US Nonresident Alien Income Tax ReturnForm 1040NRUS Nonresident Alien Income Tax ReturnForm 1040NRAbout Form 1040 NR, U S Nonres 2021

Understanding the 1040 NR Form

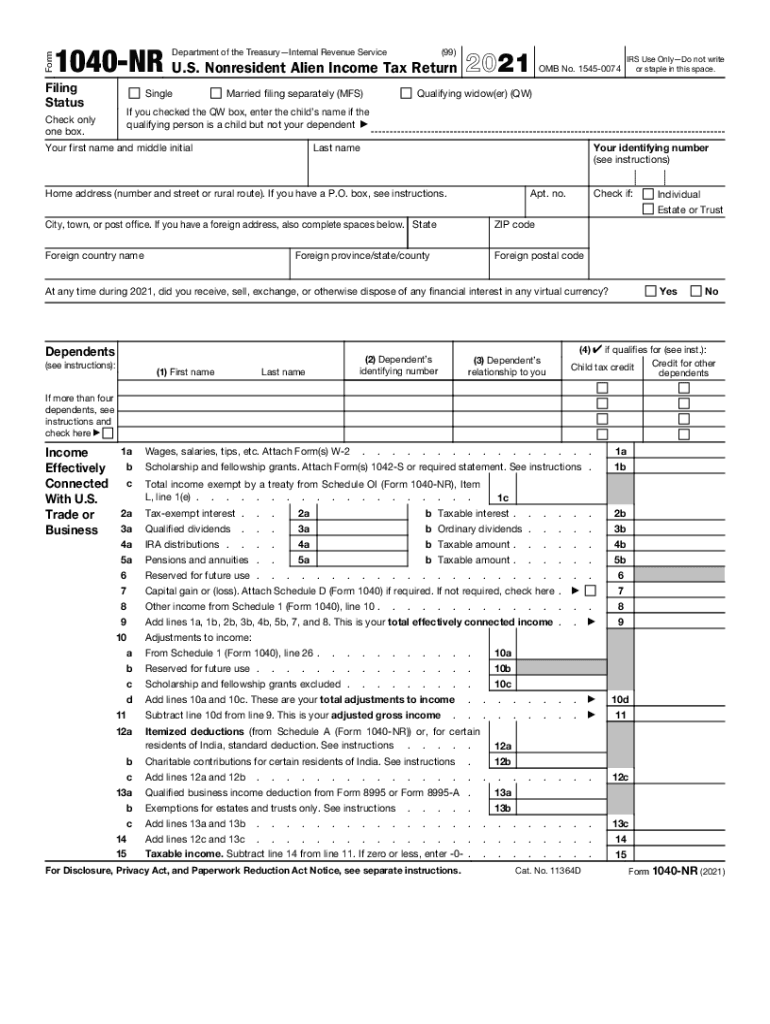

The 1040 NR form, officially known as the U.S. Nonresident Alien Income Tax Return, is designed for individuals who are not U.S. citizens or residents but have income sourced from within the United States. This form is essential for reporting income, calculating tax liability, and claiming any applicable deductions or credits. Nonresident aliens must file this form if they earn income that is subject to U.S. taxation, which can include wages, salaries, dividends, and rental income.

The Internal Revenue Service (IRS) requires nonresident aliens to report their U.S. income accurately to ensure compliance with U.S. tax laws. Understanding the specific requirements and instructions for the 1040 NR form is crucial for avoiding penalties and ensuring proper filing.

Steps to Complete the 1040 NR Form

Completing the 1040 NR form involves several key steps to ensure accuracy and compliance. Here’s a breakdown of the process:

- Gather necessary documents: Collect all relevant income statements, such as W-2s or 1099s, and any documentation for deductions or credits.

- Identify your residency status: Confirm that you qualify as a nonresident alien based on the substantial presence test or other IRS guidelines.

- Fill out the form: Complete all sections of the 1040 NR form, including personal information, income details, and tax calculations.

- Review for accuracy: Double-check all entries for completeness and correctness to avoid errors that could lead to delays or penalties.

- Submit the form: File your completed 1040 NR form either electronically or via mail, ensuring you meet all filing deadlines.

Required Documents for Filing the 1040 NR Form

To successfully file the 1040 NR form, certain documents are necessary to substantiate income and deductions. These include:

- Income statements: W-2 forms from employers, 1099 forms for freelance or contract work, and any additional income records.

- Tax identification: A valid Individual Taxpayer Identification Number (ITIN) or Social Security Number (SSN) is required.

- Deductions and credits documentation: Receipts or records for any eligible deductions or credits claimed on the form.

Filing Deadlines for the 1040 NR Form

Filing deadlines for the 1040 NR form are crucial for compliance. Typically, the deadline for submitting the form is April 15 of the year following the tax year. However, if you are a nonresident alien who is not in the U.S. on that date, you may have until June 15 to file. It is important to check for any changes or extensions that may apply, especially in light of special circumstances or IRS announcements.

Legal Use of the 1040 NR Form

The 1040 NR form serves as a legal document for nonresident aliens to report their income and fulfill their tax obligations in the United States. Properly completing and filing this form is essential for compliance with U.S. tax laws. Failure to file can lead to penalties, interest on unpaid taxes, and potential legal repercussions. It is advisable to consult IRS guidelines or seek professional assistance to ensure that the form is used correctly and legally.

IRS Guidelines for the 1040 NR Form

The IRS provides specific guidelines for completing the 1040 NR form, including instructions on income types, allowable deductions, and filing procedures. Nonresident aliens should familiarize themselves with these guidelines to ensure accurate reporting and compliance. The IRS also offers resources and publications that can assist in understanding the requirements and nuances of filing as a nonresident alien.

Quick guide on how to complete us nonresident alien income tax returnform 1040nrus nonresident alien income tax returnform 1040nrabout form 1040 nr us

Complete US Nonresident Alien Income Tax ReturnForm 1040NRUS Nonresident Alien Income Tax ReturnForm 1040NRAbout Form 1040 NR, U S Nonres effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage US Nonresident Alien Income Tax ReturnForm 1040NRUS Nonresident Alien Income Tax ReturnForm 1040NRAbout Form 1040 NR, U S Nonres on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to edit and electronically sign US Nonresident Alien Income Tax ReturnForm 1040NRUS Nonresident Alien Income Tax ReturnForm 1040NRAbout Form 1040 NR, U S Nonres with ease

- Obtain US Nonresident Alien Income Tax ReturnForm 1040NRUS Nonresident Alien Income Tax ReturnForm 1040NRAbout Form 1040 NR, U S Nonres and click on Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize important sections of your files or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only moments and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device of your choice. Edit and electronically sign US Nonresident Alien Income Tax ReturnForm 1040NRUS Nonresident Alien Income Tax ReturnForm 1040NRAbout Form 1040 NR, U S Nonres and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct us nonresident alien income tax returnform 1040nrus nonresident alien income tax returnform 1040nrabout form 1040 nr us

Create this form in 5 minutes!

How to create an eSignature for the us nonresident alien income tax returnform 1040nrus nonresident alien income tax returnform 1040nrabout form 1040 nr us

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an e-signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the 1040 nr form and who needs it?

The 1040 nr form is a U.S. tax return specifically designed for non-resident aliens. It's essential for foreign individuals who earn income in the U.S. to report their taxable income and ensure compliance with U.S. tax laws.

-

How can airSlate SignNow assist with completing a 1040 nr?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending documents, including the 1040 nr form. With its user-friendly interface, users can streamline the process of filling out and submitting tax documents securely.

-

Is airSlate SignNow cost-effective for businesses filing 1040 nr forms?

Yes, airSlate SignNow offers competitive pricing that makes it a cost-effective solution for businesses needing to manage 1040 nr forms. This allows companies to save costs while ensuring compliance and efficiency in handling tax-related documents.

-

What features does airSlate SignNow offer for managing 1040 nr documents?

airSlate SignNow offers features such as secure e-signature capabilities, document templates, and automated workflows, making it easier to manage 1040 nr forms. These tools enhance efficiency and reduce the likelihood of errors.

-

Can I integrate airSlate SignNow with other software for filing 1040 nr forms?

Absolutely! airSlate SignNow supports integrations with various software services, allowing you to seamlessly connect with your accounting or tax software when filing 1040 nr forms. This enhances your workflow and simplifies the document management process.

-

What are the benefits of using airSlate SignNow for 1040 nr e-signatures?

Using airSlate SignNow for e-signatures on 1040 nr forms provides a variety of benefits, such as enhanced document security, faster turnaround times, and reduced paperwork. This helps streamline the filing process for both individuals and businesses.

-

How secure is my information when using airSlate SignNow for 1040 nr forms?

Your information is highly secure when using airSlate SignNow for 1040 nr forms. The platform employs advanced encryption and security measures to protect sensitive data, ensuring your tax information remains confidential and safe.

Get more for US Nonresident Alien Income Tax ReturnForm 1040NRUS Nonresident Alien Income Tax ReturnForm 1040NRAbout Form 1040 NR, U S Nonres

Find out other US Nonresident Alien Income Tax ReturnForm 1040NRUS Nonresident Alien Income Tax ReturnForm 1040NRAbout Form 1040 NR, U S Nonres

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF