Form 3520 2016

What is the Form 3520

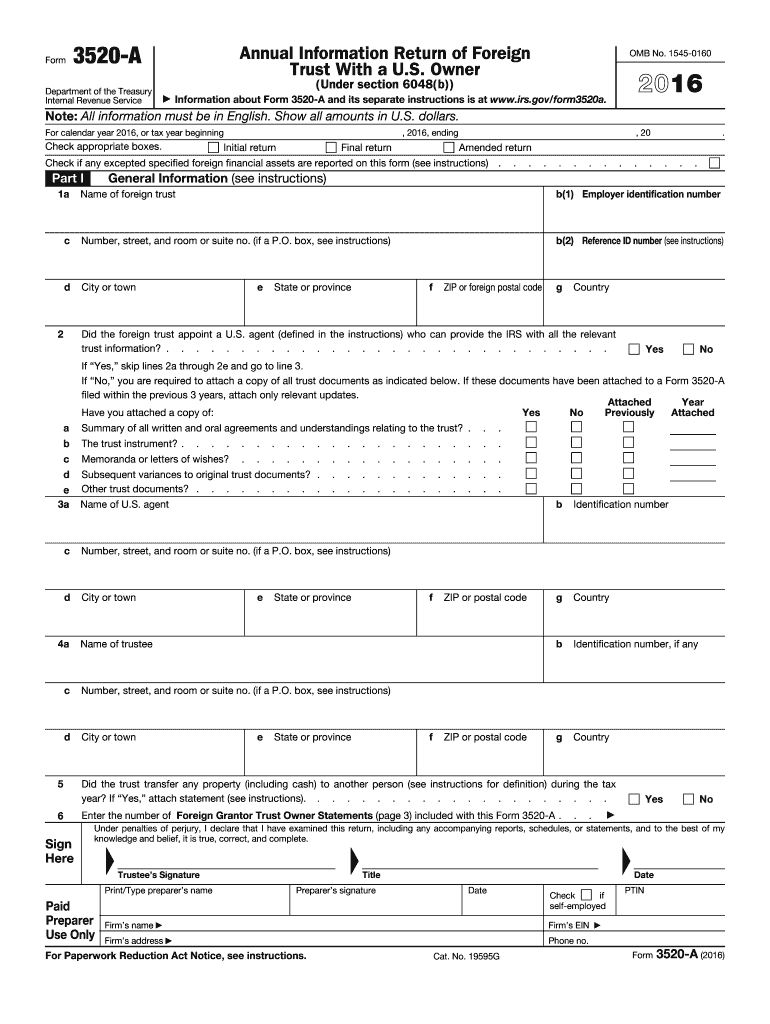

The Form 3520, officially known as the Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, is a tax form required by the Internal Revenue Service (IRS) in the United States. It is primarily used to report transactions involving foreign trusts, as well as to disclose certain foreign gifts received by U.S. taxpayers. This form is crucial for ensuring compliance with U.S. tax laws regarding foreign assets and gifts, helping to prevent tax evasion and maintain transparency in international financial dealings.

How to use the Form 3520

Using the Form 3520 involves accurately reporting any transactions with foreign trusts and disclosing foreign gifts. Taxpayers must fill out the form with detailed information about the trust or gifts, including the names of the foreign entities, the amounts involved, and the nature of the transactions. It is essential to ensure that all information is complete and accurate to avoid penalties. The form can be filed alongside your annual tax return or separately, depending on the specific circumstances surrounding the foreign trust or gift.

Steps to complete the Form 3520

Completing the Form 3520 requires several key steps:

- Gather necessary documentation, including details of the foreign trust and any gifts received.

- Fill out the form, providing information such as the name and address of the foreign trust, the amount of gifts, and any relevant dates.

- Review the completed form for accuracy and completeness, ensuring all required fields are filled.

- Submit the form by the due date, either electronically or via mail, depending on your filing preferences.

Filing Deadlines / Important Dates

The filing deadline for the Form 3520 is typically the same as the due date for your annual income tax return, including extensions. For most taxpayers, this means April 15. However, if you are filing for a foreign trust, the deadlines may vary. It is crucial to stay aware of these dates to avoid penalties for late submission. If the deadline falls on a weekend or holiday, it may be extended to the next business day.

Penalties for Non-Compliance

Failure to file the Form 3520, or filing it inaccurately, can lead to significant penalties. The IRS imposes a penalty of up to $10,000 for failing to report foreign gifts or transactions with foreign trusts. Additional penalties may apply for continued non-compliance or for inaccuracies in the information provided. Understanding these potential consequences is vital for any taxpayer dealing with foreign assets or gifts.

Required Documents

To complete the Form 3520, taxpayers must gather various documents, including:

- Records of the foreign trust, such as trust agreements and statements.

- Documentation of any gifts received from foreign sources, including the amount and nature of the gift.

- Taxpayer identification information, such as Social Security numbers or Employer Identification Numbers.

Legal use of the Form 3520

The legal use of the Form 3520 is defined by IRS regulations, which require U.S. taxpayers to report certain transactions with foreign trusts and gifts. This form serves as a tool for compliance, ensuring that taxpayers disclose relevant financial information. It is important to understand that the form must be filled out accurately and submitted on time to avoid legal repercussions, including fines and potential audits.

Quick guide on how to complete 2016 form 3520

Effortlessly Prepare Form 3520 on Any Device

Digital document management has gained traction among companies and individuals alike. It offers a superb eco-friendly substitute to conventional printed and signed documentation, as you can easily locate the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Form 3520 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The simplest method to modify and eSign Form 3520 with ease

- Find Form 3520 and click Obtain Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of your documents or redact sensitive content with features that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Complete button to save your changes.

- Select your preferred method to send your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 3520 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 3520

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 3520

How to make an electronic signature for your 2016 Form 3520 online

How to create an eSignature for your 2016 Form 3520 in Google Chrome

How to create an electronic signature for signing the 2016 Form 3520 in Gmail

How to generate an electronic signature for the 2016 Form 3520 straight from your smartphone

How to make an eSignature for the 2016 Form 3520 on iOS devices

How to make an electronic signature for the 2016 Form 3520 on Android

People also ask

-

What is Form 3520 and why is it important?

Form 3520 is an IRS form required for reporting certain transactions with foreign trusts, as well as the receipt of certain foreign gifts. Understanding Form 3520 is crucial for compliance with U.S. tax laws, helping individuals and businesses avoid penalties and ensure proper reporting of foreign financial interests.

-

How can airSlate SignNow help with Form 3520?

airSlate SignNow simplifies the process of managing and eSigning Form 3520 by providing a user-friendly platform that allows you to easily fill out, send, and sign documents electronically. This ensures that your Form 3520 is completed accurately and submitted on time, reducing potential filing errors.

-

What features does airSlate SignNow offer for managing Form 3520?

airSlate SignNow offers features like customizable templates, secure eSigning, and automated workflows that streamline the management of Form 3520. These tools not only enhance efficiency but also ensure that all necessary information is captured accurately.

-

Is there a cost associated with using airSlate SignNow for Form 3520?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan includes features that support the management of Form 3520, ensuring that users can find a cost-effective solution that fits their budget.

-

Can I integrate airSlate SignNow with my existing software for Form 3520?

Absolutely! airSlate SignNow provides integrations with popular business applications, allowing you to seamlessly manage Form 3520 alongside your other documents and processes. This helps streamline your workflow and ensures that all your forms are easily accessible.

-

What benefits will I gain by using airSlate SignNow for Form 3520?

Using airSlate SignNow for Form 3520 provides numerous benefits, including enhanced document security, faster turnaround times, and improved accuracy. The platform's intuitive design makes it easy for users to navigate, ensuring a hassle-free experience when handling important tax documents.

-

Is airSlate SignNow compliant with eSigning regulations for Form 3520?

Yes, airSlate SignNow complies with all eSigning regulations, ensuring that your Form 3520 is legally binding and recognized by the IRS. This compliance provides peace of mind, allowing you to focus on your business while managing your tax obligations efficiently.

Get more for Form 3520

Find out other Form 3520

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form