Georgia Department of Revenue Sales Tax Exempt Fillable Form

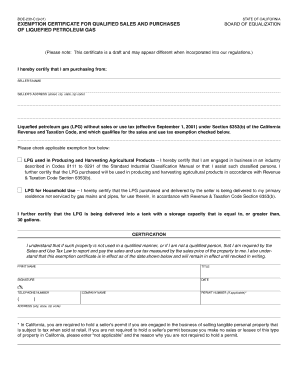

What is the Georgia Department Of Revenue Sales Tax Exempt Fillable Form

The Georgia Department of Revenue Sales Tax Exempt Fillable Form is a document that allows eligible organizations and individuals to claim exemption from sales tax on certain purchases. This form is essential for entities such as non-profits, government agencies, and educational institutions that qualify for tax-exempt status under state law. By completing this form, users can legally avoid paying sales tax on eligible transactions, ensuring compliance with Georgia tax regulations.

How to use the Georgia Department Of Revenue Sales Tax Exempt Fillable Form

Using the Georgia Department of Revenue Sales Tax Exempt Fillable Form involves several straightforward steps. First, download the fillable form from the Georgia Department of Revenue website or a trusted source. Next, fill in the required fields, including the name of the purchaser, the type of exemption, and the details of the purchase. After completing the form, ensure that it is signed by an authorized representative of the exempt organization. Finally, present the completed form to the seller at the time of purchase to validate the exemption.

Steps to complete the Georgia Department Of Revenue Sales Tax Exempt Fillable Form

Completing the Georgia Department of Revenue Sales Tax Exempt Fillable Form requires careful attention to detail. Follow these steps:

- Download the form and open it in a compatible PDF viewer.

- Fill in the organization’s name and address accurately.

- Select the appropriate exemption type from the provided options.

- Provide a description of the items being purchased.

- Include the seller’s information and the date of the transaction.

- Ensure the form is signed by an authorized representative.

- Save a copy for your records before submitting it to the seller.

Legal use of the Georgia Department Of Revenue Sales Tax Exempt Fillable Form

The legal use of the Georgia Department of Revenue Sales Tax Exempt Fillable Form is crucial for maintaining compliance with state tax laws. This form must be used only by entities that qualify for tax exemption under Georgia law. Misuse of the form can lead to penalties, including back taxes and fines. It is important for users to understand their eligibility and ensure that the form is filled out completely and accurately to avoid any legal complications.

Key elements of the Georgia Department Of Revenue Sales Tax Exempt Fillable Form

Key elements of the Georgia Department of Revenue Sales Tax Exempt Fillable Form include:

- Purchaser Information: Name and address of the exempt organization.

- Exemption Type: Specific category under which the exemption is claimed.

- Purchase Details: Description of the items or services being purchased.

- Seller Information: Name and address of the seller.

- Signature: Required signature of an authorized representative.

Eligibility Criteria

Eligibility for using the Georgia Department of Revenue Sales Tax Exempt Fillable Form is determined by specific criteria set forth by state law. Organizations such as non-profit entities, government agencies, and educational institutions typically qualify for exemption. To be eligible, the organization must provide proof of its tax-exempt status, such as a federal tax exemption letter or state-issued documentation. It is essential to review the criteria carefully to ensure compliance and avoid any issues during the purchasing process.

Quick guide on how to complete georgia department of revenue sales tax exempt fillable form

Complete Georgia Department Of Revenue Sales Tax Exempt Fillable Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents quickly without delays. Handle Georgia Department Of Revenue Sales Tax Exempt Fillable Form on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Georgia Department Of Revenue Sales Tax Exempt Fillable Form seamlessly

- Find Georgia Department Of Revenue Sales Tax Exempt Fillable Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow satisfies your needs in document management in just a few clicks from any device of your preference. Alter and eSign Georgia Department Of Revenue Sales Tax Exempt Fillable Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the georgia department of revenue sales tax exempt fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Georgia Department Of Revenue Sales Tax Exempt Fillable Form?

The Georgia Department Of Revenue Sales Tax Exempt Fillable Form is a specific document that allows businesses to claim sales tax exemption in Georgia. It can be conveniently completed and submitted electronically, ensuring a smooth process for organizations looking to manage their sales tax obligations effectively.

-

How do I obtain the Georgia Department Of Revenue Sales Tax Exempt Fillable Form?

You can easily obtain the Georgia Department Of Revenue Sales Tax Exempt Fillable Form from the official Georgia Department of Revenue website or through platforms like airSlate SignNow. With airSlate SignNow, you can fill out and eSign this form quickly and efficiently from any device.

-

Is there a cost associated with using the Georgia Department Of Revenue Sales Tax Exempt Fillable Form?

While the Georgia Department Of Revenue Sales Tax Exempt Fillable Form itself is typically free, using airSlate SignNow for filling and eSigning may incur a nominal fee. However, this cost is often outweighed by the time and resources saved by using our efficient solution.

-

What features does airSlate SignNow offer for the Georgia Department Of Revenue Sales Tax Exempt Fillable Form?

airSlate SignNow offers various features for the Georgia Department Of Revenue Sales Tax Exempt Fillable Form, including secure eSigning, real-time tracking, and the ability to store and manage documents in one place. This user-friendly platform enhances the efficiency of your document workflows.

-

Can I integrate airSlate SignNow with other tools for the Georgia Department Of Revenue Sales Tax Exempt Fillable Form?

Yes, airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM systems. This integration allows you to streamline document management related to the Georgia Department Of Revenue Sales Tax Exempt Fillable Form, ensuring a unified workflow.

-

What are the benefits of using airSlate SignNow for the Georgia Department Of Revenue Sales Tax Exempt Fillable Form?

Using airSlate SignNow for the Georgia Department Of Revenue Sales Tax Exempt Fillable Form provides numerous benefits such as enhanced efficiency, reduced paperwork, and simplified eSigning. Our platform is designed to improve your overall documentation experience, making it quick and convenient.

-

How does eSigning the Georgia Department Of Revenue Sales Tax Exempt Fillable Form work?

eSigning the Georgia Department Of Revenue Sales Tax Exempt Fillable Form using airSlate SignNow is straightforward. After filling out the form, you can easily add your signature electronically, ensuring authenticity and compliance, while saving time compared to traditional methods.

Get more for Georgia Department Of Revenue Sales Tax Exempt Fillable Form

Find out other Georgia Department Of Revenue Sales Tax Exempt Fillable Form

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile