Sc1120 T Form

What is the SC1120 T?

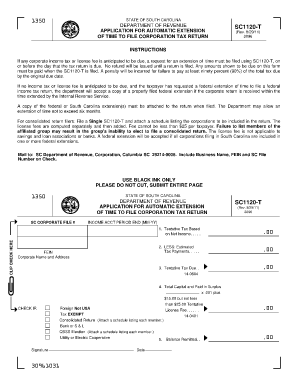

The SC1120 T is a tax form used by certain entities in the United States to report income, deductions, and credits. This form is specifically designed for S corporations that are electing to be taxed as such. It provides a comprehensive overview of the financial activities of the corporation for the tax year. Understanding the SC1120 T is essential for ensuring compliance with IRS regulations and for accurate tax reporting.

How to Obtain the SC1120 T

To obtain the SC1120 T, taxpayers can visit the official IRS website, where the form is available for download. Additionally, tax professionals and accounting software may provide access to the form. It is important to ensure that you are using the most current version of the SC1120 T to avoid any issues during the filing process.

Steps to Complete the SC1120 T

Completing the SC1120 T involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported.

- Review the completed form for any errors or omissions.

- Sign and date the form, ensuring it is submitted by the appropriate deadline.

Legal Use of the SC1120 T

The SC1120 T is legally binding when completed and submitted according to IRS guidelines. It is essential that the information provided is truthful and accurate, as any discrepancies may lead to penalties or audits. Utilizing a reliable eSignature solution can enhance the legal validity of the form when submitting electronically.

Filing Deadlines / Important Dates

Filing deadlines for the SC1120 T are crucial for compliance. Typically, the form must be filed by the fifteenth day of the third month following the end of the tax year. For S corporations operating on a calendar year, this means the deadline is March 15. It is advisable to check for any changes or extensions that may apply.

Required Documents

When completing the SC1120 T, certain documents are required to support the information reported. These may include:

- Income statements detailing revenue generated during the tax year.

- Expense receipts and records to substantiate deductions.

- Prior year tax returns for reference and consistency.

Form Submission Methods

The SC1120 T can be submitted through various methods, including:

- Online submission via approved e-filing services.

- Mailing a paper copy to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete sc1120 t

Complete Sc1120 T effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Sc1120 T on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Sc1120 T with ease

- Locate Sc1120 T and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or mask sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Sc1120 T and ensure outstanding communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc1120 t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC1120 T solution offered by airSlate SignNow?

The SC1120 T is an advanced eSignature solution designed to streamline document workflows. With airSlate SignNow, users can easily send and sign documents electronically, ensuring a fast and efficient process. This product is ideal for businesses looking to improve their document management systems.

-

How does pricing work for the SC1120 T service?

The pricing for the SC1120 T varies based on the number of users and specific features required. airSlate SignNow offers tiered pricing plans to accommodate businesses of all sizes. You can easily find a plan that fits your budget while maximizing the benefits of using the SC1120 T.

-

What features make SC1120 T stand out from competitors?

The SC1120 T offers several standout features, including customizable templates, robust security measures, and integration options with popular applications. These features not only enhance user experience but also increase efficiency in managing documents. Choosing SC1120 T ensures that your business remains competitive in a digital environment.

-

Can SC1120 T integrate with other software applications?

Yes, the SC1120 T easily integrates with various software applications such as CRM and document management systems. This flexibility allows businesses to incorporate airSlate SignNow into their existing workflows without any disruptions. Integration with the SC1120 T enhances overall productivity and collaboration.

-

What are the benefits of using SC1120 T for businesses?

Using the SC1120 T can signNowly reduce the time and costs associated with traditional paper-based document processes. Businesses can improve efficiency, enhance the customer experience, and increase overall satisfaction. Plus, the automation provided by SC1120 T frees up resources for other critical business functions.

-

Is SC1120 T suitable for small businesses?

Absolutely! The SC1120 T is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses. With its scalable features, it can easily adapt to the needs of growing companies, ensuring they can manage documents effectively as they expand.

-

How secure is the SC1120 T eSignature process?

The SC1120 T prioritizes security with advanced encryption and authentication measures to protect sensitive documents. Compliance with industry standards ensures that your documents are stored and transmitted securely. Businesses can trust that the SC1120 T maintains the highest level of security for their electronic signatures.

Get more for Sc1120 T

Find out other Sc1120 T

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now