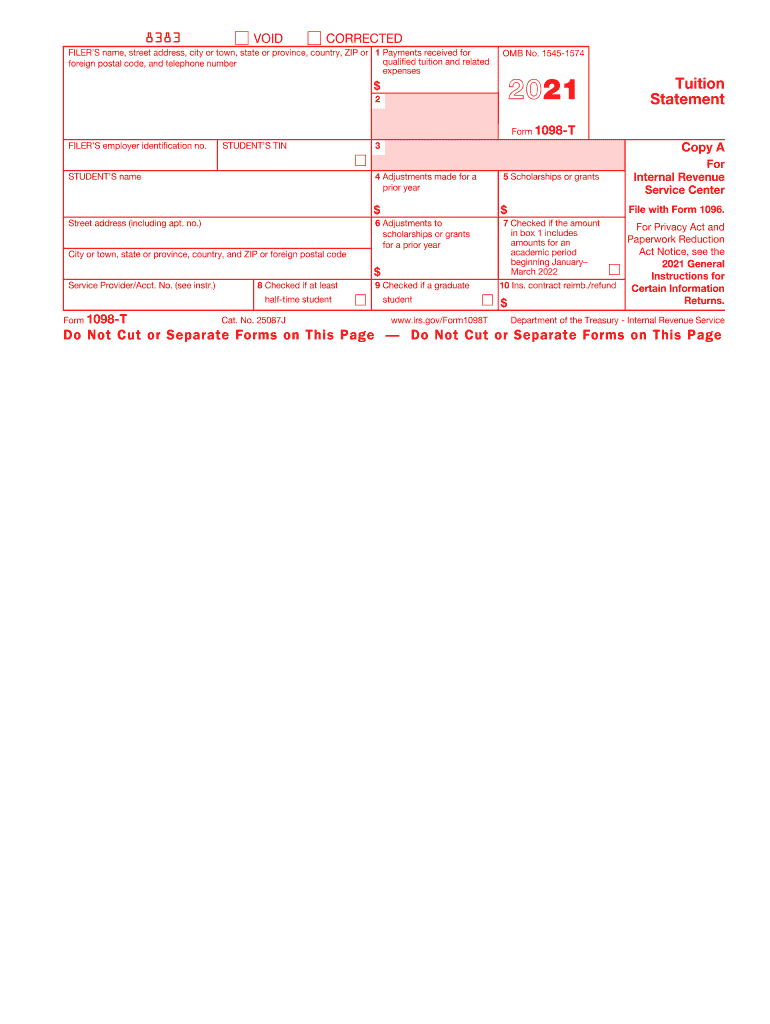

Form 1098 T Tuition Statement 2021

Understanding Form 1099-G for 2017

The 1099-G form is used by the Internal Revenue Service (IRS) to report certain types of government payments, including unemployment compensation and state tax refunds. For the year 2017, individuals who received these payments may need to include this information when filing their federal tax returns. Understanding the details of the 1099-G form is essential for accurate reporting and compliance with tax regulations.

Key Elements of the 1099-G Form

The 1099-G form includes several critical pieces of information that taxpayers should be aware of:

- Payer Information: This section identifies the government agency that issued the payment.

- Recipient Information: This includes the taxpayer's name, address, and Social Security number.

- Box 1 - Unemployment Compensation: This box shows the total amount of unemployment benefits received during the year.

- Box 2 - State or Local Income Tax Refund: This indicates any state or local tax refunds that may need to be reported.

- Box 3 - Other Income: This may include other types of payments that do not fall under the usual categories.

Steps to Complete Your 1099-G Form

Filling out the 1099-G form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather all relevant documents, including any notices from the government agency that issued the payment.

- Fill in your personal information, ensuring that your name and Social Security number are correct.

- Enter the total amount of unemployment compensation or any state tax refunds in the appropriate boxes.

- Review the form for accuracy before submission.

- Keep a copy of the completed form for your records.

Filing Deadlines for the 1099-G Form

Timely filing of the 1099-G form is crucial to avoid penalties. The IRS typically requires that the form be sent to recipients by January 31 of the year following the tax year. For 2017, this means that the form should have been issued by January 31, 2018. Additionally, the form must be filed with the IRS by the end of February if submitting by paper or by March 31 if filing electronically.

Legal Use of the 1099-G Form

The 1099-G form must be used in compliance with IRS regulations. Taxpayers are required to report any unemployment benefits or state tax refunds received as income on their federal tax returns. Failure to report this income may result in penalties or additional taxes owed. It is essential to maintain accurate records and ensure that the information reported matches what is provided on the 1099-G form.

Obtaining Your 1099-G Form

If you did not receive your 1099-G form or need a replacement, you can obtain it through the issuing agency. Most states provide access to these forms online, allowing you to download and print a copy. Alternatively, you can contact the agency directly for assistance. Ensure that you have your personal information ready to expedite the process.

Quick guide on how to complete 2021 form 1098 t tuition statement

Complete Form 1098 T Tuition Statement effortlessly on any device

Managing documents online has gained signNow traction among organizations and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely store it on the web. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and seamlessly. Manage Form 1098 T Tuition Statement on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to edit and electronically sign Form 1098 T Tuition Statement without hassle

- Obtain Form 1098 T Tuition Statement and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious document searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form 1098 T Tuition Statement and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1098 t tuition statement

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1098 t tuition statement

How to create an e-signature for a PDF document in the online mode

How to create an e-signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an e-signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is a 1099g 2017 form?

The 1099g 2017 form is a tax document used to report certain government payments to the IRS, including unemployment compensation and state tax refunds. Businesses and individuals use it to report income received from government sources. Understanding the 1099g 2017 is crucial for accurate tax filing.

-

How can airSlate SignNow help me with 1099g 2017 forms?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending 1099g 2017 forms securely and efficiently. With its simple interface, you can prepare and share your tax documents without hassle. This streamlines the process of tax preparation for individuals and businesses alike.

-

Are there any additional features related to 1099g 2017 in airSlate SignNow?

Yes, airSlate SignNow offers features like customizable templates and document tracking for your 1099g 2017 forms. These tools help you manage your documents more effectively, ensuring that all parties can sign and receive their forms promptly. This convenience is essential during tax season.

-

Is airSlate SignNow cost-effective for handling 1099g 2017 forms?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses looking to manage documents, including 1099g 2017 forms. With competitive pricing and features tailored for business needs, it allows you to save time and money in your document management processes.

-

Can I integrate airSlate SignNow with other tools for 1099g 2017 processing?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enabling you to streamline your workflow for 1099g 2017 processing. This means you can connect it with accounting software or document management systems for enhanced efficiency. The integrations help centralize your tax documentation process.

-

What are the benefits of using airSlate SignNow for 1099g 2017 forms?

Using airSlate SignNow for 1099g 2017 forms ensures that you benefit from a secure, fast, and user-friendly platform for document management. E-signatures are legally binding, and the platform offers great visibility into document status. These advantages help ease the anxiety of tax preparation and compliance.

-

How secure is my information when using airSlate SignNow for 1099g 2017?

airSlate SignNow prioritizes the security of your information by employing industry-standard encryption and robust authentication methods. Your 1099g 2017 forms will be protected against unauthorized access, providing peace of mind as you manage important tax documents. Security is a critical feature we take very seriously.

Get more for Form 1098 T Tuition Statement

- Easement arizona form

- Arizona correction deed form

- Quitclaim deed from husband and wife to husband and wife arizona form

- Warranty deed from husband and wife to husband and wife arizona form

- Arizona irrevocable form

- Arizona property agreement form

- Postnuptial property agreement arizona arizona form

- Arizona property agreement 497296918 form

Find out other Form 1098 T Tuition Statement

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document