Form 2441 2016

What is the Form 2441

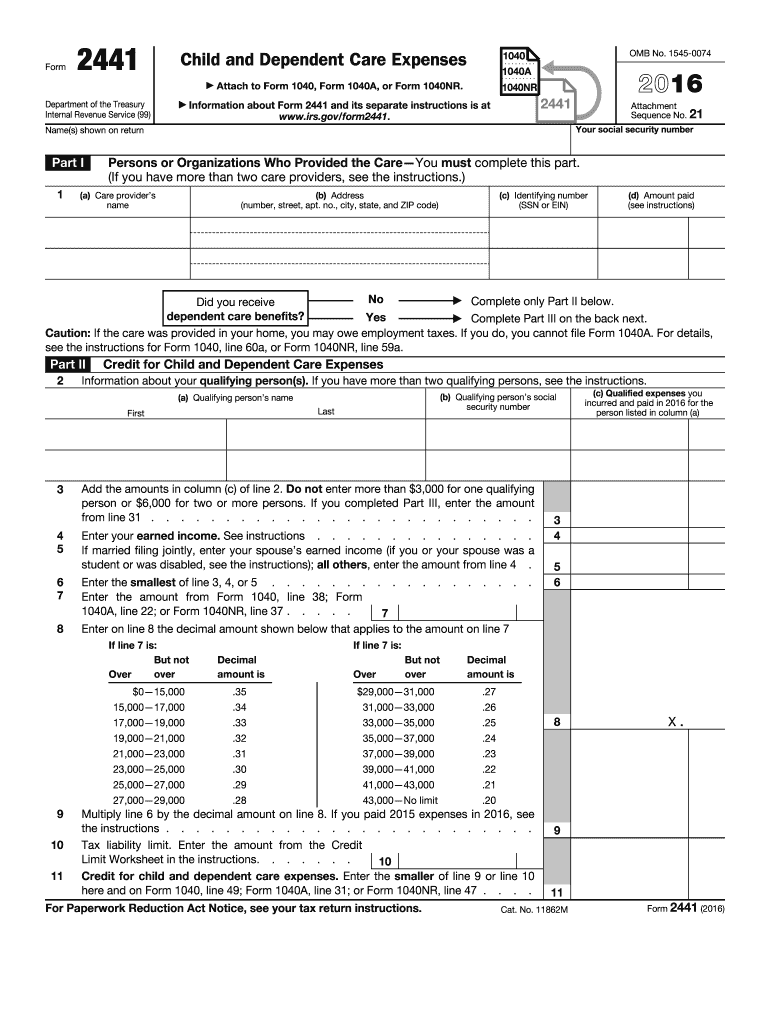

The Form 2441, titled "Child and Dependent Care Expenses," is a tax form used by taxpayers in the United States to claim a credit for expenses incurred while caring for qualifying children or dependents. This form is essential for individuals who have paid for care that allows them to work or look for work. The credit can help reduce the overall tax liability, making it a valuable resource for eligible taxpayers.

How to use the Form 2441

To effectively use the Form 2441, taxpayers must first gather all necessary information regarding their dependent care expenses. This includes the names and addresses of care providers, the amounts paid for care, and the details of the qualifying individuals. After completing the form, it should be attached to the taxpayer's federal income tax return, typically Form 1040. Accurate completion ensures that the taxpayer receives the appropriate credit for their expenses.

Steps to complete the Form 2441

Completing the Form 2441 involves several key steps:

- Gather necessary documentation, including receipts and provider information.

- Fill out personal information, including the taxpayer's name and Social Security number.

- Provide details about the qualifying individuals, including their names and ages.

- List the care provider's information and the total amount paid for care.

- Calculate the credit based on the provided expenses and complete the form.

After ensuring all information is accurate, the form should be submitted with the tax return.

Legal use of the Form 2441

The legal use of Form 2441 requires adherence to IRS guidelines regarding eligibility and qualifying expenses. Taxpayers must ensure that the care provided meets the IRS definition of qualifying care, which typically includes expenses for daycare, babysitters, and other care services. Failure to comply with these guidelines can result in disqualification from claiming the credit.

Filing Deadlines / Important Dates

Form 2441 must be filed by the same deadline as the taxpayer's federal income tax return. Typically, this deadline is April 15 for most taxpayers. However, if a taxpayer files for an extension, they may have until October 15 to submit their return, including Form 2441. It is crucial to adhere to these deadlines to avoid penalties and ensure the timely processing of tax credits.

Eligibility Criteria

To be eligible to claim the credit on Form 2441, taxpayers must meet specific criteria, including:

- Having a qualifying child or dependent under the age of 13.

- Incurring expenses for care that enables the taxpayer to work or look for work.

- Meeting income limits set by the IRS, which can affect the amount of credit received.

Understanding these eligibility requirements is essential for taxpayers to ensure they can successfully claim the credit.

Quick guide on how to complete form 2441 2016

Prepare Form 2441 seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Form 2441 on any platform with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to alter and electronically sign Form 2441 effortlessly

- Locate Form 2441 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides for this specific function.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal importance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Form 2441 and guarantee exceptional communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2441 2016

Create this form in 5 minutes!

How to create an eSignature for the form 2441 2016

How to create an eSignature for your Form 2441 2016 online

How to generate an eSignature for your Form 2441 2016 in Chrome

How to create an eSignature for signing the Form 2441 2016 in Gmail

How to create an eSignature for the Form 2441 2016 right from your smartphone

How to make an eSignature for the Form 2441 2016 on iOS devices

How to generate an electronic signature for the Form 2441 2016 on Android devices

People also ask

-

What is Form 2441 and how can airSlate SignNow help with it?

Form 2441 is used to claim the Child and Dependent Care Expenses Credit on your tax return. With airSlate SignNow, you can easily eSign and send Form 2441 to clients or colleagues, ensuring a smooth and secure process for managing essential tax documents.

-

Is airSlate SignNow suitable for completing Form 2441?

Absolutely! airSlate SignNow provides a user-friendly platform for filling out and eSigning Form 2441. Our solution ensures that you can complete your tax documents efficiently while maintaining compliance with all necessary regulations.

-

How much does it cost to use airSlate SignNow for Form 2441?

airSlate SignNow offers various pricing plans to fit different business needs. Whether you need basic features for occasional use of Form 2441 or advanced tools for frequent document handling, our pricing is designed to be cost-effective for everyone.

-

Can I integrate airSlate SignNow with my existing software for Form 2441 processing?

Yes, airSlate SignNow seamlessly integrates with numerous applications, allowing you to streamline your workflow for processing Form 2441. This means you can manage your documents directly from your preferred platforms without any hassle.

-

What features does airSlate SignNow offer for managing Form 2441?

airSlate SignNow includes features like document templates, eSignature capabilities, and secure storage, all tailored for forms like Form 2441. These tools help you complete your tax documentation accurately and efficiently.

-

Is it easy to share Form 2441 with clients using airSlate SignNow?

Yes, sharing Form 2441 with clients is straightforward using airSlate SignNow. You can send the document directly via email or share a secure link, making collaboration simple and effective.

-

What benefits does using airSlate SignNow provide for handling Form 2441?

Using airSlate SignNow for Form 2441 offers numerous benefits, including enhanced security, faster turnaround times, and reduced paperwork. Our platform simplifies the eSigning process, allowing you to focus on your business while ensuring compliance.

Get more for Form 2441

- Coca cola product request university of oklahoma ou form

- Eli lilly matching form

- Ttb 5154 2 2007 form

- Motion to file notice concerning fiduciary relationship form

- Form sc1041es state of south carolina department sctax

- Certificate iv in accounting and bookkeeping tafe gippsland form

- Ncea commission on accreditation coa the ncea certified nceacertified form

- Skincare training amp continuing educationpro skin care form

Find out other Form 2441

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself