Federal Form 1098 Mortgage Interest Statement Info Copy 2021

Understanding the 1099-R Form

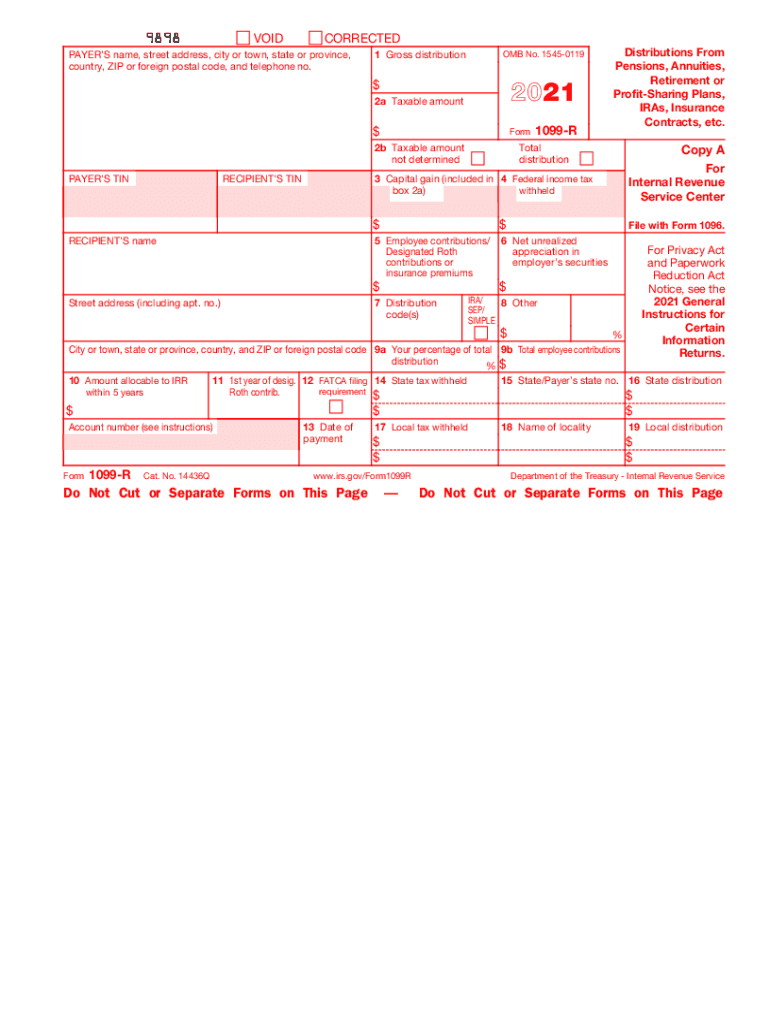

The 1099-R form, officially known as the Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., is a crucial tax document issued by financial institutions. It reports distributions made to individuals from retirement accounts. This form is essential for taxpayers who have received distributions from pensions, annuities, or retirement plans, as it provides the necessary information for reporting income on their tax returns.

Key Elements of the 1099-R Form

Several key elements are included in the 1099-R form that taxpayers should understand:

- Payer Information: This section includes the name, address, and taxpayer identification number of the entity making the distribution.

- Recipient Information: This part contains details about the individual receiving the distribution, including their name, address, and Social Security number.

- Distribution Amount: The total amount distributed during the tax year is reported in Box 1.

- Taxable Amount: Box 2a indicates the taxable portion of the distribution, which is crucial for determining tax liability.

- Federal Income Tax Withheld: If any federal tax was withheld, it is reported in Box 4.

Steps to Complete the 1099-R Form

Completing the 1099-R form involves several steps to ensure accuracy and compliance:

- Gather Information: Collect all relevant documents, including statements from your retirement accounts.

- Fill in Payer and Recipient Details: Accurately enter the information for both the payer and the recipient.

- Report Distribution Amounts: Enter the total distribution amount in Box 1 and the taxable amount in Box 2a.

- Indicate Withholding: If applicable, report any federal tax withheld in Box 4.

- Review for Accuracy: Double-check all entries for accuracy before submission.

Filing Deadlines for the 1099-R Form

Timely filing of the 1099-R form is essential to avoid penalties. The form must be sent to the IRS by January thirty-first of the year following the distribution. Recipients should also receive their copies by this date to ensure they can accurately report their income on their tax returns.

Who Issues the 1099-R Form?

The 1099-R form is typically issued by financial institutions, such as banks, insurance companies, and pension funds. These entities are responsible for reporting distributions made to individuals from retirement accounts. It is important for recipients to keep track of these forms, as they are necessary for accurate tax reporting.

Legal Use of the 1099-R Form

The 1099-R form is legally binding and must be filled out accurately to comply with IRS regulations. Failure to report distributions correctly can lead to penalties and additional tax liabilities. It is advisable for taxpayers to consult with a tax professional if they have questions regarding the completion or implications of the 1099-R form.

Quick guide on how to complete federal form 1098 mortgage interest statement info copy

Easily prepare Federal Form 1098 Mortgage Interest Statement Info Copy on any device

Managing documents online has gained popularity among companies and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, since you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle Federal Form 1098 Mortgage Interest Statement Info Copy on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign Federal Form 1098 Mortgage Interest Statement Info Copy effortlessly

- Find Federal Form 1098 Mortgage Interest Statement Info Copy and click on Get Form to begin.

- Make use of the tools provided to complete your document.

- Mark important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select how you want to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Federal Form 1098 Mortgage Interest Statement Info Copy and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal form 1098 mortgage interest statement info copy

Create this form in 5 minutes!

How to create an eSignature for the federal form 1098 mortgage interest statement info copy

How to create an e-signature for your PDF in the online mode

How to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an e-signature for a PDF on Android OS

People also ask

-

What is a 1099 r form?

A 1099 r form is used to report distributions from pensions, annuities, retirement plans, or IRAs. It provides important tax information that individuals need to file their returns correctly. Understanding the details within a 1099 r is crucial for proper financial management.

-

How can airSlate SignNow help with 1099 r forms?

airSlate SignNow provides a streamlined process for sending and eSigning 1099 r forms. With its user-friendly interface, businesses can efficiently manage document workflows, ensuring that all necessary signatures are obtained quickly and securely. This simplifies the often complex task of handling tax documents.

-

What is the pricing structure for using airSlate SignNow for 1099 r forms?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs. Users can choose from monthly or yearly subscriptions, ensuring that they receive an affordable solution for managing their 1099 r forms without breaking the bank. Detailed pricing information is available on the website.

-

Are there any additional features for handling 1099 r forms on airSlate SignNow?

Yes, airSlate SignNow includes features such as document templates, a customizable signing order, and team collaboration tools specifically designed to make managing 1099 r forms easier. These tools enhance efficiency and reduce the time spent on administrative tasks related to tax forms.

-

Can I integrate airSlate SignNow with other software for managing 1099 r forms?

Definitely! airSlate SignNow offers integration capabilities with various accounting and tax software that can facilitate managing 1099 r forms. This allows businesses to maintain seamless data flow and keep all related information organized in one place.

-

What are the benefits of eSigning 1099 r forms with airSlate SignNow?

eSigning 1099 r forms with airSlate SignNow speeds up the process and enhances efficiency. Electronic signatures are legally binding and secure, making it easy to track document status and manage compliance. Additionally, using airSlate SignNow helps reduce paper use and storage costs.

-

Is airSlate SignNow secure for signing and storing 1099 r forms?

Yes, airSlate SignNow prioritizes security to ensure that your 1099 r forms are protected. With features such as encryption and secure cloud storage, your sensitive information remains confidential and integral. This gives you peace of mind while managing your tax-related documents.

Get more for Federal Form 1098 Mortgage Interest Statement Info Copy

- Letter from tenant to landlord about insufficient notice of rent increase hawaii form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase during lease hawaii form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase hawaii form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant hawaii form

- Letter from tenant to landlord containing notice to landlord to withdraw retaliatory rent increase hawaii form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services hawaii form

- Temporary lease agreement to prospective buyer of residence prior to closing hawaii form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497304412 form

Find out other Federal Form 1098 Mortgage Interest Statement Info Copy

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document