Michigan Homestead Property Tax Credit Claim for Veterans 2023

What is the Michigan Homestead Property Tax Credit Claim for Veterans

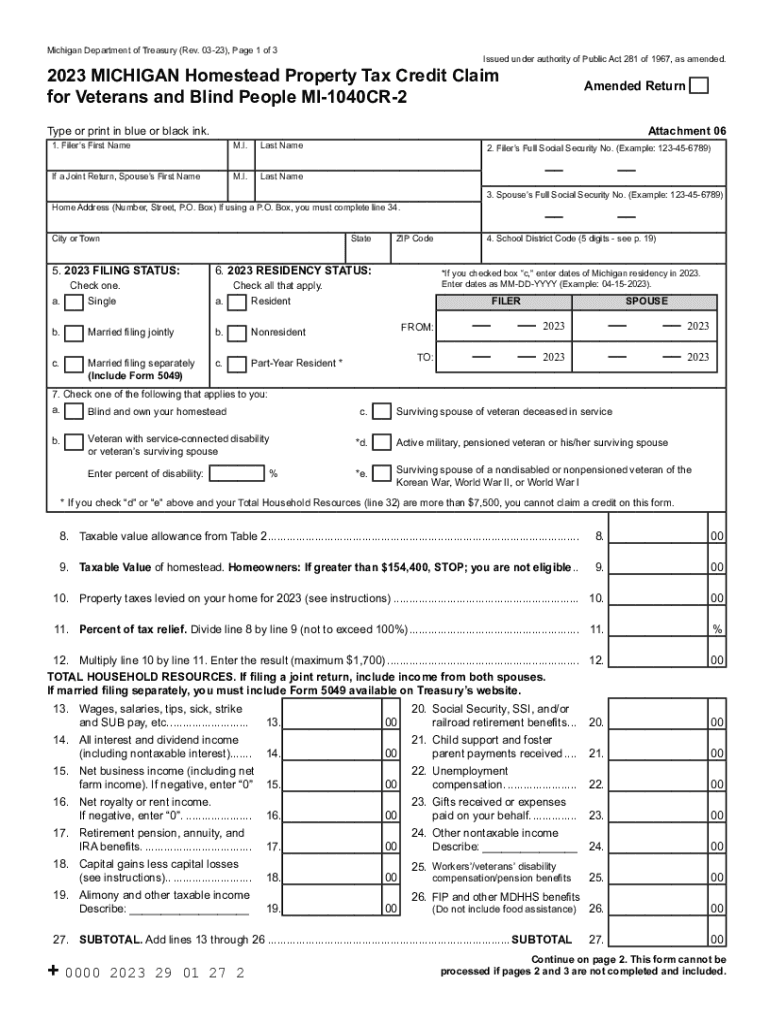

The Michigan Homestead Property Tax Credit Claim for Veterans is a financial benefit designed to assist eligible veterans in reducing their property tax burden. This credit is applicable to those who own and occupy a home in Michigan and meet specific eligibility criteria. The program aims to provide support to veterans who may face financial challenges due to their service. It is essential for veterans to understand the details of this credit, including qualifying conditions and the impact it can have on their overall tax obligations.

Eligibility Criteria

To qualify for the Michigan Homestead Property Tax Credit Claim for Veterans, applicants must meet several requirements:

- The individual must be a veteran as defined by Michigan law.

- The property must be the applicant's primary residence.

- The applicant must meet income limits set by the state.

- Applicants must provide proof of service, typically through military discharge papers.

Understanding these criteria is crucial for veterans seeking to benefit from the program, as failure to meet any of these requirements may result in ineligibility.

Steps to Complete the Michigan Homestead Property Tax Credit Claim for Veterans

Completing the Michigan Homestead Property Tax Credit Claim for Veterans involves several key steps:

- Gather necessary documentation, including proof of veteran status and income information.

- Obtain the appropriate form, typically the MI-1040CR or MI-1040CR-2, from the Michigan Department of Treasury.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form along with any supporting documents to the local tax assessor's office or the Michigan Department of Treasury.

Following these steps carefully will help ensure that the application is processed smoothly and efficiently.

Required Documents

When applying for the Michigan Homestead Property Tax Credit Claim for Veterans, several documents are typically required:

- Proof of veteran status, such as a DD-214 form.

- Income verification documents, including tax returns or W-2 forms.

- Property tax statements for the home being claimed.

Having these documents ready can expedite the application process and help avoid delays.

Form Submission Methods

Applicants can submit the Michigan Homestead Property Tax Credit Claim for Veterans through various methods:

- Online: Some local tax offices may offer online submission options.

- Mail: Completed forms can be sent via postal service to the appropriate tax authority.

- In-Person: Applicants may also choose to deliver their forms directly to their local tax assessor's office.

Choosing the right submission method can depend on personal preferences and the resources available in the local area.

Filing Deadlines / Important Dates

It is crucial for applicants to be aware of filing deadlines associated with the Michigan Homestead Property Tax Credit Claim for Veterans. Typically, the deadline for submitting claims is July 1 for the previous tax year. However, specific dates may vary, and it is advisable to check with the Michigan Department of Treasury for the most current information. Missing the deadline can result in the loss of potential tax benefits.

Quick guide on how to complete michigan homestead property tax credit claim for veterans

Effortlessly Complete Michigan Homestead Property Tax Credit Claim For Veterans on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the resources you require to quickly create, edit, and electronically sign your documents without delays. Handle Michigan Homestead Property Tax Credit Claim For Veterans on any platform using airSlate SignNow apps for Android or iOS and enhance any document-oriented process today.

How to Edit and eSign Michigan Homestead Property Tax Credit Claim For Veterans with Ease

- Locate Michigan Homestead Property Tax Credit Claim For Veterans and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or conceal sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Choose your method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Michigan Homestead Property Tax Credit Claim For Veterans and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan homestead property tax credit claim for veterans

Create this form in 5 minutes!

How to create an eSignature for the michigan homestead property tax credit claim for veterans

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2014 homestead property?

A 2014 homestead property refers to a primary residence that qualifies for tax benefits and protections under state laws. By designating a property as a homestead, eligible owners can receive exemptions and other advantages that can reduce their tax burden. It is important to understand the specific regulations in your state regarding homestead properties.

-

How can airSlate SignNow assist with managing documents for my 2014 homestead property?

AirSlate SignNow provides a user-friendly platform to securely eSign and manage documents related to your 2014 homestead property. You can easily send and receive important files like property tax forms and exemption applications, making the process seamless. This ensures that all necessary documents are processed efficiently and securely.

-

What are the pricing options for using airSlate SignNow for my 2014 homestead property documents?

AirSlate SignNow offers flexible pricing plans suitable for individuals and businesses managing a 2014 homestead property. You can choose from different tiers that provide various features to meet your document needs. Regardless of the plan, our solution remains cost-effective while ensuring you can streamline your paperwork.

-

What features does airSlate SignNow offer for handling documents related to a 2014 homestead property?

AirSlate SignNow includes features like electronic signing, document templates, and secure file storage which are perfect for managing 2014 homestead property documents. You can customize templates for property tax applications and get documents signed quickly. Our platform makes it easier to organize and access these vital documents when needed.

-

What are the benefits of using airSlate SignNow for my 2014 homestead property?

Using airSlate SignNow for your 2014 homestead property provides numerous benefits, including saving time and reducing paper clutter. You can efficiently manage all your property-related documents from one centralized platform. Additionally, our secure digital environment helps protect sensitive information, giving you peace of mind.

-

Is it easy to integrate airSlate SignNow with other tools for managing my 2014 homestead property?

Yes, airSlate SignNow easily integrates with various tools and platforms that can help you manage your 2014 homestead property more effectively. Whether it’s real estate management software or accounting applications, our solution can enhance your workflow. This seamless integration ensures that all your documents and operations are connected.

-

Can I collaborate with others on documents related to my 2014 homestead property using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to collaborate with others on documents related to your 2014 homestead property by enabling multiple users to comment and eSign. This collaborative feature is particularly useful when working with realtors, tax professionals, or family members. You can ensure everyone stays updated and informed throughout the process.

Get more for Michigan Homestead Property Tax Credit Claim For Veterans

Find out other Michigan Homestead Property Tax Credit Claim For Veterans

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter