Form 3520 2016

What is the Form 3520

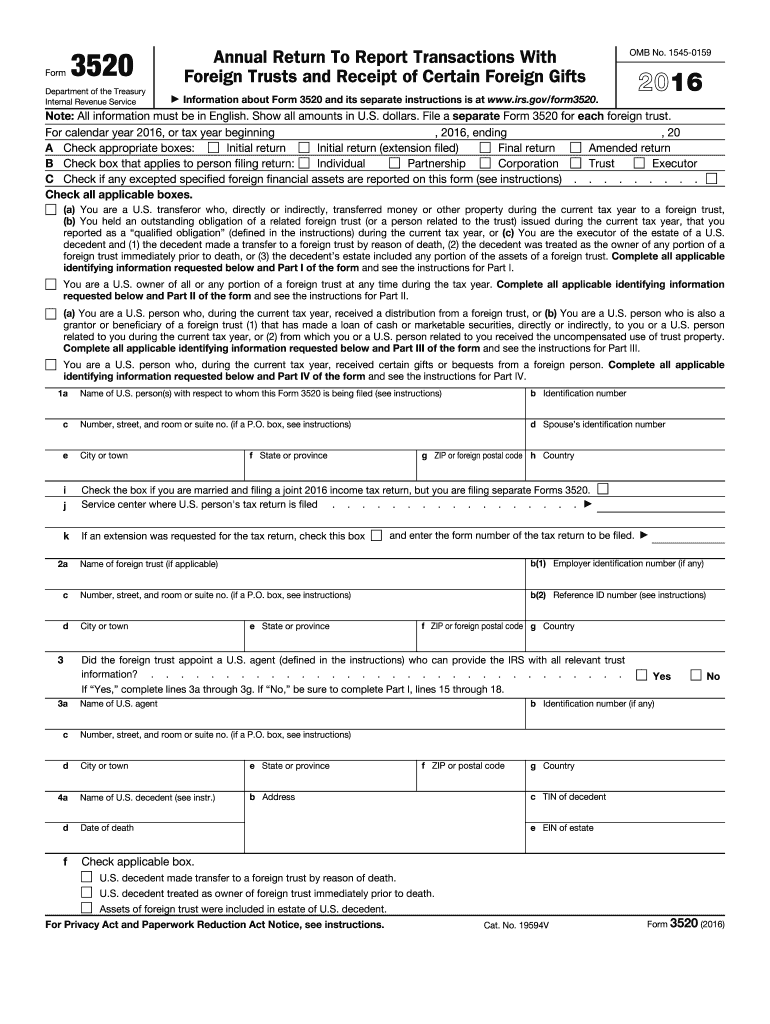

The Form 3520 is an important tax document used by U.S. taxpayers to report certain transactions with foreign trusts, the receipt of foreign gifts, and the transfer of assets to foreign entities. This form is primarily required by the Internal Revenue Service (IRS) and serves to ensure compliance with U.S. tax laws regarding foreign financial interests. Understanding the purpose of Form 3520 is crucial for individuals who have international financial dealings, as it helps avoid potential penalties associated with non-compliance.

How to use the Form 3520

Using Form 3520 involves several steps to ensure accurate reporting. Taxpayers must first determine whether they need to file the form based on their financial activities. If required, they should gather all relevant information, including details about foreign trusts, gifts received, and any transfers made. The form can be filled out using tax software or manually, ensuring that all sections are completed accurately. Once completed, the form must be submitted to the IRS by the designated deadline.

Steps to complete the Form 3520

Completing Form 3520 requires careful attention to detail. Here are the essential steps:

- Identify the need to file based on your financial circumstances.

- Gather necessary documents, such as records of foreign gifts, trust information, and asset transfers.

- Fill out the form, ensuring all required sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form to the IRS by the appropriate deadline.

Legal use of the Form 3520

The legal use of Form 3520 is governed by IRS regulations, which stipulate that it must be filed to report specific transactions involving foreign entities. Failure to file this form when required can result in significant penalties. It is essential for taxpayers to understand the legal implications of their financial activities and ensure compliance with all reporting requirements to avoid legal issues.

Filing Deadlines / Important Dates

Form 3520 has specific filing deadlines that taxpayers must adhere to. Generally, the form is due on the same date as the taxpayer's income tax return, including extensions. For most individuals, this means it is due on April 15, with an extension available until October 15. However, if the taxpayer is outside the United States on the due date, they may qualify for additional time to file. It is crucial to stay informed about these deadlines to avoid penalties.

Penalties for Non-Compliance

Non-compliance with Form 3520 filing requirements can lead to severe penalties. The IRS imposes fines for failing to file the form or for filing it late. These penalties can be substantial, often amounting to a percentage of the unreported foreign assets or gifts. Understanding these potential penalties underscores the importance of timely and accurate filing to protect against financial repercussions.

Quick guide on how to complete form 3520 2016

Accomplish Form 3520 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed materials, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Form 3520 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign Form 3520 effortlessly

- Locate Form 3520 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 3520 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3520 2016

Create this form in 5 minutes!

How to create an eSignature for the form 3520 2016

How to generate an electronic signature for the Form 3520 2016 in the online mode

How to generate an eSignature for your Form 3520 2016 in Chrome

How to create an eSignature for putting it on the Form 3520 2016 in Gmail

How to generate an electronic signature for the Form 3520 2016 right from your mobile device

How to generate an eSignature for the Form 3520 2016 on iOS

How to create an eSignature for the Form 3520 2016 on Android OS

People also ask

-

What is Form 3520 and why is it important?

Form 3520 is an IRS document that individuals must file if they receive certain foreign gifts or inheritances. It's crucial for compliance with U.S. tax laws, as failing to file can result in signNow penalties. Understanding how to fill out Form 3520 correctly can help avoid these issues.

-

How does airSlate SignNow help with submitting Form 3520?

airSlate SignNow simplifies the process of signing and sending Form 3520 electronically. Our platform allows users to eSign documents securely, ensuring that your Form 3520 is not only completed correctly but also submitted on time. With airSlate SignNow, you can manage all your important documents efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 3520?

Yes, airSlate SignNow offers several pricing plans tailored to fit different business needs. We provide a cost-effective solution for sending and eSigning Form 3520, with options for individuals and businesses alike. You can choose a plan that best suits your volume of documents and features required.

-

What features does airSlate SignNow offer for handling Form 3520?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all designed to facilitate the preparation and submission of Form 3520. Additionally, our intuitive interface makes it easy to manage multiple forms and ensure compliance with IRS regulations.

-

Can I integrate airSlate SignNow with other software for Form 3520 management?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your ability to manage Form 3520 and other documents seamlessly. You can connect our platform with tools like CRM systems, accounting software, and more to streamline your workflow.

-

What benefits does airSlate SignNow provide for businesses dealing with Form 3520?

Using airSlate SignNow for Form 3520 offers numerous benefits, including time savings, improved accuracy, and enhanced security for sensitive information. Our electronic signature solution reduces the hassle of paper documents, enabling faster processing and compliance with IRS requirements.

-

Is airSlate SignNow secure for sending sensitive documents like Form 3520?

Absolutely! airSlate SignNow prioritizes security with industry-leading encryption and compliance with e-signature laws. When you send Form 3520 through our platform, you can trust that your data is protected, ensuring confidentiality and integrity.

Get more for Form 3520

Find out other Form 3520

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy