Form 941 X Rev July Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund 2021

What is the Form 941 X Rev July Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund

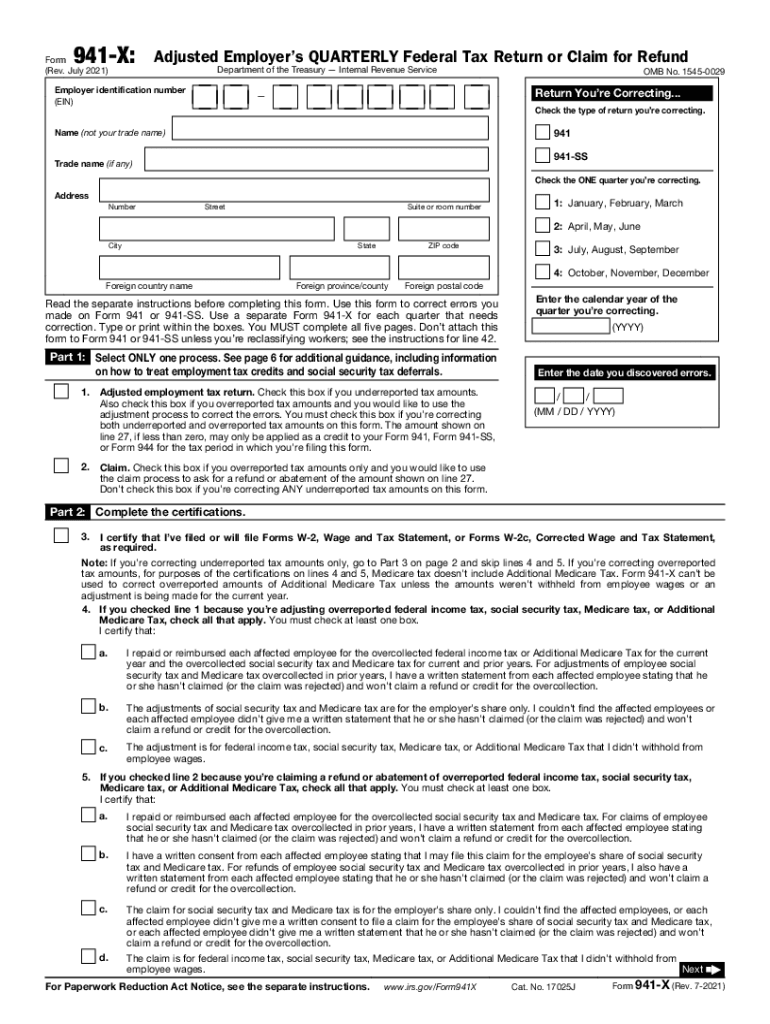

The Form 941 X, officially known as the Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund, is a tax form used by employers to correct errors made on previously filed Form 941 submissions. This form allows employers to amend their quarterly payroll tax filings, ensuring accurate reporting of withheld federal income taxes, Social Security, and Medicare taxes. It is essential for employers who need to rectify mistakes in their tax filings, whether due to miscalculations, incorrect employee information, or changes in tax liabilities.

How to use the Form 941 X Rev July Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund

Using the Form 941 X involves several key steps. First, you should gather all relevant information from your original Form 941 filings. Next, complete the 941 X by indicating the specific changes you are making, including the corrected amounts and the reasons for these adjustments. It is crucial to provide accurate information to avoid further complications. After completing the form, you must sign and date it before submitting it to the appropriate IRS address based on your location and the nature of your corrections.

Steps to complete the Form 941 X Rev July Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund

Completing the Form 941 X requires careful attention to detail. Follow these steps:

- Obtain a copy of the Form 941 X from the IRS website or through your tax professional.

- Review your previously filed Form 941 to identify the errors that need correction.

- Fill out the form, ensuring to clearly indicate the corrected amounts in the designated sections.

- Provide an explanation for each change in the space provided on the form.

- Sign and date the form, confirming that the information is accurate and complete.

- Mail the completed form to the appropriate IRS address, which can vary based on your location.

Filing Deadlines / Important Dates

When filing the Form 941 X, it is important to be aware of the deadlines. Generally, the form should be filed as soon as you discover an error in your original Form 941. However, there are specific time limits for claiming a refund or making adjustments. Typically, you have up to three years from the date you filed the original Form 941 to submit the 941 X for corrections. Keeping track of these deadlines helps ensure compliance and avoids potential penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 941 X. These guidelines detail the information required on the form, the process for making corrections, and the necessary documentation to support your claims. It is advisable to consult the IRS instructions for Form 941 X to ensure that you are following the most current procedures and requirements. Adhering to these guidelines helps prevent issues with the IRS and ensures that your corrections are processed smoothly.

Penalties for Non-Compliance

Failure to file the Form 941 X when necessary or submitting incorrect information can result in penalties from the IRS. These penalties may include fines for late filing, interest on unpaid taxes, and additional charges for inaccuracies. It is crucial for employers to take the necessary steps to correct any errors promptly to avoid these potential penalties. Understanding the implications of non-compliance can help motivate timely and accurate filings.

Quick guide on how to complete form 941 x rev july 2021 adjusted employers quarterly federal tax return or claim for refund

Prepare Form 941 X Rev July Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers a superb environmentally friendly option to conventional printed and signed documents, enabling you to obtain the necessary form and store it securely online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Form 941 X Rev July Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The most efficient way to edit and eSign Form 941 X Rev July Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund with ease

- Obtain Form 941 X Rev July Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that reason.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Form 941 X Rev July Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 x rev july 2021 adjusted employers quarterly federal tax return or claim for refund

Create this form in 5 minutes!

How to create an eSignature for the form 941 x rev july 2021 adjusted employers quarterly federal tax return or claim for refund

How to create an e-signature for your PDF file in the online mode

How to create an e-signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

How to generate an e-signature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

How to generate an e-signature for a PDF file on Android

People also ask

-

Where to mail 941x forms for corrections?

To properly correct your 941x forms, you need to mail them to the address listed on the form itself. Depending on your business location, the mailing address may vary, so it's essential to check the instructions. For detailed guidance, you can also visit the IRS website to confirm where to mail 941x based on your state.

-

What are the costs associated with sending 941x forms using airSlate SignNow?

The pricing for using airSlate SignNow can vary based on the plan you choose. With features that streamline the document workflow, investing in our service can save time and reduce the hassle associated with where to mail 941x forms. Our plans are designed to be cost-effective, catering to the needs of businesses of all sizes.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow offers various integrations with popular accounting software to ensure a seamless experience. By integrating your existing tools, you can easily manage documents and quickly find information on where to mail 941x forms. This boosts efficiency and keeps your processes organized.

-

What features does airSlate SignNow offer for managing 941x forms?

airSlate SignNow provides features like e-signatures, document templates, and workflow automation, making it easy to manage 941x forms. These tools help you efficiently organize your documents and minimize the time spent figuring out where to mail 941x forms. This means that you can focus more on your business and less on paperwork.

-

Is airSlate SignNow secure for submitting sensitive tax documents?

Yes, airSlate SignNow prioritizes the security of your sensitive tax documents. We use advanced encryption and security protocols to ensure your information is protected. This makes using our platform a safe choice when dealing with documents like the 941x forms and knowing exactly where to mail 941x.

-

How can I track the status of my submitted 941x forms?

With airSlate SignNow, you can easily track the status of your submitted 941x forms through our platform. You'll receive notifications upon document signing and submission, ensuring you have visibility into critical processes like where to mail 941x forms. This feature helps you stay informed and proactive.

-

What benefits does airSlate SignNow provide for e-signing 941x forms?

Using airSlate SignNow for e-signing 941x forms adds convenience and speed to your workflow. You won't have to worry about physical mail delays and can quickly execute important documents from anywhere. This means you can focus on ensuring you know where to mail 941x forms rather than dealing with cumbersome manual processes.

Get more for Form 941 X Rev July Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497304421 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement hawaii form

- Letter landlord rental form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants hawaii form

- Letter from tenant to landlord utility shut off notice to landlord due to tenant vacating premises hawaii form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat hawaii form

- Notice non compliance form

- Hawaii 45 day notice form

Find out other Form 941 X Rev July Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online