F1040 PDFPDFIrs Tax FormsTax Deduction 2022

What is the F1040 PDF IRS Tax Form?

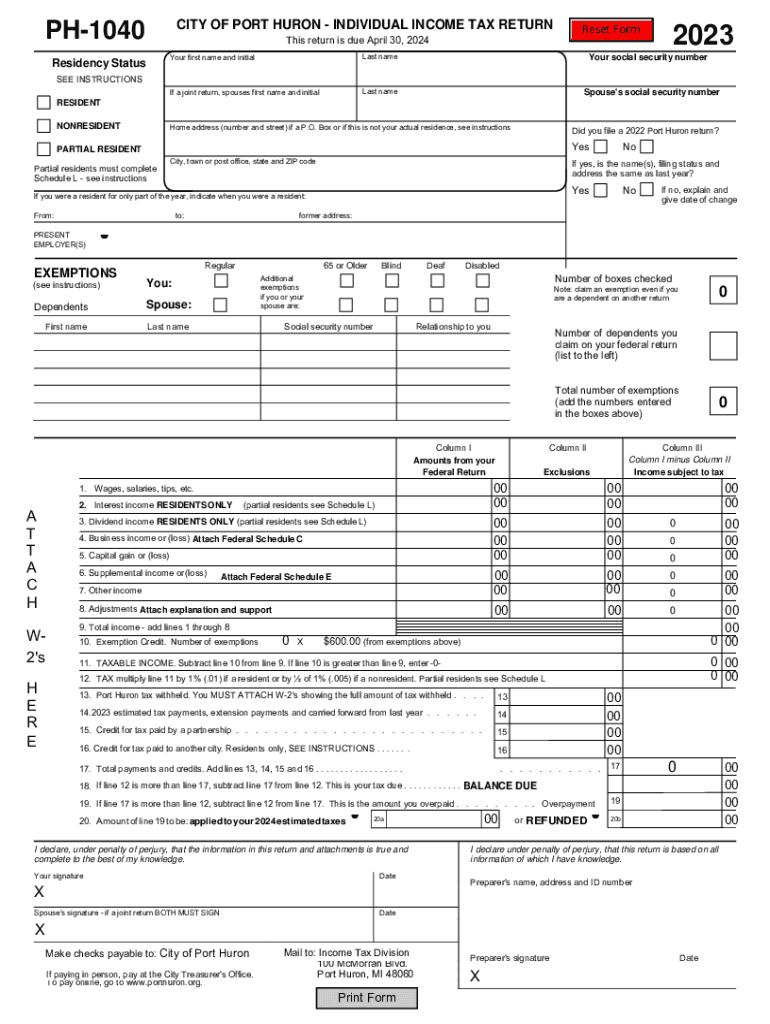

The F1040 PDF is the standard individual income tax form used by U.S. taxpayers to report their annual income and calculate their tax liability. This form is essential for individuals filing their federal tax returns with the Internal Revenue Service (IRS). It includes sections for reporting various types of income, deductions, and credits that can affect the total amount of tax owed or refunded. Understanding the F1040 PDF is crucial for ensuring compliance with tax laws and maximizing potential deductions.

How to Obtain the F1040 PDF IRS Tax Form

To obtain the F1040 PDF IRS tax form, taxpayers can visit the official IRS website where the form is available for download. It is also possible to request a physical copy by contacting the IRS directly. Many tax preparation software programs include the F1040 PDF as part of their services, allowing users to fill out and file the form electronically. It is advisable to ensure that the most current version of the form is used, as tax laws and regulations can change annually.

Steps to Complete the F1040 PDF IRS Tax Form

Completing the F1040 PDF involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as name, address, and Social Security number.

- Report all sources of income in the appropriate sections.

- Claim deductions and credits that apply to your situation, ensuring to follow IRS guidelines.

- Calculate your total tax liability and any refund or amount owed.

- Sign and date the form before submission.

IRS Guidelines for Filing the F1040 PDF IRS Tax Form

The IRS provides specific guidelines for filing the F1040 PDF. Taxpayers must ensure that all information is accurate and complete to avoid delays or penalties. It is important to refer to the IRS instructions that accompany the form, which detail eligibility criteria for various deductions and credits. Additionally, taxpayers should be aware of filing deadlines to avoid late fees. The IRS also offers resources and assistance for those who may have questions or need help with their tax filings.

Form Submission Methods for the F1040 PDF IRS Tax Form

Taxpayers have several options for submitting the F1040 PDF IRS tax form:

- Online filing through approved e-filing software, which is often the fastest method.

- Mailing a printed copy of the completed form to the appropriate IRS address, based on the taxpayer's location.

- In-person submission at designated IRS offices, though this option may require an appointment.

Key Elements of the F1040 PDF IRS Tax Form

The F1040 PDF contains several key elements that are critical for accurate tax reporting:

- Personal information section for taxpayer identification.

- Income section for reporting wages, dividends, and other earnings.

- Deductions section to claim eligible expenses that reduce taxable income.

- Tax credits section to reduce the overall tax liability.

- Signature line to certify the accuracy of the information provided.

Quick guide on how to complete f1040 pdfpdfirs tax formstax deduction

Complete F1040 PDFPDFIrs Tax FormsTax Deduction with ease on any gadget

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents quickly without delays. Handle F1040 PDFPDFIrs Tax FormsTax Deduction on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign F1040 PDFPDFIrs Tax FormsTax Deduction effortlessly

- Find F1040 PDFPDFIrs Tax FormsTax Deduction and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign F1040 PDFPDFIrs Tax FormsTax Deduction and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f1040 pdfpdfirs tax formstax deduction

Create this form in 5 minutes!

How to create an eSignature for the f1040 pdfpdfirs tax formstax deduction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are F1040 PDF Irs Tax Forms for Tax Deductions?

F1040 PDF Irs Tax Forms for Tax Deductions are essential documents used by individuals and businesses to report their income and claim eligible tax deductions. These forms ensure accurate tax reporting and help users maximize their deductions. airSlate SignNow makes it easy to manage and eSign these forms digitally.

-

How can airSlate SignNow help with F1040 PDF Irs Tax Forms for Tax Deductions?

airSlate SignNow simplifies the process of filling out and signing F1040 PDF Irs Tax Forms for Tax Deductions. With our user-friendly platform, you can quickly complete, eSign, and store your tax documents securely. This efficiency helps streamline your tax preparation process.

-

Are there any costs associated with using airSlate SignNow for F1040 PDF Irs Tax Forms for Tax Deductions?

Yes, there are costs associated with using airSlate SignNow. However, our pricing plans are designed to be cost-effective, ensuring that you receive excellent value while managing your F1040 PDF Irs Tax Forms for Tax Deductions. Explore our various plans to find one that suits your needs.

-

What features does airSlate SignNow offer for managing F1040 PDF Irs Tax Forms for Tax Deductions?

airSlate SignNow offers a range of features to assist with F1040 PDF Irs Tax Forms for Tax Deductions, including customizable templates, secure eSignatures, and document tracking. These features enhance the efficiency and security of your tax document management, making it easier to handle during tax season.

-

Can airSlate SignNow integrate with other software for F1040 PDF Irs Tax Forms for Tax Deductions?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software and tax preparation tools to streamline the process of handling F1040 PDF Irs Tax Forms for Tax Deductions. This integration helps in maintaining consistency and accuracy across your documents.

-

How secure is airSlate SignNow when dealing with F1040 PDF Irs Tax Forms for Tax Deductions?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your F1040 PDF Irs Tax Forms for Tax Deductions, ensuring that your sensitive information remains confidential and secure throughout the signing process.

-

Can I access my F1040 PDF Irs Tax Forms for Tax Deductions from anywhere?

Yes, with airSlate SignNow, you can access your F1040 PDF Irs Tax Forms for Tax Deductions from anywhere with an internet connection. Our cloud-based platform allows you to manage and eSign your documents on any device, providing ultimate flexibility.

Get more for F1040 PDFPDFIrs Tax FormsTax Deduction

Find out other F1040 PDFPDFIrs Tax FormsTax Deduction

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF