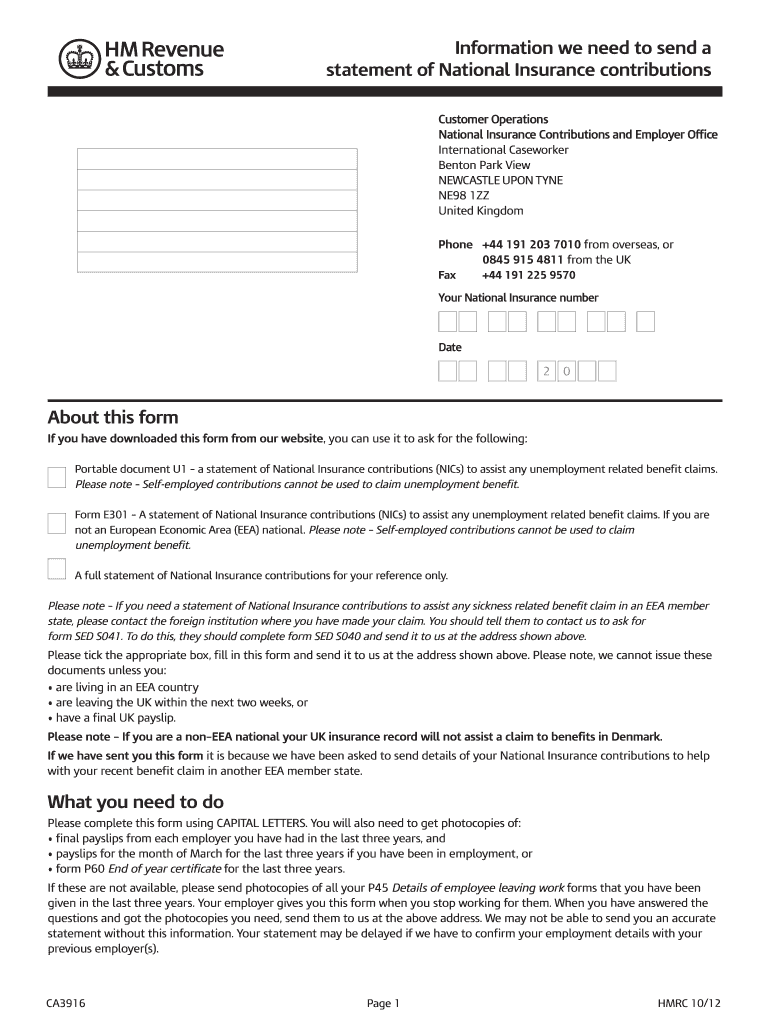

The Hmrcgovukforms2005ca3916pdf is a specific form used for tax-related purposes in the United Kingdom. It is primarily associated with the HM Revenue and Customs (HMRC) and serves as a crucial document for individuals and businesses in managing their tax obligations. Understanding this form is essential for anyone who needs to navigate the complexities of tax compliance, especially if they have ties to the UK tax system.

How to use the Hmrcgovukforms2005ca3916pdf

Using the Hmrcgovukforms2005ca3916pdf involves several steps. First, ensure that you have the correct version of the form, as updates may occur. Next, gather all necessary information and documentation required to complete the form accurately. This includes personal identification, financial records, and any relevant tax information. Once you have filled out the form, it can be submitted electronically or by mail, depending on the guidelines provided by HMRC.

Steps to complete the Hmrcgovukforms2005ca3916pdf

Completing the Hmrcgovukforms2005ca3916pdf requires careful attention to detail. Follow these steps:

- Download the latest version of the form from an official source.

- Read the instructions carefully to understand each section.

- Fill in all required fields with accurate information.

- Double-check for any errors or omissions before submission.

- Submit the form via the preferred method, ensuring you keep a copy for your records.

Legal use of the Hmrcgovukforms2005ca3916pdf

The legal use of the Hmrcgovukforms2005ca3916pdf is governed by tax laws and regulations set forth by HMRC. To ensure compliance, it is vital to use the form as intended, providing truthful and complete information. Misrepresentation or failure to submit the form correctly can lead to penalties or legal repercussions. Always consult with a tax professional if unsure about the legal implications of using this form.

Key elements of the Hmrcgovukforms2005ca3916pdf

Key elements of the Hmrcgovukforms2005ca3916pdf include:

- Personal identification details, such as name and address.

- Financial information relevant to tax calculations.

- Specific sections that require signatures or declarations.

- Instructions for submission and deadlines.

Form Submission Methods

The Hmrcgovukforms2005ca3916pdf can be submitted through various methods. Typically, you can choose to file online, which is often the fastest and most efficient option. Alternatively, you may opt to print the form and send it via traditional mail. In-person submissions may also be possible at designated HMRC offices, depending on your location and circumstances. Ensure you follow the guidelines for your chosen submission method to avoid delays.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the Hmrcgovukforms2005ca3916pdf can result in significant penalties. These may include fines, interest on unpaid taxes, or legal action. It is crucial to understand the importance of timely and accurate submission to avoid these consequences. Regularly reviewing your obligations and staying informed about any changes in tax law can help mitigate risks associated with non-compliance.

Quick guide on how to complete hmrcgovukforms2005ca3916pdf 2012

A concise guide on preparing your Hmrcgovukforms2005ca3916pdf

Locating the appropriate template can turn into a hurdle when you are required to submit formal international documents. Even if you possess the necessary form, it might be tedious to swiftly prepare it in compliance with all specifications if you rely on physical copies instead of managing everything digitally. airSlate SignNow is the online electronic signature service that assists you in navigating these challenges. It allows you to select your Hmrcgovukforms2005ca3916pdf and expediently fill it out and sign it on the spot without needing to reprint papers if you make an error.

Here are the procedures you need to follow to prepare your Hmrcgovukforms2005ca3916pdf with airSlate SignNow:

- Click the Get Form button to promptly upload your document to our editor.

- Begin with the first blank space, enter your information, and proceed using the Next tool.

- Complete the empty fields using the Cross and Check tools from the upper toolbar.

- Select the Highlight or Line features to emphasize the critical information.

- Click on Image and upload one if your Hmrcgovukforms2005ca3916pdf requires it.

- Utilize the right-side panel to add additional fields for yourself or others to complete if needed.

- Review your inputs and validate the form by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing by clicking the Done button and choosing your file-sharing preferences.

Once your Hmrcgovukforms2005ca3916pdf is completed, you can share it in your preferred manner—send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely save all your finalized documents in your account, organized in folders as per your liking. Don’t squander time on manual form filling; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct hmrcgovukforms2005ca3916pdf 2012

FAQs

-

Can I fill out an income tax return for FY 2012-2013?

According to section 139 (1) of the Income Tax Act, 1961:Every person —

Create this form in 5 minutes!

How to create an eSignature for the hmrcgovukforms2005ca3916pdf 2012

How to generate an electronic signature for your Hmrcgovukforms2005ca3916pdf 2012 in the online mode

How to generate an electronic signature for your Hmrcgovukforms2005ca3916pdf 2012 in Chrome

How to generate an eSignature for putting it on the Hmrcgovukforms2005ca3916pdf 2012 in Gmail

How to generate an eSignature for the Hmrcgovukforms2005ca3916pdf 2012 right from your mobile device

How to create an eSignature for the Hmrcgovukforms2005ca3916pdf 2012 on iOS devices

How to create an electronic signature for the Hmrcgovukforms2005ca3916pdf 2012 on Android devices

People also ask

-

What is Hmrcgovukforms2005ca3916pdf and why is it important?

Hmrcgovukforms2005ca3916pdf refers to a specific form used for tax submissions in the UK. Understanding this form is crucial as it helps businesses comply with HMRC regulations and manage their tax obligations effectively.

-

How can airSlate SignNow assist with Hmrcgovukforms2005ca3916pdf?

airSlate SignNow allows users to easily upload, send, and eSign Hmrcgovukforms2005ca3916pdf documents. This streamlined process ensures that your submissions are not only compliant but also secure and efficiently managed.

-

What features does airSlate SignNow offer for handling Hmrcgovukforms2005ca3916pdf?

With airSlate SignNow, you can automate the signing process of Hmrcgovukforms2005ca3916pdf, integrate with various applications, and track document status. These features enhance efficiency and ensure timely completion of your tax-related documents.

-

Is there a cost associated with using airSlate SignNow for Hmrcgovukforms2005ca3916pdf?

airSlate SignNow provides a cost-effective solution for managing Hmrcgovukforms2005ca3916pdf documents with flexible pricing plans. Depending on your business needs, you can choose a plan that fits your budget while still enjoying full access to features.

-

Can I integrate airSlate SignNow with other software for Hmrcgovukforms2005ca3916pdf?

Yes, airSlate SignNow integrates seamlessly with various software applications, making it easy to manage Hmrcgovukforms2005ca3916pdf within your existing workflows. This integration enhances productivity by connecting your tools and streamlining processes.

-

What benefits does airSlate SignNow offer for businesses using Hmrcgovukforms2005ca3916pdf?

Using airSlate SignNow for Hmrcgovukforms2005ca3916pdf provides several benefits, including improved turnaround time, enhanced document security, and reduced errors associated with manual processes. This allows businesses to focus more on their core operations.

-

How secure is airSlate SignNow for managing Hmrcgovukforms2005ca3916pdf?

airSlate SignNow takes document security seriously by implementing encryption, secure storage, and compliance with industry standards. This ensures that your Hmrcgovukforms2005ca3916pdf documents are protected from unauthorized access and any potential data bsignNowes.

Get more for Hmrcgovukforms2005ca3916pdf

Find out other Hmrcgovukforms2005ca3916pdf

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist