MICHIGAN Adjustments of Capital Gains and Losses MI 1040D 2023-2026

Understanding the Michigan Adjustments of Capital Gains and Losses MI 1040D

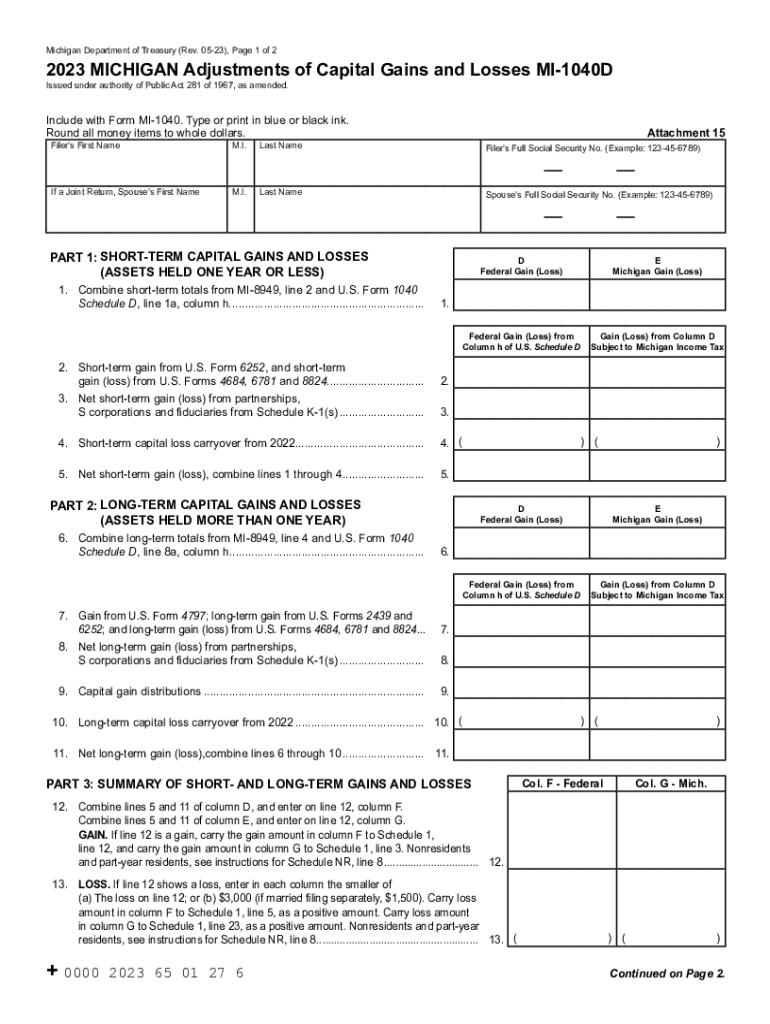

The Michigan Adjustments of Capital Gains and Losses, commonly referred to as the MI 1040D, is a crucial form for taxpayers in Michigan. This form allows individuals to report capital gains and losses from the sale of assets, such as stocks, bonds, and real estate. The adjustments made on this form are essential for calculating the correct amount of state income tax owed, as Michigan has specific rules regarding how capital gains are taxed. Understanding the nuances of the MI 1040D can help taxpayers maximize their deductions and ensure compliance with state tax laws.

Steps to Complete the Michigan Adjustments of Capital Gains and Losses MI 1040D

Completing the MI 1040D involves several key steps:

- Gather necessary documentation, including records of all capital transactions.

- Determine your total capital gains and losses for the tax year.

- Fill out the MI 1040D form, ensuring to accurately report each transaction.

- Calculate any adjustments based on Michigan's tax regulations.

- Review the completed form for accuracy before submission.

Each step is vital to ensure that the form is filled out correctly and that all applicable deductions are claimed.

Eligibility Criteria for Using the Michigan Adjustments of Capital Gains and Losses MI 1040D

To use the MI 1040D, taxpayers must meet specific eligibility criteria. Generally, this form is intended for individuals who have realized capital gains or losses during the tax year. Taxpayers must have sold assets that qualify, and the gains or losses must be reported in accordance with Michigan tax law. It is important for individuals to assess their financial activities to determine if they need to file this form.

Key Elements of the Michigan Adjustments of Capital Gains and Losses MI 1040D

The MI 1040D includes several key elements that taxpayers must be aware of:

- Capital Gains: Profits from the sale of assets that are subject to tax.

- Capital Losses: Losses incurred from the sale of assets, which can offset gains.

- Adjustments: Specific modifications as per Michigan tax regulations that affect the final tax calculation.

- Filing Requirements: Guidelines on when and how to submit the form.

Understanding these elements is crucial for proper completion and compliance.

Legal Use of the Michigan Adjustments of Capital Gains and Losses MI 1040D

The MI 1040D is legally mandated for reporting capital gains and losses in Michigan. Taxpayers are required to use this form if they have engaged in transactions that result in capital gains or losses. Failing to report these accurately can lead to penalties or audits by the Michigan Department of Treasury. It is essential for taxpayers to understand the legal implications of using this form and to ensure compliance with all state tax laws.

Examples of Using the Michigan Adjustments of Capital Gains and Losses MI 1040D

Examples of when to use the MI 1040D include:

- When an individual sells stocks and realizes a profit or loss.

- When a property is sold for more or less than its purchase price.

- When investments in bonds result in capital gains or losses.

These scenarios illustrate the practical application of the MI 1040D in various financial situations.

Quick guide on how to complete michigan adjustments of capital gains and losses mi 1040d

Complete MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documentation, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without interruptions. Manage MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to modify and eSign MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D without hassle

- Find MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D and click on Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form hunts, or mistakes necessitating new document prints. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Modify and eSign MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan adjustments of capital gains and losses mi 1040d

Create this form in 5 minutes!

How to create an eSignature for the michigan adjustments of capital gains and losses mi 1040d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MI 1040D form and why is it important?

The MI 1040D form is a key document required for filing individual income taxes in Michigan. It contains essential information about your income, deductions, and credits. Understanding how to correctly complete the MI 1040D is crucial for ensuring compliance and optimizing your tax return.

-

How can airSlate SignNow help with the MI 1040D form?

airSlate SignNow offers a streamlined solution for electronically signing and sending your MI 1040D form. This user-friendly platform makes it easy to manage your documents efficiently while ensuring that your signatures are secure and legally binding.

-

What are the pricing options for using airSlate SignNow with the MI 1040D?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes. Whether you're an individual or part of a larger firm, you can choose a plan that fits your budget while ensuring you can efficiently handle documents like the MI 1040D.

-

Are there any integrations available for the MI 1040D in airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage the MI 1040D form. This includes integrations with popular accounting software, CRM systems, and cloud storage services, streamlining your workflow.

-

What features does airSlate SignNow offer for signing documents like the MI 1040D?

airSlate SignNow provides features such as electronic signatures, document templates, and real-time tracking, which enhance the signing process for your MI 1040D. These tools ensure that your documents are processed quickly and securely, reducing turnaround time.

-

Is airSlate SignNow compliant with legal regulations for the MI 1040D?

Absolutely, airSlate SignNow complies with all relevant legal regulations for electronic signatures, ensuring that your MI 1040D is signed in accordance with state and federal laws. This compliance gives users peace of mind when submitting their tax documents.

-

How does airSlate SignNow ensure the security of my MI 1040D information?

airSlate SignNow employs advanced security measures, including encryption and multi-factor authentication, to protect your MI 1040D information. Your data's safety is a top priority, ensuring that only authorized users can access sensitive details.

Get more for MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D

Find out other MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed