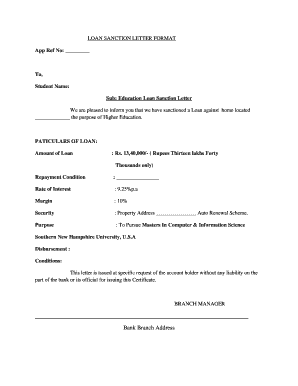

LOAN SANCTION LETTER FORMAT

Understanding the loan disbursement letter format

A loan disbursement letter is a crucial document that outlines the terms and conditions under which a loan is provided. This letter serves as a formal agreement between the lender and the borrower, detailing the loan amount, interest rate, repayment schedule, and any other relevant terms. It is essential for both parties to understand the specifics included in this document to ensure clarity and compliance with the loan agreement.

The format of a loan disbursement letter typically includes the following key elements:

- Borrower Information: Name, address, and contact details of the borrower.

- Lender Information: Name and contact details of the lending institution.

- Loan Details: Amount, interest rate, and loan purpose.

- Repayment Terms: Schedule, due dates, and payment methods.

- Signatures: Required signatures from both the lender and borrower.

Steps to complete the loan disbursement letter format

Completing a loan disbursement letter involves several steps to ensure that all necessary information is accurately provided. Follow these steps for a smooth process:

- Gather Information: Collect all relevant details about the borrower and the loan.

- Choose the Right Format: Select a template that meets your needs, ensuring it includes all required sections.

- Fill in the Details: Input the gathered information into the template, being precise and thorough.

- Review the Document: Check for any errors or missing information before finalizing.

- Obtain Signatures: Ensure both parties sign the document, either digitally or in person.

Legal use of the loan disbursement letter format

The loan disbursement letter is a legally binding document once signed by both parties. To ensure its legality, it must comply with relevant regulations such as the ESIGN Act, which governs electronic signatures in the United States. This means that if the letter is signed electronically, it must meet specific criteria to be considered valid.

Key legal considerations include:

- Consent: Both parties must agree to use electronic signatures.

- Intent: Signatures must indicate a clear intention to enter into the agreement.

- Security: The document must be securely stored and accessible to both parties.

Examples of using the loan disbursement letter format

Loan disbursement letters can be used in various scenarios, including personal loans, education loans, and home loans. Here are a few examples:

- Personal Loans: A borrower may receive a loan disbursement letter detailing a personal loan for debt consolidation.

- Education Loans: Students often receive a disbursement letter outlining the terms of their education loan, including the amount and repayment options.

- Home Loans: A home loan disbursement letter provides essential information about the mortgage, including interest rates and payment schedules.

Key elements of the loan disbursement letter format

Understanding the key elements of a loan disbursement letter is vital for both lenders and borrowers. These elements ensure that all parties are aware of their rights and responsibilities. Important components include:

- Loan Amount: The total amount being disbursed to the borrower.

- Interest Rate: The percentage charged on the loan amount.

- Repayment Schedule: Specific dates and amounts for loan repayments.

- Fees and Charges: Any additional costs associated with the loan.

- Default Terms: Conditions under which the loan may be considered in default.

How to obtain the loan disbursement letter format

Obtaining a loan disbursement letter format can be done through various means. Many financial institutions provide templates on their websites, or borrowers can request one directly from their lender. Additionally, online resources may offer customizable templates that can be tailored to specific needs.

When seeking a loan disbursement letter format, consider the following:

- Institution Guidelines: Check if your lender has specific requirements for the format.

- Template Sources: Look for reputable websites that offer free or paid templates.

- Legal Compliance: Ensure that any template used complies with local laws and regulations.

Quick guide on how to complete loan disbursement letter format pdf

Complete loan disbursement letter format pdf effortlessly on any device

Electronic document management has gained traction among companies and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle loan disbursement letter on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to edit and eSign disbursement letter sample seamlessly

- Find disbursement letter and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from your preferred device. Edit and eSign disbursement letter format and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to home loan disbursement letter format pdf

Create this form in 5 minutes!

How to create an eSignature for the housing loan disbursement request letter format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask loan disbursement request letter sample to bank manager

-

What is a loan disbursement letter?

A loan disbursement letter is a formal document issued by a lender to inform borrowers that their loan funds are ready for disbursement. This letter outlines the terms of the loan, payment schedules, and the amount being disbursed. Having a loan disbursement letter is essential for borrowers to understand their financial obligations.

-

How can airSlate SignNow streamline the process of obtaining a loan disbursement letter?

AirSlate SignNow simplifies the process by allowing users to create, send, and eSign loan disbursement letters electronically. This reduces paperwork and speeds up the approval process, allowing businesses and borrowers to get funds faster. Additionally, the user-friendly interface makes it easy for anyone to manage document signing.

-

What are the pricing options for using airSlate SignNow to create loan disbursement letters?

AirSlate SignNow offers flexible pricing plans that cater to different business needs. Users can choose from monthly or annual subscriptions, with features designed specifically for the electronic signing of documents, including loan disbursement letters. Pricing is competitive, ensuring you have cost-effective solutions for all your document needs.

-

Are there any additional features available with airSlate SignNow for loan disbursement letters?

Yes, airSlate SignNow provides a variety of features that enhance the way you handle loan disbursement letters. This includes the ability to add custom templates, automated workflows, and real-time tracking of document status. These features enable users to manage their loan documents efficiently and effectively.

-

Can airSlate SignNow integrate with other software for loan disbursement processes?

Absolutely! AirSlate SignNow integrates seamlessly with numerous business applications, such as CRM systems and payment platforms. This integration allows for a more holistic approach when managing loan disbursement letters, ensuring all aspects of the loan process are coordinated and easily accessible.

-

What are the benefits of using airSlate SignNow for loan disbursement letters?

Using airSlate SignNow for loan disbursement letters offers signNow benefits, including increased efficiency and reduced turnaround time for document processing. It enhances security through eSigning, keeping sensitive information safe while ensuring compliance. Furthermore, it provides a more organized approach to managing loan documentation.

-

How secure is the signing process for loan disbursement letters in airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption and secure cloud storage to protect your loan disbursement letters and other documents. Additionally, signing is compliant with industry standards, ensuring that your transactions are not only secure but also legally binding.

Get more for home loan disbursement request letter format

- Wwwirsgovpubirs pdf2020 form 8815 internal revenue service

- Internal revenue service proposed collection requesting form

- Form 1040 ss us self employment tax return including

- Wwwirsgovpubirs pdftreasury department regulations governing irs tax forms

- Pdf 2021 instructions for form 8865 internal revenue service

- Us nonresident alien income tax returnform 1040nrus nonresident alien income tax returnform 1040nrabout form 1040 nr us

- Form 6251 department of the treasury internal revenue

- About form 5330 return of excise taxes related to

Find out other disbursement letter to bank

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney