Www Irs Govpubirs Pdf2020 Form 8815 Internal Revenue Service 2021

What is IRS Form 8815?

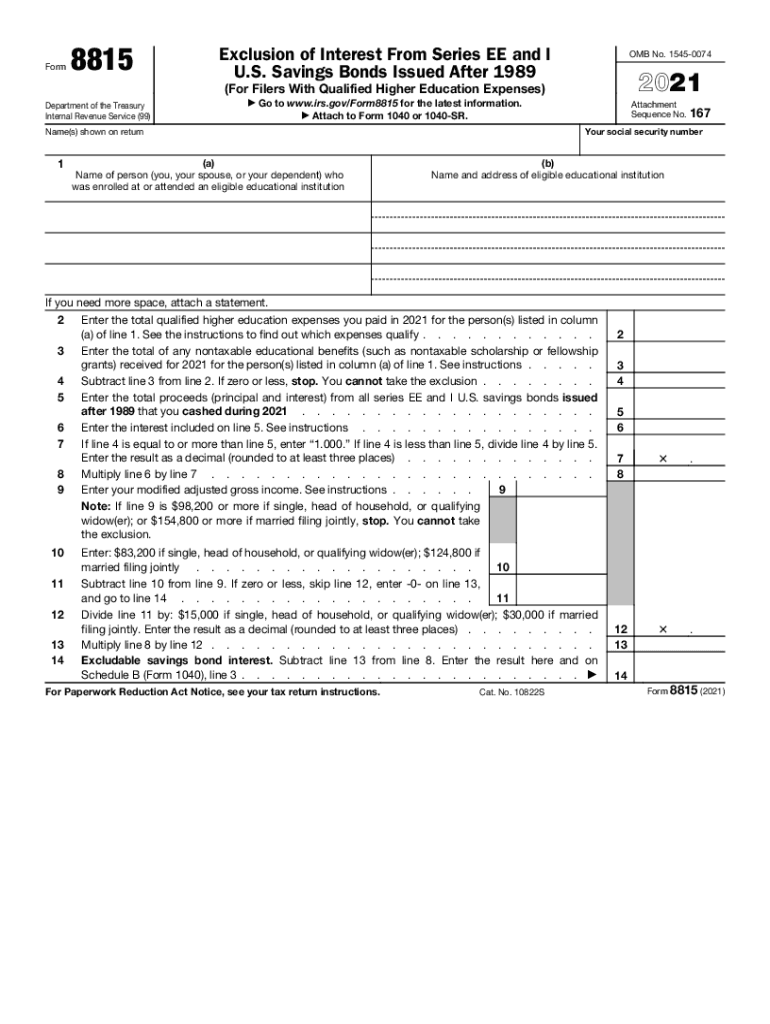

IRS Form 8815 is a tax form used by individuals to report the interest earned on U.S. savings bonds, specifically Series EE bonds, that were issued after 1989. This form allows taxpayers to exclude a portion of the interest income from their taxable income if the bonds were used to pay for qualified higher education expenses. The form is essential for those who want to take advantage of the tax benefits associated with education-related savings bonds.

How to Obtain IRS Form 8815

To obtain IRS Form 8815, individuals can visit the official IRS website, where the form is available for download in PDF format. It is advisable to ensure that you are accessing the most current version of the form, as tax regulations and forms can change annually. Alternatively, taxpayers can request a physical copy of the form by contacting the IRS directly or visiting a local IRS office.

Steps to Complete IRS Form 8815

Completing IRS Form 8815 involves several key steps:

- Gather necessary documentation, including the total interest earned on your savings bonds and proof of qualified education expenses.

- Fill out the taxpayer's information at the top of the form, including name, address, and Social Security number.

- Report the interest income from your savings bonds in the appropriate section of the form.

- Calculate the amount of interest that can be excluded based on your education expenses.

- Review the completed form for accuracy before submission.

Legal Use of IRS Form 8815

IRS Form 8815 is legally binding when completed accurately and submitted in accordance with IRS guidelines. The form must be filed with your federal income tax return, and any inaccuracies or omissions may result in penalties or the need for amendments. It is crucial to maintain records of your savings bonds and related expenses to substantiate your claims in case of an audit.

Filing Deadlines for IRS Form 8815

The deadline for filing IRS Form 8815 typically aligns with the tax filing deadline for individual income tax returns, which is usually April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure they file on time to avoid penalties and interest on any unpaid taxes.

Eligibility Criteria for IRS Form 8815

To qualify for the benefits of IRS Form 8815, taxpayers must meet specific eligibility criteria. These include being the owner of the savings bonds, using the proceeds for qualified higher education expenses, and meeting income limitations set by the IRS. It is essential to review the latest IRS guidelines to ensure compliance with these requirements.

Quick guide on how to complete wwwirsgovpubirs pdf2020 form 8815 internal revenue service

Effortlessly Prepare Www irs govpubirs pdf2020 Form 8815 Internal Revenue Service on Any Device

Web-based document management has become widely adopted by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Handle Www irs govpubirs pdf2020 Form 8815 Internal Revenue Service on any device through airSlate SignNow’s Android or iOS applications and enhance any document-centered process today.

How to Modify and eSign Www irs govpubirs pdf2020 Form 8815 Internal Revenue Service with Ease

- Locate Www irs govpubirs pdf2020 Form 8815 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate generating new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign Www irs govpubirs pdf2020 Form 8815 Internal Revenue Service to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2020 form 8815 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2020 form 8815 internal revenue service

The best way to create an e-signature for your PDF document in the online mode

The best way to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an e-signature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an e-signature for a PDF file on Android devices

People also ask

-

What is IRS Form 8815?

IRS Form 8815 is used to determine the amount of the exclusion for the taxable amount of certain social security benefits or railroad retirement benefits. By filing this form, taxpayers can accurately report their benefit amounts when preparing their tax returns.

-

How can airSlate SignNow help with IRS Form 8815?

airSlate SignNow provides a seamless platform for sending and eSigning IRS Form 8815 securely. With its user-friendly interface, you can quickly prepare and eSign the form, ensuring that your documentation is accurate and timely.

-

Is airSlate SignNow affordable for small businesses preparing IRS Form 8815?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for small businesses. This allows you to efficiently manage the signing process for IRS Form 8815 without straining your budget.

-

What features does airSlate SignNow offer for IRS Form 8815 document management?

airSlate SignNow includes features such as templates, automated reminders, and secure cloud storage, specifically designed for managing IRS Form 8815 and similar documents. These features streamline the process and reduce errors.

-

Can I integrate airSlate SignNow with my existing software for IRS Form 8815?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, making it easy to incorporate the eSigning of IRS Form 8815 into your existing workflow. You can connect it with CRMs, document management systems, and more.

-

What are the benefits of using airSlate SignNow for IRS Form 8815?

Using airSlate SignNow for IRS Form 8815 offers numerous benefits including faster processing times, enhanced security for sensitive information, and improved accuracy in documentation. These advantages help simplify tax preparation and filing.

-

Is it easy to eSign IRS Form 8815 with airSlate SignNow?

Yes, eSigning IRS Form 8815 with airSlate SignNow is straightforward. Users can simply upload the form, add necessary signatures, and send it for approval, all within a few clicks.

Get more for Www irs govpubirs pdf2020 Form 8815 Internal Revenue Service

- Interrogatories to defendant for motor vehicle accident louisiana form

- Llc notices resolutions and other operations forms package louisiana

- Louisiana judgment la form

- Probation form

- Custody child support agreement form

- Notice of dishonored check civil keywords bad check bounced check louisiana form

- Interrogatories and request for production of documents louisiana form

- Appearances louisiana form

Find out other Www irs govpubirs pdf2020 Form 8815 Internal Revenue Service

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template