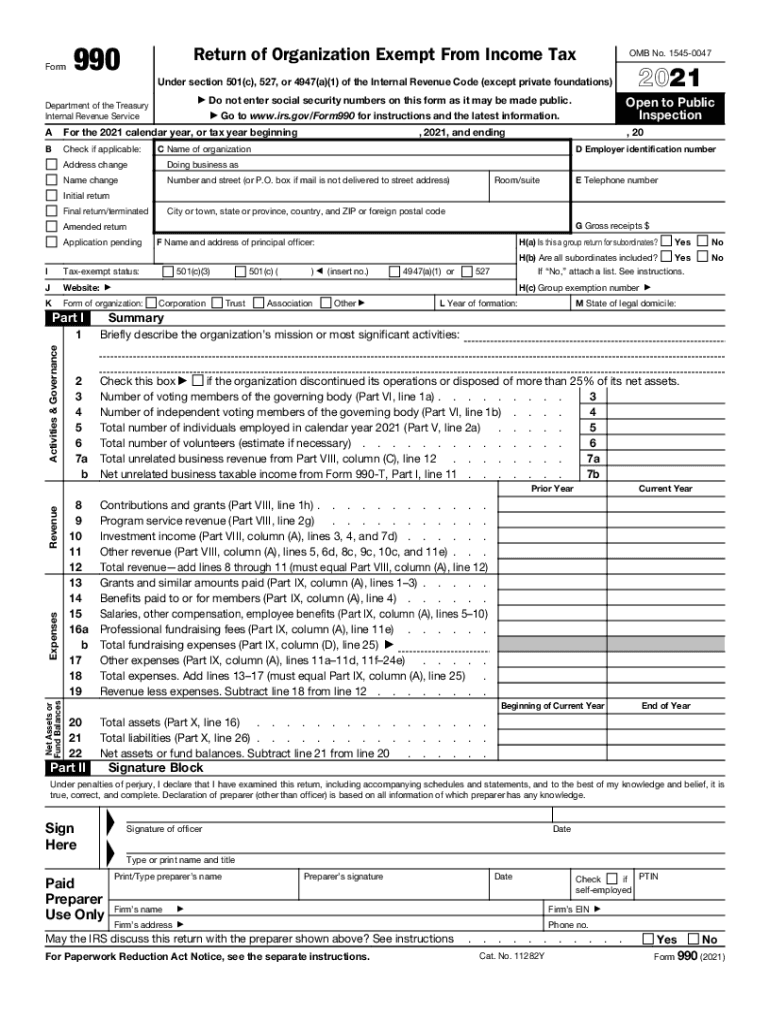

Form 990 Return of Organization Exempt from Income Tax 2021

What is the Form 990 Return of Organization Exempt From Income Tax

The Form 990 is a crucial document for organizations that are exempt from federal income tax under Section 501(c) of the Internal Revenue Code. This form serves as an annual information return that provides the IRS and the public with detailed insights into the organization's financial activities, governance, and compliance with tax regulations. It is essential for maintaining tax-exempt status and ensuring transparency in operations.

Organizations required to file this form include charities, foundations, and other nonprofit entities. The Form 990 helps the IRS monitor compliance with tax laws and provides valuable data for potential donors and the general public to assess the organization’s financial health and mission effectiveness.

Steps to Complete the Form 990 Return of Organization Exempt From Income Tax

Completing the Form 990 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and records of expenses. Next, follow these steps:

- Identify the correct version: Determine if you need to file Form 990, Form 990-EZ, or Form 990-N based on your organization’s gross receipts and total assets.

- Fill out the form: Provide detailed information about your organization, including mission, programs, and financial data. Ensure that all sections are completed accurately.

- Review and validate: Check for errors or missing information. It is advisable to have a second set of eyes review the form before submission.

- File the form: Submit the completed Form 990 electronically or via mail, depending on your organization’s size and filing requirements.

Legal Use of the Form 990 Return of Organization Exempt From Income Tax

The legal use of Form 990 is vital for maintaining compliance with IRS regulations. Filing this form is not just a requirement; it also serves as a public record that demonstrates transparency and accountability. Organizations must ensure that the information reported is truthful and complete, as inaccuracies can lead to penalties or loss of tax-exempt status.

Additionally, the Form 990 must be made available to the public, allowing donors and stakeholders to assess the organization’s financial integrity and operational effectiveness. This transparency builds trust and encourages continued support from the community.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form 990 is essential for compliance. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the deadline is May fifteenth. If the deadline falls on a weekend or holiday, the due date is extended to the next business day.

Organizations can apply for an automatic six-month extension by filing Form 8868, but it is important to note that this extension only applies to the filing deadline, not to any taxes owed. Being aware of these dates helps organizations avoid penalties and maintain good standing with the IRS.

Required Documents

When preparing to file Form 990, organizations must gather several key documents to ensure a complete and accurate submission. These documents typically include:

- Financial statements, including income statements and balance sheets.

- Records of contributions and grants received.

- Details of program services and expenses.

- Board meeting minutes and governance documents.

- IRS determination letter confirming tax-exempt status.

Having these documents readily available streamlines the filing process and helps ensure compliance with IRS requirements.

Form Submission Methods (Online / Mail / In-Person)

Organizations have several options for submitting Form 990, each with its own benefits. The primary methods include:

- Online submission: Many organizations choose to file electronically through the IRS e-file system, which is faster and allows for immediate confirmation of receipt.

- Mail submission: Organizations can also choose to print and mail the completed form to the appropriate IRS address. This method may take longer for processing.

- In-person submission: While less common, some organizations may opt to deliver the form directly to an IRS office, though this is not typically necessary.

Choosing the right submission method can help organizations manage their filing process efficiently and ensure timely compliance.

Quick guide on how to complete 2021 form 990 return of organization exempt from income tax

Effortlessly Prepare Form 990 Return Of Organization Exempt From Income Tax on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly option compared to traditional printed and signed documents, allowing you to access the appropriate form and store it securely online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delay. Manage Form 990 Return Of Organization Exempt From Income Tax on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedures today.

How to modify and electronically sign Form 990 Return Of Organization Exempt From Income Tax effortlessly

- Find Form 990 Return Of Organization Exempt From Income Tax and click Get Form to initiate the process.

- Use the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 990 Return Of Organization Exempt From Income Tax and guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 990 return of organization exempt from income tax

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 990 return of organization exempt from income tax

How to create an e-signature for your PDF online

How to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to generate an e-signature right from your smartphone

How to generate an electronic signature for a PDF on iOS

How to generate an e-signature for a PDF on Android

People also ask

-

What is the 990 n. feature in airSlate SignNow?

The 990 n. feature in airSlate SignNow refers to our innovative eSignature capabilities that simplify the document signing process. This feature allows users to send, sign, and manage documents all in one secure platform. With 990 n., businesses can streamline their workflow and enhance productivity.

-

How does the pricing structure work for 990 n. users?

The pricing structure for airSlate SignNow offering 990 n. is designed to be cost-effective for businesses of all sizes. We provide various plans, including basic and advanced tiers, to suit different needs. Users can choose the plan that best fits their requirements and budget while benefiting from the features provided by 990 n.

-

What are the key benefits of using the 990 n. feature?

Using the 990 n. feature within airSlate SignNow provides several key benefits, including increased efficiency and reduced turnaround time for document signing. Additionally, businesses can enhance security with robust authentication methods. The overall user experience is signNowly improved, making it easier for teams to collaborate and finalize documents.

-

Can I integrate 990 n. with other software applications?

Yes, the 990 n. feature in airSlate SignNow easily integrates with various third-party applications. This allows businesses to connect their existing workflows and tools, such as CRMs and project management software. Integration enhances the overall effectiveness of 990 n., ensuring seamless operations across platforms.

-

Is the 990 n. feature scalable for growing businesses?

Absolutely! The 990 n. feature is designed to be scalable, making it suitable for businesses that are growing or evolving. As your organization expands, you can adjust your airSlate SignNow services to accommodate the increasing volume of documents and users while maintaining efficiency and security.

-

What types of documents can I manage with 990 n.?

With the 990 n. feature in airSlate SignNow, you can manage a wide range of documents, including contracts, agreements, and forms. This versatility is essential for businesses that handle various document types regularly. Our platform supports all formats, helping you stay organized and compliant.

-

How secure is the 990 n. feature for document signing?

The 990 n. feature in airSlate SignNow prioritizes security to protect sensitive information during the signing process. We implement advanced encryption and compliance with industry standards, ensuring that your documents are safe from unauthorized access. Trust is key, and 990 n. offers a secure environment for all your electronic signatures.

Get more for Form 990 Return Of Organization Exempt From Income Tax

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497304397 form

- Letter from landlord to tenant for failure of to dispose all ashes rubbish garbage or other waste in a clean and safe manner in 497304398 form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497304399 form

- Letter from landlord to tenant for failure to use electrical plumbing sanitary heating ventilating air conditioning and other 497304400 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497304401 form

- Hi tenant 497304402 form

- Hawaii about law form

- Hawaii letter tenant 497304404 form

Find out other Form 990 Return Of Organization Exempt From Income Tax

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form