1120s K 1 Form 2016

What is the 1120S K-1 Form

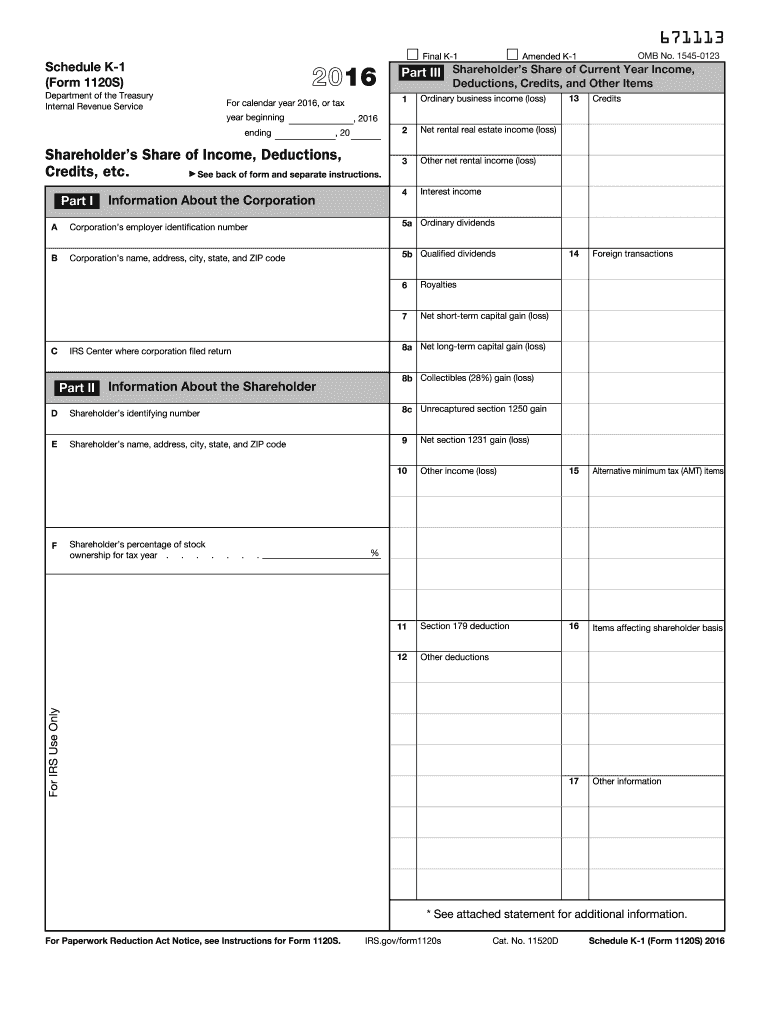

The 1120S K-1 Form is a tax document used by S corporations to report income, deductions, and credits to shareholders. Each shareholder receives a K-1 that details their share of the corporation's income, which they must report on their personal tax returns. This form is crucial for ensuring that all shareholders accurately report their income and pay the appropriate taxes on their share of the corporation's earnings.

How to Use the 1120S K-1 Form

To use the 1120S K-1 Form, shareholders must first receive their individual K-1 from the S corporation. Once received, shareholders should review the form for accuracy, ensuring that the reported amounts align with their expectations. The information on the K-1 must then be transferred to the shareholder's personal tax return, typically on Schedule E of Form 1040. It is important to keep a copy of the K-1 for personal records and future reference.

Steps to Complete the 1120S K-1 Form

Completing the 1120S K-1 Form involves several key steps:

- Gather necessary financial information from the S corporation, including income, deductions, and credits.

- Fill out the K-1 by entering the shareholder's name, address, and identifying information.

- Report the shareholder's share of income, deductions, and credits as provided by the S corporation.

- Double-check all entries for accuracy before distributing the K-1 to shareholders.

Legal Use of the 1120S K-1 Form

The 1120S K-1 Form is legally binding and must be completed in accordance with IRS regulations. It serves as a formal declaration of the income and deductions attributable to each shareholder. Accurate completion of the K-1 is essential to avoid penalties or audits by the IRS. Shareholders should ensure that the information reported on their K-1 matches their own records to maintain compliance with tax laws.

Filing Deadlines / Important Dates

For S corporations, the 1120S K-1 Form must be issued to shareholders by the due date of the S corporation's tax return, typically March 15 for calendar year filers. Shareholders must then report the information from the K-1 on their personal tax returns, which are due on April 15. It is crucial for both S corporations and shareholders to adhere to these deadlines to avoid late filing penalties.

Who Issues the Form

The 1120S K-1 Form is issued by the S corporation itself. The corporation is responsible for preparing and distributing the K-1 to each shareholder. This process ensures that each shareholder has the necessary information to accurately report their share of the corporation's income on their personal tax returns. It is advisable for shareholders to confirm receipt of their K-1 in a timely manner to facilitate their own tax filing process.

Quick guide on how to complete 2016 1120s k 1 form

Complete 1120s K 1 Form effortlessly on any device

Online document management has become increasingly popular among enterprises and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 1120s K 1 Form on any device utilizing the airSlate SignNow Android or iOS applications and enhance your document-centric processes today.

How to modify and eSign 1120s K 1 Form with ease

- Obtain 1120s K 1 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 1120s K 1 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 1120s k 1 form

Create this form in 5 minutes!

How to create an eSignature for the 2016 1120s k 1 form

How to create an eSignature for your 2016 1120s K 1 Form online

How to make an eSignature for the 2016 1120s K 1 Form in Google Chrome

How to create an electronic signature for signing the 2016 1120s K 1 Form in Gmail

How to make an eSignature for the 2016 1120s K 1 Form straight from your mobile device

How to make an electronic signature for the 2016 1120s K 1 Form on iOS

How to create an electronic signature for the 2016 1120s K 1 Form on Android

People also ask

-

What is the 1120s K 1 Form and why is it important?

The 1120s K 1 Form is a tax document used to report income, deductions, and credits from an S Corporation to its shareholders. It is essential for ensuring that shareholders accurately report their share of the corporation's income on their personal tax returns. Understanding how to complete the 1120s K 1 Form can help you avoid tax penalties and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with the 1120s K 1 Form process?

airSlate SignNow streamlines the process of preparing and signing the 1120s K 1 Form by allowing businesses to electronically send and eSign documents. This reduces the time spent on paperwork and minimizes errors associated with manual forms. With its user-friendly interface, airSlate SignNow helps you manage your tax documents efficiently.

-

Is airSlate SignNow suitable for preparing the 1120s K 1 Form?

Yes, airSlate SignNow is an excellent tool for preparing the 1120s K 1 Form. Its collaborative features enable multiple users to fill out and review the form seamlessly, ensuring accuracy before submission. The platform's robust security features also protect sensitive tax information throughout the process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Each plan includes features that can assist in managing documents like the 1120s K 1 Form. You can choose a plan that fits your budget and needs, ensuring you have access to the tools necessary for efficient document management.

-

Can I integrate airSlate SignNow with other accounting software for handling the 1120s K 1 Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage the 1120s K 1 Form alongside your other financial documents. This integration helps streamline your workflow, ensuring that all your tax documents are organized and easily accessible.

-

What are the benefits of using airSlate SignNow for tax documents like the 1120s K 1 Form?

Using airSlate SignNow for the 1120s K 1 Form offers numerous benefits, including faster processing times, reduced paperwork, and enhanced security. The platform allows for easy tracking of document status and ensures that signatures are obtained promptly. This can ultimately save you time and reduce stress during tax season.

-

How secure is the information shared when using airSlate SignNow for the 1120s K 1 Form?

airSlate SignNow prioritizes the security of your information, utilizing advanced encryption and secure cloud storage. When you handle sensitive documents like the 1120s K 1 Form, you can trust that your data is protected against unauthorized access. Regular security audits and compliance with industry standards further enhance the safety of your documents.

Get more for 1120s K 1 Form

- Phonebetcom form

- North carolina judicial department application for employment form

- Sf sac 2014 form

- Savable notice of appeal form

- Drdo vendor registration application form

- Exchange of infringement and invalidity contentions form

- Duns form

- Positive interventions and effective strategies riffel b2005b 1 bb form

Find out other 1120s K 1 Form

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple