Form 8854 Initial and Annual Expatriation Statement 2016

What is the Form 8854 Initial And Annual Expatriation Statement

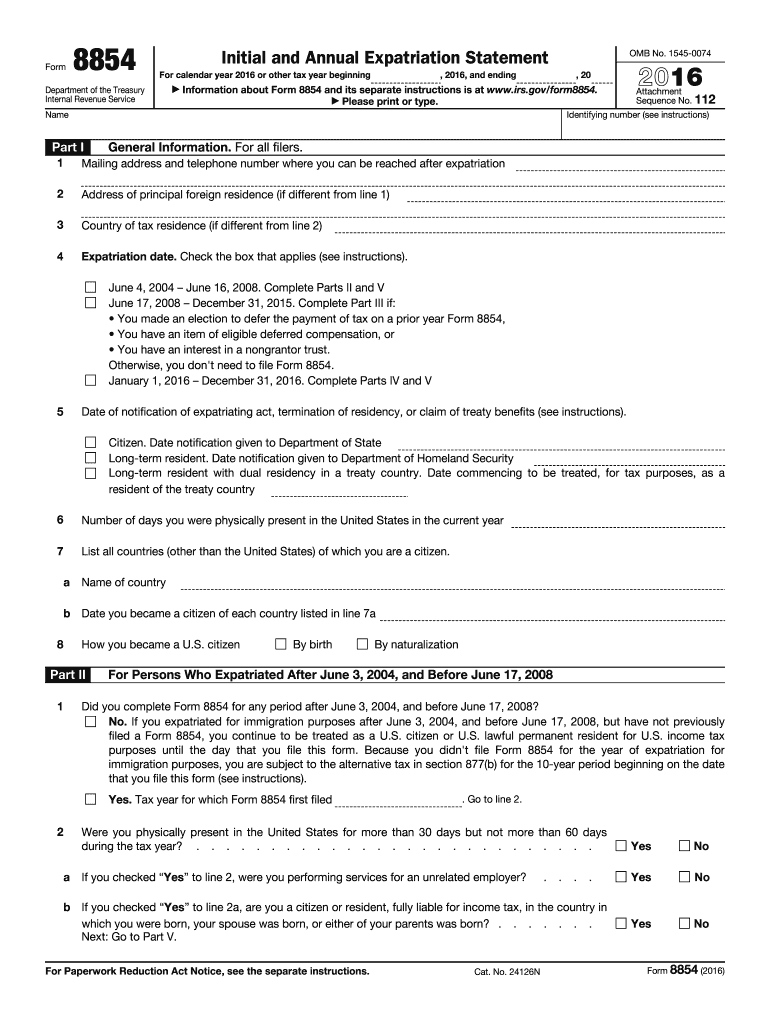

The Form 8854 Initial and Annual Expatriation Statement is a crucial document for U.S. citizens and long-term residents who are planning to renounce their citizenship or terminate their residency. This form is used to report expatriation to the Internal Revenue Service (IRS) and to determine whether the individual is subject to the exit tax. It includes information about the individual's assets, liabilities, and tax obligations at the time of expatriation. Understanding the requirements and implications of this form is essential for anyone considering expatriation.

Steps to complete the Form 8854 Initial And Annual Expatriation Statement

Completing the Form 8854 involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary financial information, including details about assets, liabilities, and income sources. Next, fill out the form by providing personal information, including your name, address, and taxpayer identification number. It is important to accurately report your net worth and any tax obligations. Finally, review the completed form for any errors before submitting it to the IRS, either electronically or by mail.

Filing Deadlines / Important Dates

Timely filing of the Form 8854 is critical to avoid penalties. The form must be submitted on or before the due date of your tax return for the year in which you expatriate. If you renounce your citizenship or terminate your residency, the deadline is typically April fifteenth of the following year. It is advisable to check for any updates on deadlines or extensions that may apply, especially if expatriation occurs close to tax season.

Legal use of the Form 8854 Initial And Annual Expatriation Statement

The Form 8854 serves a legal purpose in documenting the expatriation process for U.S. citizens and long-term residents. Proper completion and submission of this form help establish compliance with U.S. tax laws and can protect individuals from future tax liabilities. The form must be filed accurately to avoid potential legal repercussions, including penalties for non-compliance. Understanding the legal implications of the form is essential for anyone undergoing the expatriation process.

Required Documents

When completing the Form 8854, certain documents are necessary to support the information provided. These may include tax returns for the previous five years, documentation of assets and liabilities, and proof of citizenship or residency status. Having these documents ready can streamline the process and ensure that the form is filled out correctly. It is important to retain copies of all submitted documents for your records.

Penalties for Non-Compliance

Failure to file the Form 8854 or inaccuracies in the information provided can result in significant penalties. The IRS may impose an initial penalty of $10,000 for not filing the form, and additional penalties may apply if the failure continues. Moreover, not complying with the expatriation requirements can lead to being treated as a covered expatriate, which carries tax implications. Understanding these penalties can help individuals take the necessary steps to ensure compliance.

Quick guide on how to complete 2016 form 8854 initial and annual expatriation statement

Accomplish Form 8854 Initial And Annual Expatriation Statement effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents promptly without any holdups. Manage Form 8854 Initial And Annual Expatriation Statement on any device with airSlate SignNow Android or iOS applications and streamline your document-related process today.

How to alter and eSign Form 8854 Initial And Annual Expatriation Statement with ease

- Locate Form 8854 Initial And Annual Expatriation Statement and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8854 Initial And Annual Expatriation Statement and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 8854 initial and annual expatriation statement

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 8854 initial and annual expatriation statement

How to make an eSignature for your 2016 Form 8854 Initial And Annual Expatriation Statement in the online mode

How to generate an electronic signature for the 2016 Form 8854 Initial And Annual Expatriation Statement in Google Chrome

How to generate an eSignature for signing the 2016 Form 8854 Initial And Annual Expatriation Statement in Gmail

How to generate an electronic signature for the 2016 Form 8854 Initial And Annual Expatriation Statement right from your mobile device

How to make an electronic signature for the 2016 Form 8854 Initial And Annual Expatriation Statement on iOS

How to make an eSignature for the 2016 Form 8854 Initial And Annual Expatriation Statement on Android devices

People also ask

-

What is the Form 8854 Initial And Annual Expatriation Statement?

The Form 8854 Initial And Annual Expatriation Statement is a tax document required by the IRS for individuals who are expatriating from the United States. This form is crucial for reporting your tax obligations and ensuring compliance with U.S. tax laws after renouncing your citizenship or terminating your long-term residency.

-

Why do I need to file Form 8854 Initial And Annual Expatriation Statement?

Filing the Form 8854 Initial And Annual Expatriation Statement is essential for understanding your tax implications upon expatriation. This form helps the IRS determine if you owe any exit taxes and ensures that you meet your tax responsibilities, thus avoiding potential penalties.

-

How does airSlate SignNow help with the Form 8854 Initial And Annual Expatriation Statement?

airSlate SignNow provides a streamlined solution for electronically signing and managing your Form 8854 Initial And Annual Expatriation Statement. Our platform ensures that you can send, receive, and securely store your documents, making the process efficient and compliant with legal requirements.

-

What features does airSlate SignNow offer for managing the Form 8854 Initial And Annual Expatriation Statement?

With airSlate SignNow, you can easily create, edit, and eSign your Form 8854 Initial And Annual Expatriation Statement. The platform includes features like templates, audit trails, and cloud storage, ensuring that your documents are accessible and secure throughout the signing process.

-

Is there a cost associated with using airSlate SignNow for the Form 8854 Initial And Annual Expatriation Statement?

Yes, airSlate SignNow offers various pricing plans tailored to fit different needs, ensuring an affordable solution for managing your Form 8854 Initial And Annual Expatriation Statement. Each plan includes features that enhance document management and eSigning capabilities, making it a cost-effective choice.

-

Can I integrate airSlate SignNow with other applications for handling the Form 8854 Initial And Annual Expatriation Statement?

Absolutely! airSlate SignNow offers integrations with numerous applications, allowing you to streamline your workflow when handling the Form 8854 Initial And Annual Expatriation Statement. This includes popular platforms for accounting, document management, and CRM systems.

-

What benefits does airSlate SignNow provide when dealing with the Form 8854 Initial And Annual Expatriation Statement?

Using airSlate SignNow for your Form 8854 Initial And Annual Expatriation Statement ensures that you save time and reduce stress during the signing process. Our user-friendly interface, combined with robust security features, provides peace of mind and efficiency when managing important documents.

Get more for Form 8854 Initial And Annual Expatriation Statement

- Acf performance progress report acf ogm sf ppr

- Request for taxpayer identification number and certification corporate rfmh form

- Notifiable disease condition report form gachd

- Fedex claim form

- Otda 4938 form otda ny

- Minnesota new hire reporting form

- Minnesota dept of transportation instructions for completing form

- Mn uniform practitioner form

Find out other Form 8854 Initial And Annual Expatriation Statement

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure