Template Hmrc Tax Declaration Format

What is the Template Hmrc Tax Declaration Format

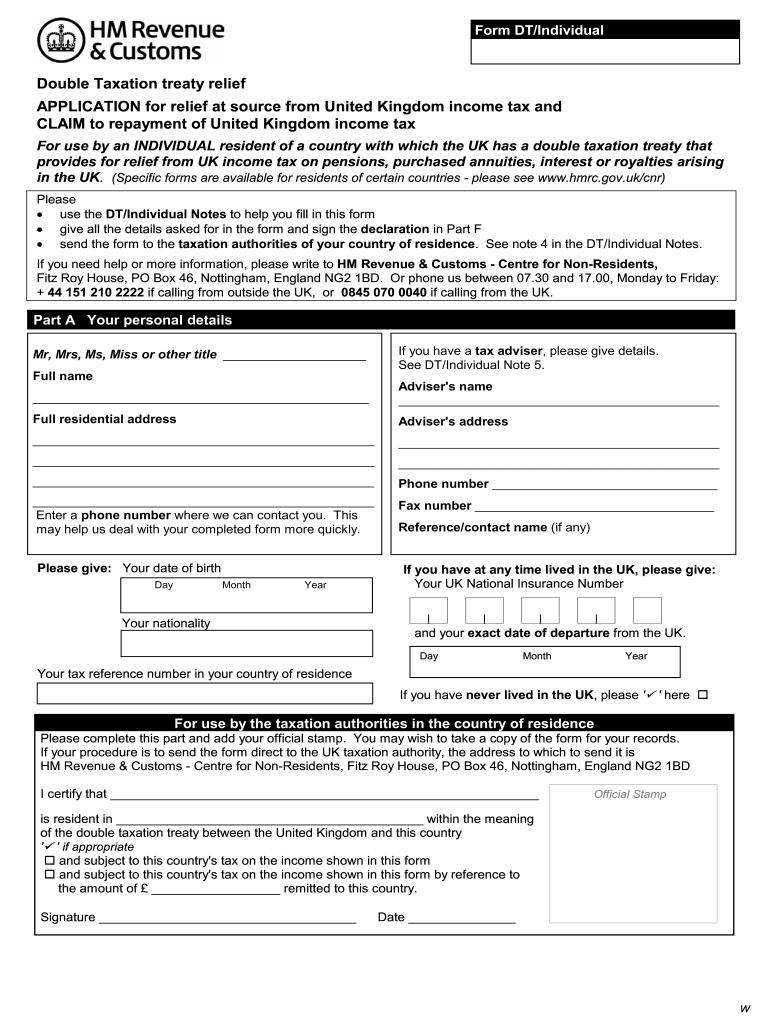

The Template Hmrc Tax Declaration Format is a standardized document used by taxpayers in the United Kingdom to report their income and calculate their tax obligations. This form is essential for individuals and businesses to ensure compliance with tax regulations. It typically includes sections for personal information, income details, deductions, and tax credits. Understanding this format is crucial for accurate tax reporting and to avoid potential penalties.

Steps to complete the Template Hmrc Tax Declaration Format

Completing the Template Hmrc Tax Declaration Format involves several key steps to ensure accuracy and compliance:

- Gather necessary documents: Collect all relevant financial documents, including income statements, receipts for deductions, and previous tax returns.

- Fill in personal information: Enter your name, address, and National Insurance number at the top of the form.

- Report income: Detail all sources of income, including wages, self-employment earnings, and investment income. Ensure that all figures are accurate and supported by documentation.

- Claim deductions: Identify eligible deductions, such as business expenses or charitable contributions, and enter them in the appropriate sections.

- Calculate tax liability: Use the provided tax tables or calculators to determine your tax liability based on your reported income and deductions.

- Review and sign: Double-check all entries for accuracy and completeness before signing the declaration.

Legal use of the Template Hmrc Tax Declaration Format

The legal use of the Template Hmrc Tax Declaration Format is governed by tax laws in the United Kingdom. This form must be completed accurately and submitted by the specified deadlines to avoid penalties. Electronic submissions are accepted, provided they comply with the relevant legal frameworks. It is essential to keep a copy of the submitted form and any supporting documents for your records, as they may be required for future reference or audits.

IRS Guidelines

While the Template Hmrc Tax Declaration Format is specific to the UK, understanding IRS guidelines can be beneficial for U.S. taxpayers who may also have obligations in the UK. The IRS provides comprehensive resources regarding international tax obligations, including how to report foreign income and claim foreign tax credits. Familiarity with these guidelines can help ensure compliance with both U.S. and UK tax laws.

Required Documents

To complete the Template Hmrc Tax Declaration Format, several documents are typically required:

- Income statements from employers or clients.

- Bank statements showing interest income.

- Receipts for deductible expenses.

- Previous year's tax return for reference.

- Any documentation related to tax credits.

Filing Deadlines / Important Dates

Filing deadlines for the Template Hmrc Tax Declaration Format are crucial for compliance. Generally, the deadline for submitting paper forms is October 31, while electronic submissions are due by January 31 of the following year. It is important to be aware of these dates to avoid late fees and penalties. Marking these dates on your calendar can help ensure timely submission.

Quick guide on how to complete template hmrc tax declaration format

Complete Template Hmrc Tax Declaration Format seamlessly on any device

Digital document management has gained traction among enterprises and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can obtain the proper format and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents quickly and without delays. Manage Template Hmrc Tax Declaration Format on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Template Hmrc Tax Declaration Format with ease

- Locate Template Hmrc Tax Declaration Format and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, laborious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Template Hmrc Tax Declaration Format and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the template hmrc tax declaration format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax declaration sample?

A tax declaration sample is a sample document that outlines how taxpayers report their income and eligible deductions to the tax authorities. Utilizing a tax declaration sample can help you understand the structure and content needed for your own declaration, making the filing process smoother.

-

How can airSlate SignNow assist with tax declaration samples?

airSlate SignNow provides a platform where you can easily create, send, and eSign tax declaration samples. By using our intuitive interface, you can customize your sample document to ensure it meets your specific tax reporting requirements.

-

Are there any costs associated with using airSlate SignNow for tax declaration samples?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. These plans provide access to features that include creating and managing tax declaration samples effectively, all while maintaining a cost-effective solution for your business.

-

What features does airSlate SignNow offer for tax declaration samples?

The platform offers features such as document templates, electronic signatures, and secure sharing options. These tools make it easier to handle tax declaration samples, ensuring that your documents are professionally prepared and legally binding.

-

Can I collaborate with my tax advisor using airSlate SignNow?

Absolutely! With airSlate SignNow, you can invite your tax advisor to review and collaborate on your tax declaration samples in real time. This collaboration feature enhances the accuracy of your filings by allowing for seamless communication and document updates.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with relevant tax regulations, ensuring that your tax declaration samples meet necessary legal standards. Our platform prioritizes security and regulatory compliance to protect sensitive information associated with tax filing.

-

What integrations are available with airSlate SignNow for handling tax declaration samples?

airSlate SignNow offers integrations with popular tools such as Google Drive, Dropbox, and various accounting software. These integrations enable you to streamline the process of creating and managing tax declaration samples by connecting your existing workflows.

Get more for Template Hmrc Tax Declaration Format

- Emergency contact amp medical information form

- Futsal team registration form

- Iec 60079 32 1 pdf form

- West nomogram chart form

- State form 10068

- Application manufacturer designer certification form

- Penndot form mv 551 penndot driver and vehicle services dmv state pa

- Apportioned registration forms and publications

Find out other Template Hmrc Tax Declaration Format

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy