Form 1040 SS, U S Self Employment Tax Return Including 2021

What is the Form 1040 SS, U S Self Employment Tax Return

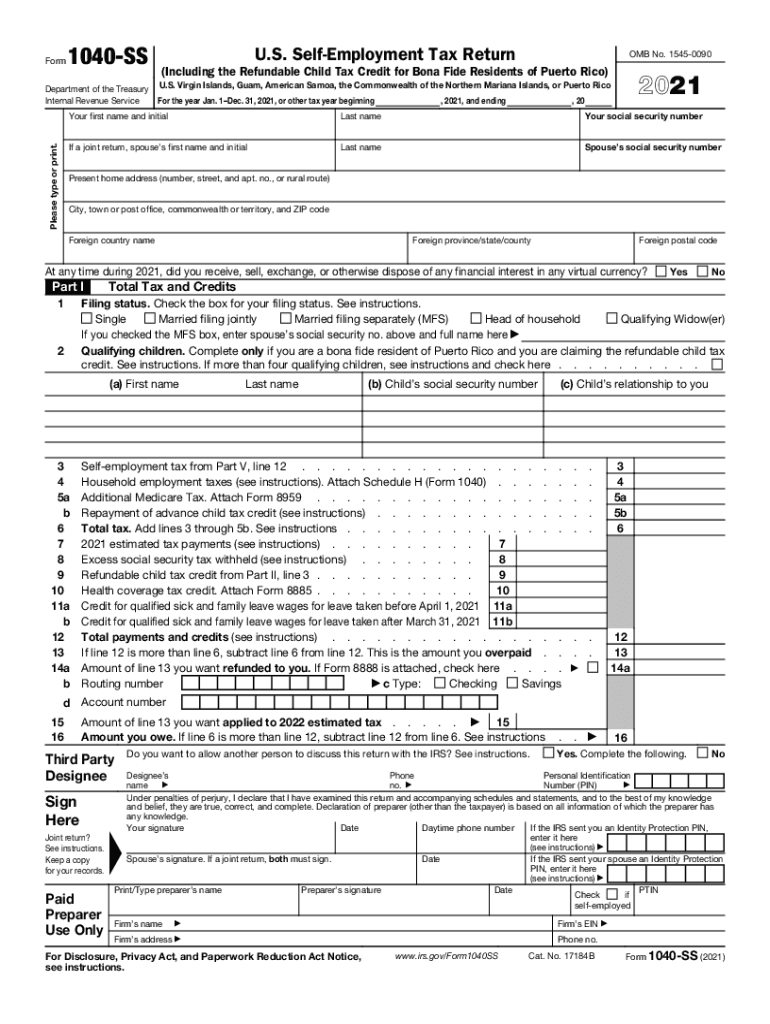

The Form 1040 SS, U S Self Employment Tax Return, is a tax form used by self-employed individuals to report their income and calculate self-employment taxes. This form is specifically designed for those who earn income from self-employment, such as freelancers, independent contractors, and small business owners. It allows taxpayers to report their net earnings from self-employment, which is essential for determining the amount of Social Security and Medicare taxes owed. Understanding this form is crucial for compliance with U.S. tax laws and for ensuring accurate tax reporting.

Steps to Complete the Form 1040 SS, U S Self Employment Tax Return

Completing the Form 1040 SS involves several key steps that ensure accurate reporting of self-employment income. First, gather all necessary documents, including income statements, expense receipts, and any other relevant financial records. Next, fill out the form by providing your personal information, including your name, Social Security number, and address. Then, report your total income from self-employment and deduct any allowable business expenses to calculate your net earnings. Finally, compute your self-employment tax and total tax liability, and ensure that all calculations are accurate before submitting the form to the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 SS align with the general tax filing deadlines set by the IRS. Typically, self-employed individuals must file their tax returns by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to be aware of these dates to avoid penalties and interest on late filings. Additionally, if you expect to owe taxes, consider making estimated tax payments throughout the year to stay compliant with IRS regulations.

Required Documents

To successfully complete the Form 1040 SS, you will need several important documents. These include:

- Income statements from self-employment activities, such as 1099 forms.

- Records of business expenses, including receipts and invoices.

- Bank statements that reflect your income and expenses.

- Any prior year tax returns for reference.

Having these documents organized will streamline the filing process and help ensure that you report accurate information.

Penalties for Non-Compliance

Failure to file the Form 1040 SS on time or accurately can result in significant penalties. The IRS may impose a failure-to-file penalty, which is typically a percentage of the unpaid taxes for each month the return is late, up to a maximum amount. Additionally, if you underreport your income or fail to pay the required self-employment taxes, you may face further penalties and interest charges. Understanding these consequences highlights the importance of timely and accurate tax filing.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Form 1040 SS. These guidelines include instructions on what constitutes self-employment income, allowable deductions, and how to calculate self-employment tax. It is essential to review these guidelines carefully to ensure compliance with IRS regulations. Additionally, the IRS offers resources and publications that can assist self-employed individuals in understanding their tax obligations and completing the form correctly.

Quick guide on how to complete form 1040 ss us self employment tax return including

Effortlessly complete Form 1040 SS, U S Self employment Tax Return including on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without any delays. Manage Form 1040 SS, U S Self employment Tax Return including on any device with airSlate SignNow's Android or iOS applications and simplify any document-centered process today.

The easiest way to modify and eSign Form 1040 SS, U S Self employment Tax Return including effortlessly

- Locate Form 1040 SS, U S Self employment Tax Return including and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form navigation, or errors that require printing new copies. airSlate SignNow meets your document management needs within just a few clicks from any device of your choice. Modify and eSign Form 1040 SS, U S Self employment Tax Return including and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 ss us self employment tax return including

Create this form in 5 minutes!

How to create an eSignature for the form 1040 ss us self employment tax return including

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

How to make an e-signature straight from your smart phone

The way to make an e-signature for a PDF on iOS devices

How to make an e-signature for a PDF document on Android OS

People also ask

-

What is the 1040 form 2019 and how do I use it?

The 1040 form 2019 is the IRS form used for individual income tax returns in the tax year 2019. You can fill it out to report your annual income and determine your taxable income. With airSlate SignNow, you can easily eSign your completed 1040 form 2019 and send it securely.

-

How does airSlate SignNow help with the 1040 form 2019?

airSlate SignNow streamlines the process of completing the 1040 form 2019 by providing templates and easy document management. You can fill, sign, and send the form digitally, saving time and minimizing errors. Our platform ensures your 1040 form 2019 is handled securely and efficiently.

-

Is there a cost associated with using airSlate SignNow for the 1040 form 2019?

Yes, airSlate SignNow offers several pricing plans tailored to your business needs. Whether you're an individual or a business, you'll find a cost-effective solution for managing your 1040 form 2019. You can start with a free trial to explore its features before committing.

-

Can I integrate airSlate SignNow with other software for managing my 1040 form 2019?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms, making it easy to manage your 1040 form 2019 alongside your existing tools. Popular integrations include CRM systems and document management platforms to enhance your workflow.

-

What features does airSlate SignNow offer for completing the 1040 form 2019?

With airSlate SignNow, you'll have access to features like eSigning, document templates, and real-time collaboration to simplify the process of completing the 1040 form 2019. Additionally, you can track progress and receive notifications when documents are signed, ensuring a smooth experience.

-

Is airSlate SignNow secure for sending my 1040 form 2019?

Yes, airSlate SignNow prioritizes security and uses advanced encryption to protect your documents, including the 1040 form 2019. Our platform is compliant with industry standards to ensure that your sensitive information remains confidential and secure.

-

How quickly can I complete the 1040 form 2019 using airSlate SignNow?

Completing the 1040 form 2019 with airSlate SignNow can be done quickly, often in just a few minutes, depending on the complexity of your documents. With our user-friendly interface and convenient eSigning features, you'll save signNow time compared to traditional methods.

Get more for Form 1040 SS, U S Self employment Tax Return including

Find out other Form 1040 SS, U S Self employment Tax Return including

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document