Elder Caregiver Senior Care Job Application Form Nanny Taxes

What is the caregiver job application form?

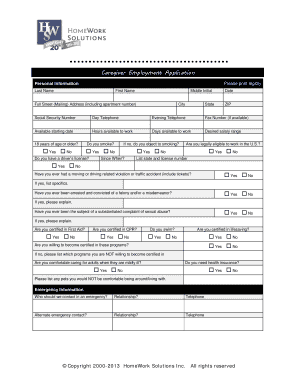

The caregiver job application form is a crucial document used by individuals seeking employment in caregiving roles. This form collects essential information about the applicant's qualifications, experience, and personal details necessary for potential employers to assess their suitability for the position. It typically includes sections for personal identification, work history, references, and relevant certifications or training related to caregiving. Completing this form accurately is vital for both the applicant and the employer, as it serves as the foundation for the hiring process.

Key elements of the caregiver job application form

Understanding the key elements of the caregiver job application form can help applicants present their qualifications effectively. Important sections often include:

- Personal Information: Name, address, contact details, and Social Security number.

- Employment History: Previous jobs, roles, responsibilities, and duration of employment.

- Education and Training: Relevant degrees, certifications, and specialized training in caregiving.

- References: Contact information for individuals who can vouch for the applicant's character and work ethic.

- Availability: Days and hours the applicant is available to work.

Steps to complete the caregiver job application form

Completing the caregiver job application form involves several steps to ensure accuracy and professionalism:

- Gather Information: Collect all necessary personal, educational, and employment details before starting the form.

- Fill Out the Form: Carefully enter information in each section, ensuring clarity and accuracy.

- Review: Double-check all entries for spelling errors and completeness.

- Sign and Date: Provide your signature and the date to validate the application.

- Submit: Follow the submission guidelines, whether online or via mail, as specified by the employer.

Legal use of the caregiver job application form

The caregiver job application form must comply with various legal standards to ensure its validity. This includes adherence to anti-discrimination laws, which require employers to evaluate applicants based on their qualifications rather than personal characteristics. Additionally, the form should be designed to protect the privacy of applicants, in line with regulations such as the Fair Credit Reporting Act (FCRA). Employers are responsible for maintaining confidentiality and securely storing completed forms.

How to use the caregiver job application form

Using the caregiver job application form effectively involves understanding its purpose and how it fits into the hiring process. Applicants should complete the form thoughtfully, providing detailed information that showcases their qualifications and experiences. Once filled out, the form serves as a tool for employers to assess candidates and make informed hiring decisions. It is essential for applicants to keep a copy of their submitted forms for future reference and to track their job applications.

How to obtain the caregiver job application form

Obtaining the caregiver job application form can be done through various means. Many employers provide this form directly on their websites, allowing applicants to download and fill it out digitally. Alternatively, applicants can request a physical copy from the employer's office or during an interview. Additionally, some online resources offer templates for caregiver job application forms, which can be tailored to meet specific job requirements.

Quick guide on how to complete elder caregiver senior care job application form nanny taxes

Effortlessly Prepare Elder Caregiver Senior Care Job Application Form Nanny Taxes on Any Device

Online document management has become widely adopted by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly without delays. Handle Elder Caregiver Senior Care Job Application Form Nanny Taxes on any device using the airSlate SignNow applications for Android or iOS and streamline any document-based process today.

How to Edit and Electronically Sign Elder Caregiver Senior Care Job Application Form Nanny Taxes with Ease

- Locate Elder Caregiver Senior Care Job Application Form Nanny Taxes and click Get Form to begin.

- Utilize the provided tools to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools offered by airSlate SignNow specifically for that goal.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that require printing new document versions. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Elder Caregiver Senior Care Job Application Form Nanny Taxes to ensure excellent communication at every phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the elder caregiver senior care job application form nanny taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the application for caregiver provided by airSlate SignNow?

The application for caregiver by airSlate SignNow is a digital solution that allows caregivers to easily send, receive, and eSign important documents. This streamlined process helps ensure that all necessary paperwork is completed accurately and efficiently, ultimately benefiting both caregivers and clients.

-

How much does the application for caregiver cost?

The application for caregiver comes with flexible pricing plans designed to meet the needs of various users and organizations. With competitive rates and multiple subscription options, airSlate SignNow ensures that your budget is accommodated while still providing top-notch service.

-

What features are included in the application for caregiver?

The application for caregiver includes features such as eSigning, document templates, and real-time tracking. These functionalities help caregivers manage their documentation efficiently, ensuring they can focus more on providing quality care rather than getting bogged down by paperwork.

-

Can the application for caregiver integrate with other software?

Yes, the application for caregiver by airSlate SignNow offers robust integrations with popular tools and platforms. This capability allows caregivers to incorporate eSigning directly into their existing workflows, enhancing productivity and ensuring seamless operations.

-

What are the benefits of using the application for caregiver?

Using the application for caregiver can signNowly reduce the time spent on paperwork and improve the accuracy of completed documents. Additionally, caregivers can enjoy enhanced security and compliance features, ensuring that sensitive information is protected according to regulations.

-

Is the application for caregiver user-friendly?

Absolutely! The application for caregiver is designed with ease of use in mind, featuring an intuitive interface that allows users to navigate effortlessly. This user-centric approach ensures that caregivers can quickly become proficient in managing their documents.

-

How does airSlate SignNow ensure the security of the application for caregiver?

AirSlate SignNow takes security seriously, employing advanced encryption and compliance measures for the application for caregiver. These protocols safeguard sensitive information and ensure that caregivers can focus on their work without worrying about data bsignNowes.

Get more for Elder Caregiver Senior Care Job Application Form Nanny Taxes

Find out other Elder Caregiver Senior Care Job Application Form Nanny Taxes

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT