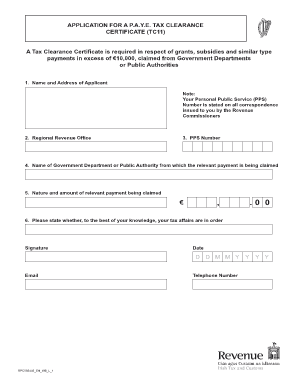

Application for a PAYE Tax Clearance Certificate TC11 Application for a PAYE Tax Clearance Certificate TC11 Revenue Form

What is the Application For A PAYE Tax Clearance Certificate TC11?

The Application For A PAYE Tax Clearance Certificate TC11 is a form utilized by employers in the United States to confirm that they are compliant with their tax obligations under the Pay As You Earn (PAYE) system. This certificate verifies that an employer has met all necessary tax payments and is essential for businesses seeking to engage in contracts or transactions that require proof of tax compliance. Obtaining this certificate is crucial for maintaining good standing with tax authorities and ensuring eligibility for various business opportunities.

Steps to Complete the Application For A PAYE Tax Clearance Certificate TC11

Completing the Application For A PAYE Tax Clearance Certificate TC11 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your Employer Identification Number (EIN), business details, and tax payment history. Next, fill out the application form with accurate data, ensuring that all sections are completed. After completing the form, review it for any errors or omissions. Finally, submit the application through the designated method, which may include online submission or mailing the physical form to the appropriate tax authority.

Required Documents for the Application For A PAYE Tax Clearance Certificate TC11

When applying for the PAYE Tax Clearance Certificate TC11, several documents may be required to support your application. These typically include:

- Your Employer Identification Number (EIN).

- Proof of tax payments made under the PAYE system.

- Financial statements or records that demonstrate compliance with tax obligations.

- Any prior correspondence with tax authorities related to your tax status.

Having these documents ready can expedite the application process and help ensure that your request is processed without delays.

How to Obtain the Application For A PAYE Tax Clearance Certificate TC11

To obtain the Application For A PAYE Tax Clearance Certificate TC11, you can typically access the form through the website of your local tax authority or the IRS. Many jurisdictions provide the form in a downloadable format, allowing you to print and fill it out. Additionally, some states may offer an online application process, enabling you to submit your request electronically. It is important to check the specific requirements and submission methods for your state to ensure compliance.

Legal Use of the Application For A PAYE Tax Clearance Certificate TC11

The Application For A PAYE Tax Clearance Certificate TC11 serves a legal purpose by providing proof of tax compliance. This certificate is often required when bidding for government contracts, applying for loans, or engaging in business transactions that necessitate verification of tax status. The legal framework surrounding this certificate ensures that businesses maintain transparency and accountability in their tax obligations, thereby fostering trust within the business community and with regulatory authorities.

Eligibility Criteria for the Application For A PAYE Tax Clearance Certificate TC11

Eligibility for the Application For A PAYE Tax Clearance Certificate TC11 generally requires that the employer is in good standing with their tax obligations. This includes having no outstanding tax liabilities, filing all required tax returns on time, and making all necessary payments under the PAYE system. Employers must also ensure that they have complied with any additional state-specific regulations that may apply to their business operations.

Quick guide on how to complete application for a paye tax clearance certificate tc11 application for a paye tax clearance certificate tc11 revenue

Complete Application For A PAYE Tax Clearance Certificate TC11 Application For A PAYE Tax Clearance Certificate TC11 Revenue seamlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Application For A PAYE Tax Clearance Certificate TC11 Application For A PAYE Tax Clearance Certificate TC11 Revenue on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Application For A PAYE Tax Clearance Certificate TC11 Application For A PAYE Tax Clearance Certificate TC11 Revenue effortlessly

- Locate Application For A PAYE Tax Clearance Certificate TC11 Application For A PAYE Tax Clearance Certificate TC11 Revenue and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and bears the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your method of submitting your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Application For A PAYE Tax Clearance Certificate TC11 Application For A PAYE Tax Clearance Certificate TC11 Revenue and ensure top-notch communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for a paye tax clearance certificate tc11 application for a paye tax clearance certificate tc11 revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For A PAYE Tax Clearance Certificate TC11?

The Application For A PAYE Tax Clearance Certificate TC11 is a formal request to Revenue for a tax clearance certificate under the PAYE (Pay As You Earn) system. This certificate confirms that an individual or entity has no outstanding tax liabilities. Utilizing airSlate SignNow, you can easily send and eSign your application for efficiency and compliance.

-

How can I submit the Application For A PAYE Tax Clearance Certificate TC11 using airSlate SignNow?

Submitting the Application For A PAYE Tax Clearance Certificate TC11 through airSlate SignNow is straightforward. Simply upload your completed application, add eSignatures where needed, and send it securely to the appropriate Revenue authority. Our platform simplifies the entire process, ensuring your documents are handled promptly and professionally.

-

What are the benefits of using airSlate SignNow for my Application For A PAYE Tax Clearance Certificate TC11?

Using airSlate SignNow for your Application For A PAYE Tax Clearance Certificate TC11 offers several benefits. It streamlines the document signing process, saves time, and eliminates paperwork. Additionally, you can track the status of your application in real-time, ensuring that you never miss an important deadline.

-

Is there a cost associated with filing the Application For A PAYE Tax Clearance Certificate TC11 via airSlate SignNow?

Yes, airSlate SignNow operates on a subscription basis, allowing you to file your Application For A PAYE Tax Clearance Certificate TC11 at a competitive price. Various plans are available to fit different business sizes and needs. This investment streamlines your documentation process, ultimately saving you both time and money.

-

Can the Application For A PAYE Tax Clearance Certificate TC11 be integrated with other software?

Absolutely! airSlate SignNow supports integrations with various software platforms, making it easy to incorporate the Application For A PAYE Tax Clearance Certificate TC11 into your existing workflow. This allows you to automate processes and enhance productivity while maintaining compliance with Revenue requirements.

-

What features does airSlate SignNow offer for the Application For A PAYE Tax Clearance Certificate TC11?

airSlate SignNow provides several features for the Application For A PAYE Tax Clearance Certificate TC11, including customizable templates, secure eSigning, and comprehensive tracking. These tools ensure that your applications are accurate and submitted timely, while also protecting sensitive information through advanced security measures.

-

How long does it take to receive the Application For A PAYE Tax Clearance Certificate TC11 approval?

The processing time for the Application For A PAYE Tax Clearance Certificate TC11 varies depending on several factors, including Revenue's workload. However, using airSlate SignNow can expedite the submission process, ensuring your application signNowes the right hands without unnecessary delays. Generally, you can expect to hear back within a few days to weeks after submission.

Get more for Application For A PAYE Tax Clearance Certificate TC11 Application For A PAYE Tax Clearance Certificate TC11 Revenue

Find out other Application For A PAYE Tax Clearance Certificate TC11 Application For A PAYE Tax Clearance Certificate TC11 Revenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors